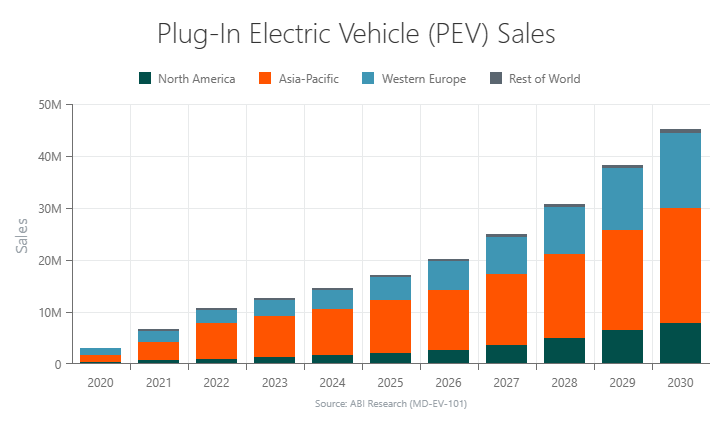

Think about the frustration of inventing the sunshine bulb 5 years earlier than there was electrical energy available to energy it. In some ways, that’s the standing of the rising EV (electrical car) market, able to take over transportation however nonetheless missing the infrastructure to assist it throughout the nation and the world. It’s estimated greater than 180,000 public quick charging stations will probably be required to assist 26 million EVs within the U.S. by 2030.

In keeping with the specialists at EnergIIZE, infrastructure will stay the most important barrier to electrical car adoption. Infrastructure challenges, akin to deployment lead time, expensive upgrades, area constraints, and demand costs are impacting an organization’s potential to successfully personal and function an electrical truck fleet. In response, the group revealed a information displaying the fundamentals of easy methods to anticipate scaling wants, construct out a depot, and have interaction with the electrical utility in order that the ensuing charging infrastructure matches a fleet’s wants.

- Anticipate scaling wants:

Although a fleet might initially show just some electrical vans to find out fleet and operational suitability, it’s vital to anticipate potential scaling wants. Your fleet may develop from 10 to 100 electrical vans prior to you assume.

- Infrastructure prices can differ:

Relying on fleet dimension, truck know-how, charging tools, entry to the grid, and energy demand, infrastructure prices can differ with components akin to required utility upgrades, trenching and laying down conduit, and extra vitality storage.

Working together with your utility from the onset of the planning course of is vital to know potential construct out necessities, value, and improvement timelines.

- Consider electrical car charges and potential demand costs:

Working together with your utility to judge electrical car charges and potential demand costs is necessary to avoiding excessive charging prices whereas working an electrical truck fleet.

The business car charging market is served by quite a lot of gamers akin to electrical business car OEMs (original-equipment producers), CPOs (cost level operators), charging tools producers, and software program suppliers. A number of CPOs have initiated tasks and pilot charging stations. In North America, ChargePoint, Discussion board Mobility, Greenlane, and TeraWatt Infrastructure are making efforts to develop charging networks for heavy-duty electrical business autos.

Berg Perception simply launched new findings about the marketplace for heavy electrical business car charging infrastructure in Europe and North America. The whole variety of linked charging factors in Europe is forecasted to develop from 6,400 in 2022 to 390,000 by the tip of 2030. In North America, the whole variety of linked charging factors will enhance from 4,150 in 2022 to succeed in 378,000 by 2030. These numbers embrace each public and private charging factors.

There are a number of software program particular suppliers providing connectivity options for charging, together with fleet administration instruments, peak shaving, and sensible charging administration. Connectivity will probably be essential for managing the charging course of successfully and a significant a part of the charging infrastructure for each private and public charging, in keeping with Berg Perception’s analysis. This functionality allows companies and charging station operators to have realtime insights into the charging standing, availability, and efficiency of charging factors. Linked charging factors might be carefully monitored and managed, using surplus vitality, or charging in periods of low vitality costs.

