Switching to paperless accounts payable is intimidating. It typically means digitizing years of information, coaching your employees, and shifting your workflows. Nonetheless, this alteration can yield important rewards.

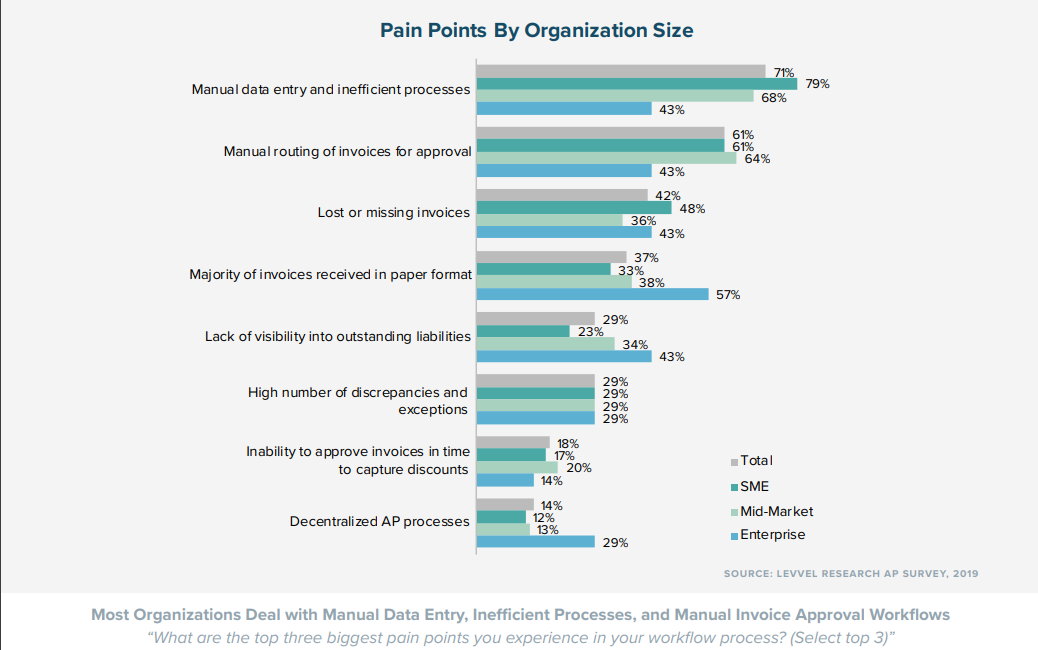

Take into account this: Levvel Analysis discovered that fifty% of companies grapple with late funds and missed reductions resulting from protracted approval cycles. Staggeringly, 79% of SMEs and 68% of mid-market companies cite guide knowledge enter and inefficient procedures as their main ache level. For big enterprises, the principle challenge is that almost all invoices arrive in paper type, with 60% experiencing this issue.

These figures underline the necessity for a extra environment friendly, streamlined solution to deal with invoices, buy orders, and funds. Might adopting a paperless accounts payable course of be the answer? On this article, we’ll delve into why it could be. We’ll additionally information you on transitioning to a paperless system and share precious ideas for a seamless shift.

What are paperless accounts payable?

The time period paperless accounts payable refers to a totally digital AP course of, eliminating the necessity for paper invoices. It entails the AP division leveraging expertise to digitize invoices and associated paperwork, automating the approval course of, and conducting funds by way of digital means.

It’s possible you’ll create a tech stack of specialised instruments or complete paperless accounts payable software program to handle all elements in a single place. Both method, the purpose is to get rid of guide steps, cut back the possibility of error, and enhance pace and effectivity.

Each enterprise needs to have the ability to pay their distributors on time and get reductions for early funds. However the paperwork and forms typically stand in the way in which. Add Excel and e mail into the combination, and it is easy to lose invoices, miss funds, or delay studies.

Here is the place going paperless is a game-changer. It helps companies handle extra invoices with out including employees or extending work hours. The cherry on prime? A standardized AP workflow you can tweak for even higher effectivity over time.

Why do it’s good to go paperless in accounts payable?

Processing an bill may value you wherever between $15 to $40. However here is the silver lining: an AIIM report reveals automated invoices can reduce prices by 29.2%. For instance you course of 10,000 invoices month-to-month at $10 every. That is roughly $300,000 saved yearly.

