After a tumultuous interval between Apple and Apple Card companion Goldman Sachs involving Apple Financial savings buyer withdrawals, the problems look like largely solved with loosened anti-fraud protections.

Shortly after Apple Financial savings launched, there have been a flurry of consumers complaining that it was troublesome or unimaginable to extract cash from the high-interest financial savings account. It has been comparatively quiet on that entrance for months — however apparently Goldman Sachs has resolved at the least a few of the systemic points resulting in issues.

The report on late Friday by The Info claims that the automated fraud detection methods are actually much less prone to flag transactions with small volumes to an out of doors account. Moreover, Goldman Sachs has additionally decreased the variety of days it says a transaction ought to take, and is alleged to be speaking with customers higher if there are points, as an alternative of not telling clients in any respect, and permitting time to tick by as an alternative.

An Apple Financial savings buyer consultant cited within the report says that transfers should not take weeks or months, but when they’re, the system, has flagged a big switch as a result of the financial institution is being cautious about unauthorized customers. That is mentioned to be alleviated some by a three-way name between the decision middle, the client, and the financial institution chosen to take the withdrawal.

After the April launch, the saga began with a report in June. Nathan Thacker mentioned that he’d been attempting to withdraw $1,700 from his Apple Financial savings account to his JPMorgan Chase account since Could 15. Nevertheless, upon calling Goldman Sachs’ customer support division, he was instructed that the cash can be in his account in a couple of extra days.

The cash was lastly posted to his account on June 1, greater than two weeks after he initiated the switch.

Thacker wasn’t the one one who has observed points, both. Some clients mentioned that upon initiating the switch, the cash seemingly vanishes. The disappeared cash did not present up in both their Apple account or the checking account they have been attempting to maneuver it to.

In one other instance, a person from Minnesota had tried to switch $10,000 from his Apple account to a U.S. financial institution on Could 16. The cash was flagged for safety assessment, leaving it in limbo till the assessment was completed.

Goldman Sachs went on document on the time saying that almost all clients don’t see any delays. Those that do, nonetheless, see them due to behind-the-scenes processes which were put in place to guard clients’ accounts.

New accounts, akin to these opened by Apple Card homeowners, could set off anti-money-laundering alerts. The transfers should then be manually accepted. On common, these delays take about 5 days.

Delays have been longer for individuals who transferred cash to an account that differed from the account the cash initially got here from.

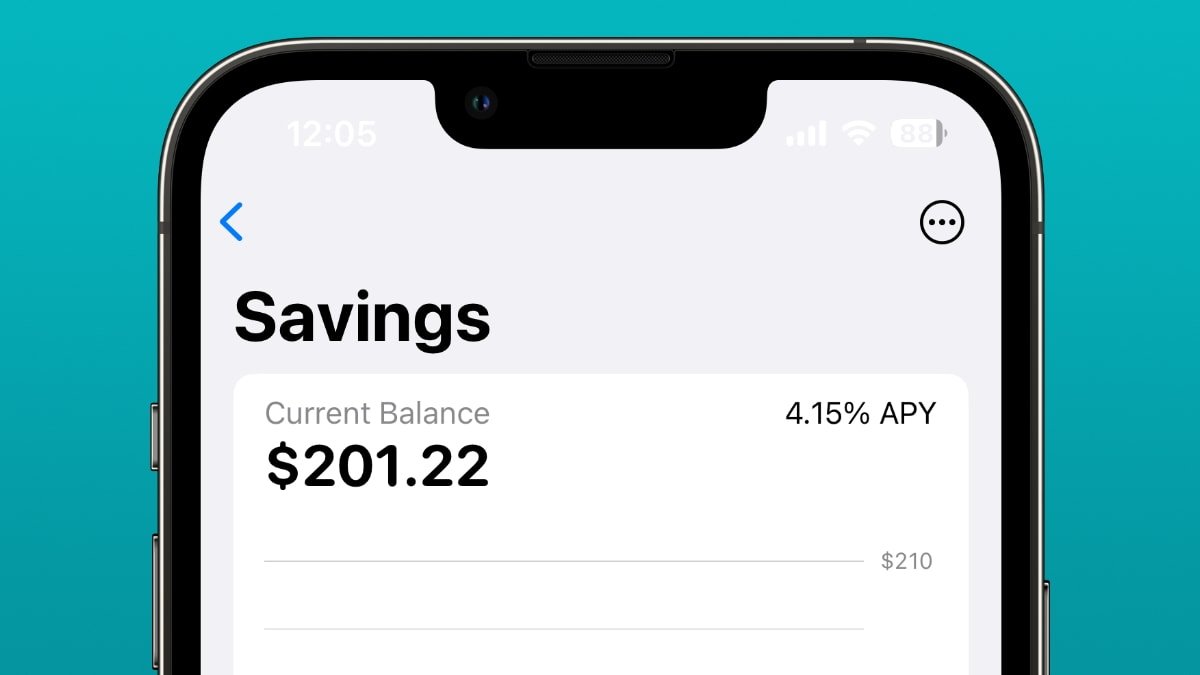

Nonetheless, regardless of this, Apple Financial savings has performed fairly effectively for itself. The primary week of Apple Financial savings proved Apple’s ecosystem energy with greater than 240,000 new accounts being created and almost $1 billion in deposits being made.

It is not clear how robust the connection between Apple and Goldman Sachs is, past contractually. Reportedly, Goldman Sachs is searching for an exit on the Apple Card and Apple Financial savings deal.