Software program-enabled connectivity additionally permits for the implementation of superior load administration strategies, optimizing charging processes by means of algorithms and information evaluation. This may guarantee a managed energy draw, stopping grid overloading, and enhancing operational effectivity by decreasing charging time for particular person autos. Furthermore, connectivity allows drivers to find chargers, monitor charging availability, e-book chargers, and handle funds by means of smartphone apps. The mixing of smart-grid applied sciences and demand response methods presents extra advantages. Demand response methods allow charging to be dynamically adjusted primarily based on grid circumstances, which reduces peak demand and additional enhances grid stability and vitality effectivity.

The place Will the Energy Come From?

A typical query about EVs, one with monumental real-world implications, is: “Can the facility grid deal with the rising uptake in electrical car adoption?” On one hand, elevated adoption of EVs is integral to assembly the nation’s zero-emissions targets, however it additional strains the grid and dangers a blackout attributable to surging EV battery charging wants. As ABI Analysis reveals, the rising demand for EVs presents enormous challenges to grid operators and but market alternative for firms that may present efficient smart-charging options that make the facility grid prepared for extra EVs.

Probably the most vital means electrical autos have an effect on the facility grid, after all, is the added complete vitality consumption. On the lowest degree, if a household decides to exchange their two ICE (Inside Combust Engine) autos with EVs, this can enhance their every day family vitality utilization by 74%. Think about each household in America switching to electrical automobiles. Add the rising business car numbers and their added charging necessities and the results would considerably affect the facility grid.

Even so, the true problem is in vitality distribution. Many international locations have greater than sufficient electrical vitality to fulfill the whole future demand for EVs, however that vitality isn’t at all times able to be drawn when required. In a world the place grid imbalances are regular attributable to elevated electrical energy utilization, the very last thing a grid operator wants are tens of millions extra EV homeowners, personal and business, charging their autos—and pulling from the grid—on the identical time.

To accommodate the elevated vitality demand from EVs, it is sensible to only merely broaden the power-generating infrastructure and re-energize the prevailing electrical infrastructure. Nonetheless, such tasks would require as much as 15 years and quite a few assets to finish. This timeline, crucially, doesn’t fulfill most governments’ deadlines to ban fossil-fueled car gross sales.

One other grid problem with EVs is the actual fact electrical programs should be constantly balanced. This ensures the facility frequency stays inside the secure grid community frequency working limits. If the grid’s energy frequency plunges, the legal guidelines of physics kick into motion and put a halt to the vitality move instantly. From there, the facility shuts right down to keep away from irreversible harm to the turbines.

Given these challenges that include electrical autos, governments, grid operators, utilities, EV charging station operators, and different vitality provide and distribution stakeholders should undertake sensible charging instruments and methods. Solely then can they make sure the facility grid can deal with larger adoption of EVs.

Placing a Greenback Worth to it

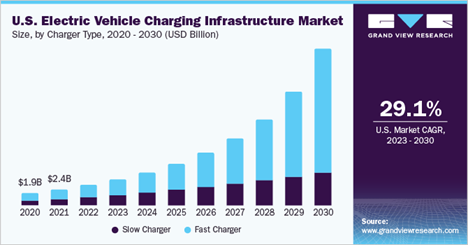

Grand View Analysis did a research on the worth of the worldwide electrical car charging infrastructure market. It estimated it was valued at $19.67 billion in 2022 and is predicted to develop at a CAGR (compound annual development price) of 25.5% from 2023 to 2030. The technological progress of each electrical autos charging software program and {hardware} is predicted to vary the best way electrical car homeowners use and profit from electrical car charging purposes.

The variety of business charging stations is predicted to extend in keeping with the rising adoption of electrical autos. Efforts towards strengthening the charging infrastructure in business areas could be decisive towards encouraging the adoption of electrical autos, as in a single day charging at residential complexes or particular person dwelling wouldn’t be enough for long-distance journeys. Furthermore, public charging infrastructure would additionally facilitate the ultra-fast charging capabilities needed for long-distance journeys.

EV charging infrastructure producers are collaborating with the automobile rental trade to combine chargers within the current infrastructure. Varied automotive producers, akin to Volkswagen Group, BMW Group, Normal Motors, and others, are investing within the improvement of Car2X know-how for charging infrastructure that’s additional driving the market development. California is rising with robust electrical car deployment targets, that are anticipated to have a optimistic affect and enhance the expansion of the market.