Now think about this: roughly a 3rd of companies surveyed have been in a position to cut back bill processing prices much more: a whopping 50%. Meaning an annual financial savings of $600,000. Spectacular, proper? Nonetheless, the advantages of going paperless lengthen past merely saving cash.

Shifting to paperless permits your group to prioritize strategic duties. It minimizes human error and bolsters compliance. It smooths vendor relationships by way of immediate funds. And to not point out the environmental impression. By going paperless, you’ll be able to considerably cut back your organization’s carbon footprint.

➡️

How does a paperless accounts payable system work?

Ask AP clerks what their least favourite activity is, and so they’ll possible inform you: guide knowledge entry. It is all over the place. From inputting bill knowledge to monitoring funds and reconciling accounts, the listing goes on. With a paperless accounts payable system, a lot of this wrestle is eradicated.

However that is not all. Let’s take a look at how a paperless accounts payable system operates and the way it can streamline totally different elements of your AP workflow.

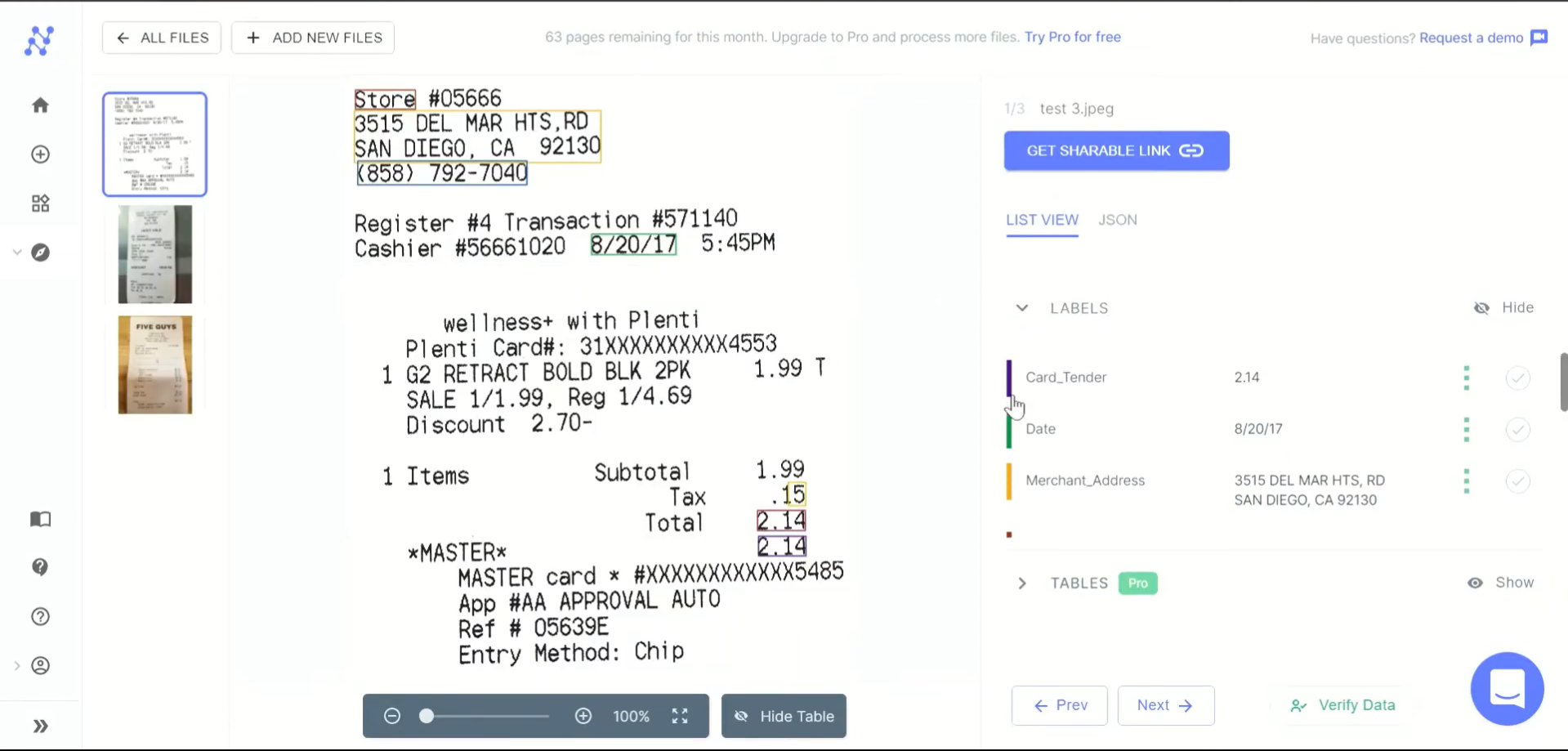

1. Seize data and digitize paperwork

You would possibly obtain buy orders, receipts, and invoices from numerous channels — e mail, Dropbox, Google Drive, submit, and even fax. Sometimes, you’d have to manually enter this knowledge or scan the paper paperwork into your system. This course of is time-consuming, liable to errors, and delays vendor funds.

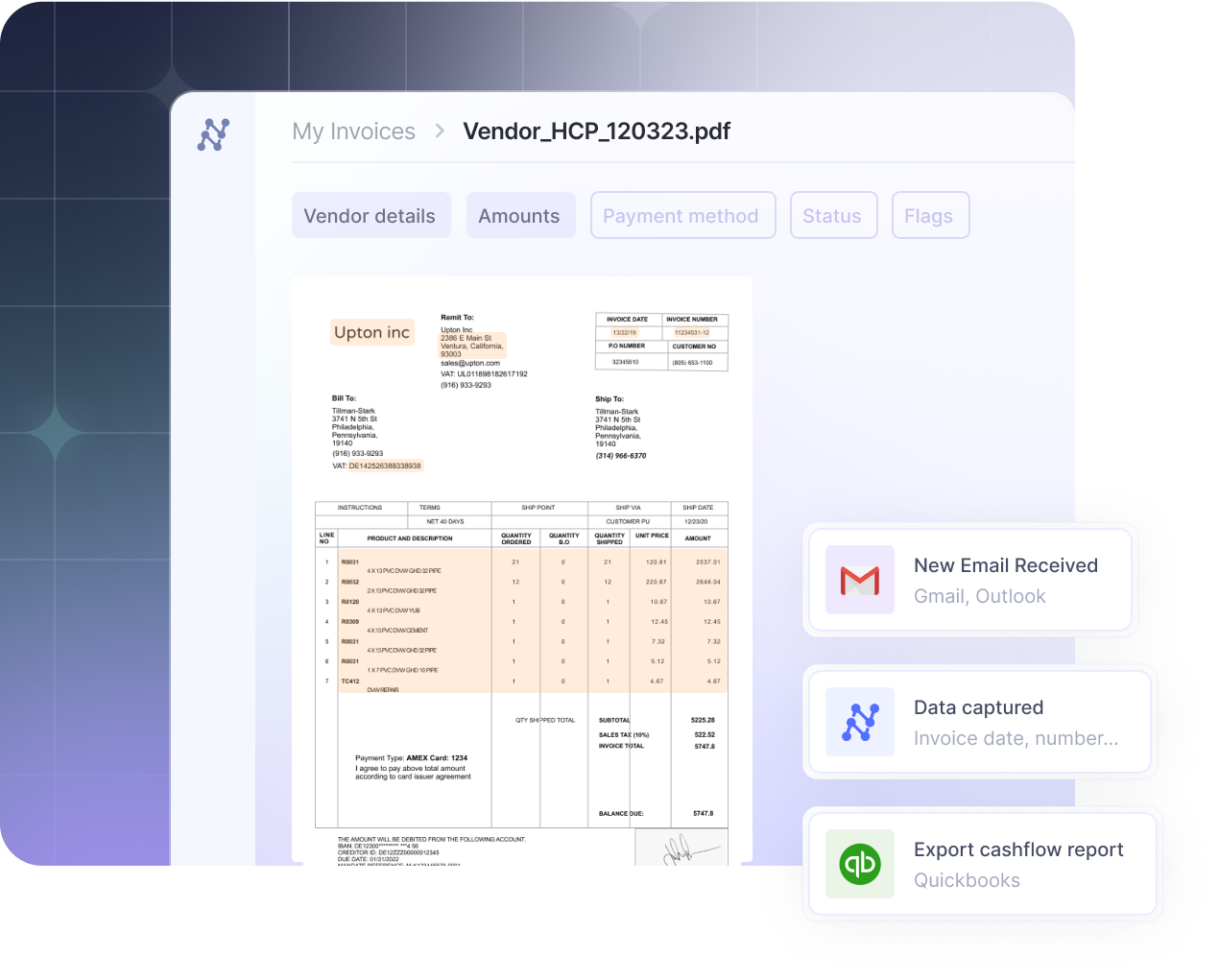

Paperless accounts payable techniques like Nanonets have options like AI-OCR (Optical Character Recognition), preset guidelines, and automatic workflows. You’d have the ability to seize doc knowledge from any channel effortlessly. The system scans, extracts, and validates knowledge as quickly because it arrives after which digitizes it.

