When you’re an early-stage founder, the loopy days of 2021 are a distant reminiscence. Cash is tight, and the method of getting extra is as unsettled as ever.

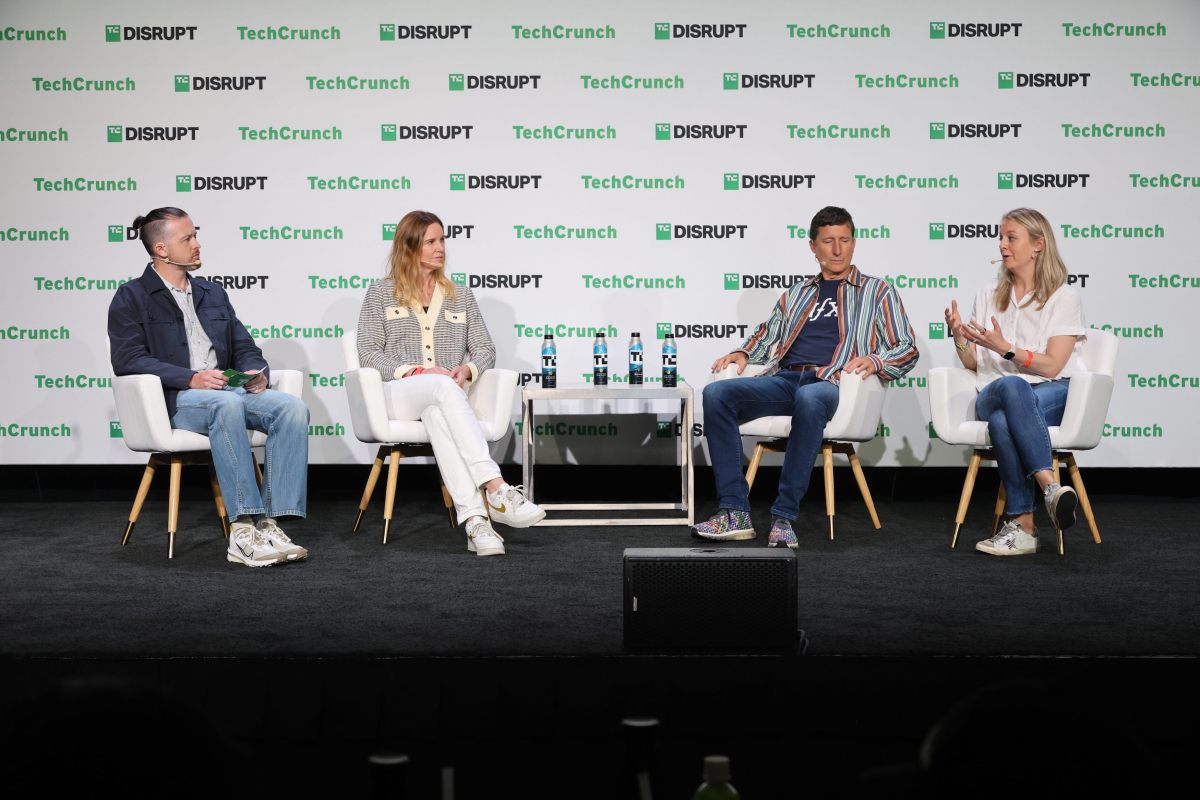

The previous few tumultuous years have tossed out the milestones that outlined earlier Collection A benchmarks. However that doesn’t imply the sport is misplaced. At this yr’s TechCrunch Disrupt, three traders shared their views on what’s modified, what’s working as we speak, and what recommendation they’re giving founders who want to elevate a Collection A.

“As corporations mature to seed and Collection A, a yr and a half in the past, if you happen to had been at 1,000,000 and even approaching 1,000,000 in income, a Collection A would come collectively in a snap. That has modified actually shortly,” Maren Bannon, co-founder and managing associate at January Ventures, advised the viewers. “Now it’s in all probability extra like 2 [million] to three million in income the place these rounds come collectively in a snap.”

For founders, the transferring goalposts may be extremely irritating — particularly because the causes for it are past their management. After a outstanding 13-year bull run, uncertainty crept into the market final yr, dampening investor urge for food for danger. Rising rates of interest compounded the issue.

Because of this, Collection A traders have pulled again dramatically. “What we’ve seen within the statistics is that the Collection A deployment is down 60% during the last yr and a half. The quantity deployed per Collection A is down 25% from $10 million to $7.5 million. And the variety of offers getting completed is far fewer,” mentioned James Currier, basic associate at NFX.

“The majority of seed stage corporations had been [successfully] elevating off of story, not traction,” Loren Straub, basic associate at Bowery Capital, mentioned of market circumstances two years in the past. “I feel there’s been an actual shift in focus in the direction of traction, momentum, official product-market match.”

“Loads of the Collection A traders are understandably on the lookout for a better bar,” she added.

A market crowded with enterprise capitalists hasn’t helped, both, Currier mentioned. Again within the ’90s, there have been about 150 basic companions within the U.S., he mentioned. At this time, there are greater than 31,000 listed on Sign, a community of traders his agency runs.