What Are Chargers?

Presently, EV charging is dominated by comparatively low-tech chargers, with the high-compute purposes occurring largely inside EVs, in keeping with Harbor Analysis. There are three ranges of EV charging options:

Degree 1: This primary charger makes use of adapters included with most EVs to straight plug autos into wall sockets or retailers. It’s gradual—a most of about 5 miles RPH (range-per-hour), and except a separate meter is put in these chargers usually haven’t any HMI (human-machine interface) and lack even probably the most primary options like vitality consumption monitoring or computerized shutoff.

Degree 2: This degree allows sooner charging utilizing 240V retailers. It requires devoted {hardware}, often SAE J1772 EV plugs and adapters, and costs between 12-25 miles RPH. Attainable options of Degree 2 embrace load balancing, distant cost and pricing, app-based wayfinding, and distant upkeep and updates.

Degree 3: Additionally referred to as DCFC chargers, Degree 3 chargers are costly to put in, requiring a separate station often in public venues, however they gas a car a lot sooner than Degree 2 (100+ miles RPH). In the present day, most Degree 3 charging stations are unconnected wall-box options or commonplace 50kW merchandise.

Grand View sees the quick charger section main the market, accounting for greater than 72% share of the worldwide income in 2022. The section can be anticipated to develop at highest CAGR due to the rising initiatives by numerous governments for accelerating the deployment of public fast-charging infrastructure. Most organizations have deployed Degree 3 DC quick chargers or Degree 2 AC charging stations that may totally cost an electrical car inside half-hour to 4 hours.

The slower charger section can be anticipated to register vital development. The gradual chargers are principally adopted by residential purposes and are used for in a single day charging. Furthermore, a lot of the electrical car producers present gradual chargers together with the acquisition of electrical autos, which is additional driving the section development. The Degree 2 section accounted for greater than 52% share of the worldwide income in 2022.

All of the Tech You Need

New fashions at Degree 3 are being developed which have even greater vitality outputs, 5G connectivity, infotainment shows utilizing LCD/LED touchscreens, and AI-level purposes like analytics-based load balancing, AC/DC energy inversion, and DER (distributed vitality assets) storage and integration.

AI (synthetic intelligence) you say? FreeWire Applied sciences launched Mobilyze Professional, an AI-enabled platform designed to supply correct predictions to effectively and profitably broaden nationwide EV charging infrastructure. The platform’s new instruments, together with a utilization prediction engine, a tariff advice engine, and a profitability calculator, leverage AI to parse by means of public and proprietary datasets to foretell the very best areas to deploy EV quick charging.

Mobilyze Professional is designed to assist charging web site hosts meet the quickly rising demand for charging infrastructure by offering correct utilization and profitability forecasts. These instruments give homeowners of charging infrastructure the assets they should examine web site areas and {hardware} options, thereby offering confidence within the enterprise case for EV charging and overcoming a key hurdle to speed up deployment and entry for drivers. The platform makes use of AI to make extremely correct predictions and optimize undertaking economics, making EV quick charging extra ubiquitous and extra accessible to the general public.

FreeWire has developed a number of options on the platform, one among which is a profitability calculator to foretell working prices and money move. This characteristic is powered by two key technical advances, together with an AI-powered utilization prediction engine and a tariff advice engine. Utilization prediction analyzes charging exercise information from 1000’s of current public charging areas and correlates this information with EV drivers’ journey patterns, demographics, and car possession to foretell what number of classes per day will happen at new charging areas.

The tariff advice engine permits web site hosts to precisely quantify the affect of putting in quick charging on their utility payments and determine the very best utility tariff for his or her web site. Collectively, these new instruments allow web site hosts and retailers to match and rank 1000’s of areas at a time, permitting them to strategically determine the websites that can drive the best utilization and greatest returns.

Connector Issues

In the present day there are roughly 20 kinds of electrical plugs in widespread use around the globe and plenty of out of date socket varieties are nonetheless present in older buildings. Any world traveler can relate to the issue of plugging of their linked autos in different international locations. Even in a single nation, there could also be wall sockets that received’t settle for the widespread plug-in use in that nation; within the U.S., many older sockets are nonetheless two-wire, two-prong whereas the plug in your laptop computer will probably be three-wire, three-prong.