Structured or unstructured, totally different currencies, tax rules, and languages — it does not matter. The system can deal with all of it. Your group will not be looking at Excel sheets, manually cross-checking numbers. As an alternative, knowledge could be available, correct, and simply searchable.

2. Automate approval and matching workflows

The subsequent step is to get the paperwork accepted. This typically entails routing them bodily or through e mail to the accountable events for approval in conventional setups. AP clerks would typically should observe up repeatedly to make sure well timed approvals.

Moreover, the invoices should be matched with the corresponding buy orders and items receipts to keep away from duplicate invoices, fraud, and errors. It typically entails manually pulling up every doc, printing them, and evaluating them line by line. It is not probably the most enjoyable job on the earth, and definitely not probably the most environment friendly.

Whenever you swap to a paperless accounts payable system, this complete course of is automated. The system routes paperwork to the fitting people primarily based on predefined guidelines for approval. With Nanonets, you’ll be able to arrange auto-reminders and alerts to approvers, guaranteeing they log out on time. Automated standing updates facilitate a extra clear and environment friendly communication course of for all events concerned within the approval course of. These updates permit for simple monitoring of progress and be sure that everyone seems to be conscious of the present standing of the paperwork.

The system additionally robotically matches the invoices with buy orders and items receipts. In case of a mismatch or discrepancy, it raises an alert, permitting you to catch errors early and keep away from cost delays or disputes. This automation reduces guide labor and considerably decreases the possibility of error, fraudulent exercise, and potential monetary loss.

3. Course of funds electronically

Processing funds sometimes entails a number of papers and paperwork. Cheques, cash orders, financial institution drafts — you identify it. These conventional strategies require assets, add to the processing time, and delay vendor funds.

Your AP clerks should manually report every cost, guaranteeing that the correct quantity is distributed to the fitting vendor. They’d should maintain observe of those funds, cross-checking in opposition to financial institution statements and resolving discrepancies once they come up. Lastly, they’d should painstakingly reconcile these funds in opposition to the unique invoices and the final ledger. This course of is each time-consuming and error-prone.

However with a paperless accounts payable system, seamless knowledge circulate and automatic workflows guarantee these challenges are successfully mitigated. It could combine together with your present financial institution or cost processor to facilitate easy and safe funds. You may select the cost technique that works for you — ACH, bank card, wire switch, and even digital playing cards.

For example, Nanonets integrates with Stripe and QuickBooks, facilitating streamlined funds whereas protecting your monetary information up-to-date. You may schedule funds in accordance with your money circulate and vendor phrases.

Paperless techniques can even robotically report every cost and its corresponding bill and vendor particulars. This implies no extra guide recording and no extra cross-checking in opposition to financial institution statements. Discrepancies, if any, are flagged by the system in real-time, permitting your group to resolve them promptly and effectively. The system additionally ensures that each one funds are precisely reconciled in opposition to the unique invoices and the final ledger.

4. Automate reporting and audit trails

With paper-based techniques, these duties typically require extra effort and time. You’d should sift by way of stacks of invoices, receipts, and different paperwork, manually coming into and cross-referencing knowledge to generate studies. Sustaining a transparent audit path can be a problem, as it is easy to lose observe of paper paperwork.

With a paperless system, your knowledge is robotically saved and managed in a central repository. This makes knowledge retrieval and report technology a breeze. Whether or not it is month-end closing, auditing, or monetary forecasting, you’ll be able to immediately entry the information you want.

Automated, real-time reporting reduces the time spent on guide knowledge consolidation. It additionally supplies precious insights into your monetary operations, serving to you determine traits, detect anomalies, and make data-driven choices.

As for audit trails, the system logs all actions, from bill receipt to cost, together with all approvals and adjustments made. This stage of transparency ensures accountability, simplifies compliance and makes investigating potential points or disputes simpler. Furthermore, integrations together with your ERP or accounting software program be sure that all monetary knowledge is synchronized and up-to-date, lowering the danger of inaccuracies and duplication.

5. Hold distributors up to date and preserve transparency

In conventional setups, provider relationship administration will be fairly difficult. Late funds, misplaced invoices, and miscommunication can pressure your relationship with distributors. Plus, protecting observe of each provider’s phrases and preferences will be daunting.

Nonetheless, a paperless accounts payable system simplifies this course of. Quicker processing and approval of invoices imply that funds are made on time, which boosts vendor satisfaction. The system additionally shops all of your vendor data centrally, making it simple to entry and handle.

Automated provider portals permit distributors to submit their invoices, observe cost standing, and talk in real-time, lowering the necessity for back-and-forth emails or telephone calls. Computerized notifications, alerts, and reminders are despatched to each events in case of delays or discrepancies, thus guaranteeing transparency and lowering misunderstandings.

As well as, the system can accommodate totally different cost phrases, reductions, or different preferences for every provider, managing these variables seamlessly. This ensures compliance together with your vendor’s necessities and lets you benefit from early cost reductions or different incentives, optimizing your money circulate and strengthening your provider relationships.

On the finish of the day, transitioning to a paperless accounts payable system is not only about value and time financial savings. It is about remodeling your AP course of right into a strategic enterprise operate that drives effectivity, transparency, and management.

How do you implement a paperless accounts payable system?

Okay, so that you’re satisfied about the advantages of a paperless accounts payable system. You may see the way it can rework your monetary operations, streamline processes, and improve management. However how do you go about implementing it?

Here is a step-by-step implementation information to provide you a transparent path towards your transition:

Step 1: Consider your present course of

Establish the areas that want enchancment and the challenges that you simply’re dealing with. Are there late funds? Do you discover reconciliation troublesome? Are there frequent errors, and the place do these happen most frequently?

Converse to your group and collect their enter. What are their main ache factors? What do they spend most of their time on? What components of the method do they discover most difficult or irritating? This suggestions can assist you perceive what you want from a paperless accounts payable system.

Step 2: Outline your wants and aims

When you perceive your present scenario and challenges, determine what you need to obtain together with your new system. Do you need to pace up bill processing? Enhance accuracy? Improve transparency? Scale back prices?

Set clear, measurable aims. For instance, you could need to cut back bill processing time by 50% or obtain 100% accuracy in cost reconciliation. Then, determine your useful necessities. Do you want an approval workflow? How about integration together with your present ERP or accounting software program? Would you like real-time reporting and analytics? A provider portal?

Take into account future wants as nicely. As your small business grows, you could have to onboard extra distributors, deal with bigger volumes of invoices, or adjust to extra rules. Be sure that the system you select can scale and adapt to those adjustments.

Step 3: Analysis and consider potential options

Begin researching accessible paperless accounts payable techniques. Have a look at product descriptions, weblog posts, buyer opinions, case research, and demo movies. Attend webinars or product demonstrations if doable.

There are quite a few paperless accounts payable techniques accessible out there. Some are standalone techniques, whereas others will be built-in together with your ERP or accounting software program. Take into account numerous components such because the system’s options, ease of use, scalability, safety, buyer assist, and value.

Search for options that particularly handle your wants. For example, select a system with automated reminders and approval workflows for those who’re combating late funds. If knowledge entry errors are an issue, go for a system with superior OCR expertise for correct, automated knowledge extraction.

Step 4: Plan and execute the implementation course of

The precise implementation of your chosen accounts payable system is a crucial step. It entails putting in or organising the software program, migrating your present knowledge, organising workflows, and coaching your employees.

Here is a guidelines of issues to contemplate through the implementation course of:

- Knowledge migration: Guarantee all of your present knowledge is transferred precisely and securely to the brand new system. This consists of vendor data, bill knowledge, cost historical past, and different related knowledge.

- Workflow setup: Configure the system to mirror your required workflows and approval processes. Make sure the system is about as much as deal with your particular wants and necessities.

- Integration: In case your new system must combine with different software program (like your ERP or accounting system), guarantee these integrations are arrange appropriately and examined completely.