The standardization of EV charging connectors is equally difficult. SAE Intl., will standardize the Tesla-developed NACS (North American Charging Normal) connector to make sure that any provider or producer will have the ability to use, manufacture, or deploy the NACS connector on electrical autos and at charging stations throughout North America. Ford Motor Co., Normal Motors, Rivian, and a bunch of EV charging firms not too long ago introduced plans to undertake the NACS connector by means of adaptors or future product choices.

Electrify America, for instance, will proceed to supply the CCS (mixed charging system) connector all through its community because it transitions to additionally assist automakers including NACS charging ports. The corporate will work to supply a NACS connector choice at current and future charging stations by 2025 to make charging as handy as attainable for EV homeowners.

CCS connectors can be found in two varieties, CCS Type1 and CCS Sort 2. CCS Sort 1 connectors are extensively use within the U.S. whereas CCS Sort 2 are utilized in Europe. Furthermore, the assist from main auto producers and OEMs, together with Daimler AG, Ford Motor Firm, Normal Motor Co., and Volkswagen Group, is predicted to drive the demand for the CCS section.

Tesla’s quick charging technique is proprietary and closed. Their autos can use adapters to gas at most “generic” charging stations, however different autos can’t use Tesla’s superchargers. An open charging commonplace might use the OCPP (Open Cost Level Protocol), which is the important thing community communication protocol for DCFC stations and Cost de Transfer (CHAdeMO), which competes with the Tesla supercharger as a technique for DC Quick Charging, and is adopted in nearly all commercially obtainable DCFC stations.

And, going by numbers alone, by 2025 China could have practically 750,000 Degree 3 stations put in, out of a worldwide complete of 943,000. The official EV plug commonplace in China is GB/T connector, which is utilized by all of the EV chargers. In keeping with Grand View Analysis evaluation, in 2022, there have been 7,082,307 EV chargers of all ranges in China.

All OEM private and business automobile and truck builders need the infrastructure needed for his or her present and future autos. It is sensible that, with the infrastructure in place, extra autos can and will probably be bought. Ford Professional, for instance, the business division inside Ford Motor Co., added new charging {hardware} to its EV options to assist make it simpler for business prospects to transition their fleets to electrical.

The brand new Collection 2 AC Charging Station 80 amp and expanded DC Quick Charger choices are designed for business car use, and paired with Ford Professional’s charging administration software program, the corporate offers a completely built-in answer that simplifies EV charging for each Ford and non-Ford electrical autos.

The Collection 2 AC Charging Station 80 amp comes with enhanced safety with RFID (radio frequency identification) that limits undesirable charger entry. Fleet operators can situation a novel Ford Professional RFID card to regulate entry to chargers enabling charging classes to be restricted to particular people or autos, by specifying day and occasions for entry. The brand new RFID software program additionally helps Ford and non-Ford autos, unlocking the power for fleet operators to trace vitality reviews by means of Ford Professional’s charging administration software program.

Ford Professional’s prolonged DC Quick Charger choices in 180kW and 240kW offers fleet operators and their drivers extra versatility with extra energy and shortened cost occasions. Aluminum pedestals characteristic an improved cable retractor, and the built-in software program and {hardware} answer helps fleet managers optimize how, when, and the place EVs are charged together with utility reimbursement reporting, necessary for home-based drivers.

EV charging stations function the essential bridge between utilities energy distribution and electrical car energy consumption. Functions akin to energy inversion, off-grid energy storage, and grid interactivity can optimize this bridging course of, serving to to keep away from overload by the huge demand for EV charging that can quickly be upon us.

Public EV charging station networks are inherently a high-technology digital enterprise. They displace the legacy fueling mannequin with a distributed, subscription-based method enabled by software program, analytics, and vitality administration to stop EV charging from crippling the grid. Business teams ought to proceed to advertise EV charging interoperability by means of open requirements, and collaborate with OEMs and utilities to deploy sooner, cheaper charging stations with vitality storage and cargo balancing, thereby accelerating the shift to business EVs.

Need to tweet about this text? Use hashtags #building #sustainability #infrastructure #IoT #AI #edge