- Coaching: Present your group complete coaching to make sure they perceive methods to use the brand new system successfully. This will embody one-on-one classes, group workshops, and even self-paced on-line tutorials.

- Testing: Earlier than going stay, completely check the system to determine and repair any potential points. This consists of checking the accuracy of information migration, testing workflows, verifying integrations, and guaranteeing the system is user-friendly and useful.

- Assist: Guarantee that you’ve a dependable assist system in place. This may be from the seller’s buyer assist group or an inner IT group. It will be finest to have somebody who can shortly resolve any points through the implementation or post-implementation interval.

Step 5: Monitor and optimize the efficiency

As soon as your paperless accounts payable system is up and working, it is important to repeatedly monitor its efficiency and determine areas for enchancment or optimization.

Here is an inventory of KPIs you could need to observe:

Bill Processing Time: This measures the time it takes from receipt of an bill to its cost. A shorter processing time can point out a extra environment friendly course of.

Price per Bill: This calculates the overall value of processing an bill. Decrease prices point out a extra environment friendly and cost-effective system.

Bill Accuracy Charge: This KPI measures the share of invoices processed with out errors. Increased accuracy charges signify a discount in expensive errors.

Bill Exception Charge: This tracks the share of invoices that require guide intervention resulting from discrepancies or errors. A decrease exception price can denote a extra streamlined and automatic course of.

Approval Cycle Time: This measures the time taken from when an bill is obtained to when it is accepted. Lowering this time can pace up your whole accounts payable course of.

Moreover, conduct common opinions of the system and its impression on your small business. Discover out in case your group is assembly their aims? Are there any points or roadblocks? Is there extra coaching required on your group? Has the system helped enhance their relationships with distributors resulting from well timed funds and higher communication?

Paperless accounts payable system finest practices

Going paperless requires self-discipline and consistency to make it really efficient. It’s possible you’ll have already got normal practices established to take care of paper-based accounts payable — routing invoices above a sure threshold for managerial approval, all of the invoices saved in a selected submitting cupboard, and many others.

Equally, when transitioning to a paperless system, you need to set up sure finest practices to maximise your new digital system.

1. Automate knowledge import

It will be a ache in case your group manually uploaded all invoices to your paperless system. Always refreshing your e mail inbox and scanning by way of attachments is hardly environment friendly.

As an alternative, having an automated knowledge import characteristic will prevent time and cut back the probabilities of error. It’ll additionally guarantee a easy circulate of invoices into the system with none bottlenecks or delays.

Nanonets affords an entire bunch of auto-import choices, together with e mail, API integration, OneDrive, Google Drive, Dropbox, and Zapier. Irrespective of the place your invoices originate, you’ll be able to simply import them into the system robotically.

2. Make use of clever knowledge seize and extraction

It’s possible you’ll obtain invoices in numerous codecs, types, currencies, and languages when your small business grows. You can not depend on easy OCR and guide knowledge entry to deal with the complexities.

The AP division wants an clever knowledge seize and extraction system to grasp the complexities and adapt accordingly. This manner, you’ll be able to course of numerous invoices shortly and precisely.

Nanonets combines AI and best-in-class OCR to extract mandatory data from invoices precisely, no matter format or language. Structured, semi-structured, or unstructured knowledge — Nanonets can deal with all of it. This ensures you can work with numerous suppliers with none knowledge gaps or inaccuracies.

3. Implement automated approval workflows

Buy orders, invoices, and different monetary paperwork typically want a number of approvals earlier than processing. Handbook approval workflows will be sluggish, opaque, susceptible to fraud, and will result in missed cost deadlines.

Automating your approval workflows can expedite this course of whereas rising transparency. You may arrange customized approval sequences primarily based on bill quantity, division, venture, or every other standards.

With Nanonets, you’ll be able to customise your approval workflow primarily based on your small business wants. You may arrange guidelines for automated routing and approval hierarchies to make sure the fitting invoices attain the fitting approvers on the proper time. With stay standing updates, automated alerts, and reminders, you’ll be able to clearly observe every bill’s progress, preserve transparency, and stop any delays or missed funds.

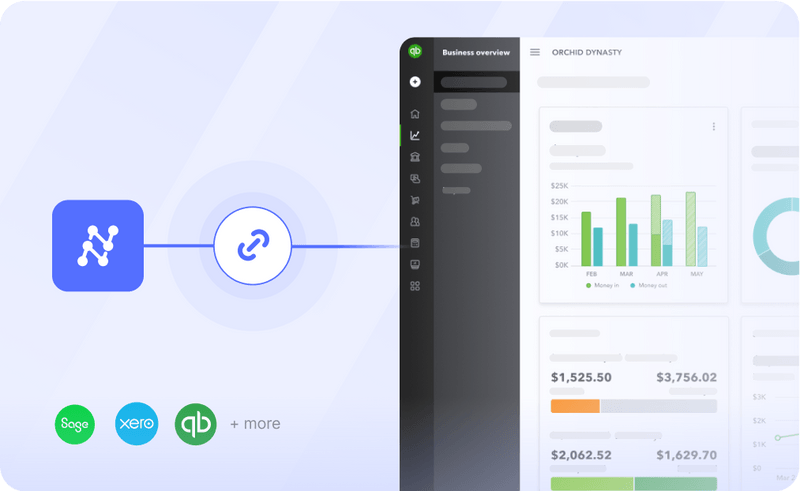

4. Arrange integrations to get rid of knowledge silos

Think about spending hours manually transferring knowledge out of your AP system to your cost system, accounting system, or ERP. It is not solely time-consuming but in addition liable to errors. What if an extra zero is added to an bill quantity or a decimal level is missed?

Integration between numerous techniques is important to make sure seamless knowledge switch and keep away from any errors. Not solely does it assist in saving time, however with automated 3-way matching and reconciliation, it additionally enhances knowledge accuracy and reliability.

Nanonets is constructed to play nicely with different techniques. It helps integration with fashionable accounting, ERP, and cost techniques, together with QuickBooks, SAP, Oracle, and many others. The info from Nanonets will be simply synced with these techniques in actual time, eliminating knowledge silos and guaranteeing easy, error-free knowledge switch. This manner, you’ll be able to focus extra on technique and fewer on guide knowledge entry.

5. Usually audit and optimize your system

To make sure that your paperless system is functioning optimally, it’s a necessity to usually audit and assessment the system’s efficiency. It will assist for those who observe key metrics like accuracy, processing time, and error charges and likewise take note of person suggestions.

Common audits won’t solely enable you determine points and bottlenecks but in addition uncover alternatives for enchancment. Optimizing your system primarily based on these insights will be sure that it continues to fulfill your wants as your small business evolves and grows.

Nanonets supplies strong real-time analytics and reporting capabilities to watch your AP processes. With actionable insights, you’ll be able to repeatedly enhance your system’s efficiency, lowering errors, enhancing pace, and rising total effectivity.

5. Prioritize safety and compliance

Sustaining the safety of your monetary knowledge is a non-negotiable requirement. Likewise, guaranteeing compliance with numerous legal guidelines and rules is essential to keep away from penalties and authorized points.

Your paperless AP system ought to have strong knowledge safety measures like encryption, safe knowledge storage, and person authentication. It must also be versatile sufficient to accommodate adjustments in regulatory necessities.

Nanonets delivers high-grade safety to maintain your delicate knowledge secure. It complies with world privateness requirements, together with GDPR and CCPA. It makes use of superior safety measures like knowledge encryption and safe cloud storage. Nanonets’ audit trails additionally preserve a transparent report of each motion, serving to you guarantee accountability and regulatory compliance.

Closing ideas

Transitioning to a paperless AP course of is not any small activity. It entails cautious planning, strategizing, and implementing. Nonetheless, the advantages outweigh the challenges with the fitting instruments and an efficient technique. From elevated effectivity and transparency to value financial savings and improved safety, the benefits of a paperless AP system are indeniable.

By harnessing the facility of Nanonets, companies can streamline their AP processes, obtain their operational objectives, and set themselves up for future development. It reduces guide labor and related errors, accelerates the bill approval course of, enhances knowledge accuracy, and facilitates seamless system integrations. With its robust concentrate on safety and compliance, Nanonets affords a dependable resolution for companies to confidently transition to a paperless atmosphere.

The highway to paperless AP could also be complicated, however with Nanonets, it is price embarking on. The alternatives that lie forward — improved effectivity, value discount, transparency, and knowledge safety — make this journey important for companies aiming to remain aggressive in a digital-first world.