Intel put out some strong earnings outcomes final month. We need not rehash these right here; as an alternative, as an alternative wish to give attention to one explicit side of their numbers – their long run gross margin steering. Within the newest quarter they reported 42.5% gross margins, however critically, they restated their aim for sometime attaining gross margins within the 60% vary.

Six months in the past, most individuals, together with us, dismissed that aim as fanciful at finest. However now, all of us must not less than take into account the chance, nonetheless slim, that they could really obtain it. Significantly, understanding how Intel is restructuring internally in preparation for launching Intel Foundry Providers (IFS) as a third-party foundry for semiconductor designers is essential.

Editor’s Be aware:

Visitor creator Jonathan Goldberg is the founding father of D2D Advisory, a multi-functional consulting agency. Jonathan has developed progress methods and alliances for firms within the cell, networking, gaming, and software program industries.

Earlier this yr, Intel introduced adjustments to its inner accounting strategies. Beneath the brand new system, Intel’s product division and fab operations will every have their separate P&L and can work together with one another on an arm’s-length foundation. Beforehand, the 2 divisions blended their prices, with operations prices hidden inside product margins.

Whereas this may seem to be a trivial accounting adjustment – in any case, the corporate will nonetheless report consolidated gross margins, which stay unchanged – this delicate shift will considerably affect inner incentives. Our core thesis on Intel is that their most important problem lies in altering their inner tradition, making this ‘small’ change doubtlessly very impactful.

Our core thesis on Intel is that their most important problem lies in altering their inner tradition, making this ‘small’ change doubtlessly very impactful.

After the earnings report, we had the chance to talk with administration about their outcomes and dug into how they plan to attain their long-term aim. A key takeaway from this dialog was the administration’s assertion that they’re implementing many ‘simple’ inner steps to enhance gross margins.

Some measures are simple, like benchmarking fab operations prices towards business friends. Others sound less complicated than they’re – like charging the product aspect for rush orders or ‘scorching heaps’. An apparent query arises: if these are all ‘low-hanging fruits’, why weren’t they already carried out? The reply is that these adjustments are usually not as simple as they appear.

Think about you might be an Intel salesperson chargeable for a hyperscaler shopper – a significant supplier of cloud computing, networking, or information storage – whose information facilities are main shoppers of Intel chips. The client is about to make a giant buy resolution between Intel and AMD CPUs for a possible $1 billion order. When you win, you get the Cadillac and an enormous bonus. AMD launched a brand new chip earlier within the yr, however the Intel product is simply popping out.

The shopper needs to check each choices in a 1,000 CPU system below actual workloads. Your product is briefly provide, however utilizing the earlier era of Intel CPUs would doubtless hand the win to AMD. So, you request a rush order of 1,000 components from the operations staff.

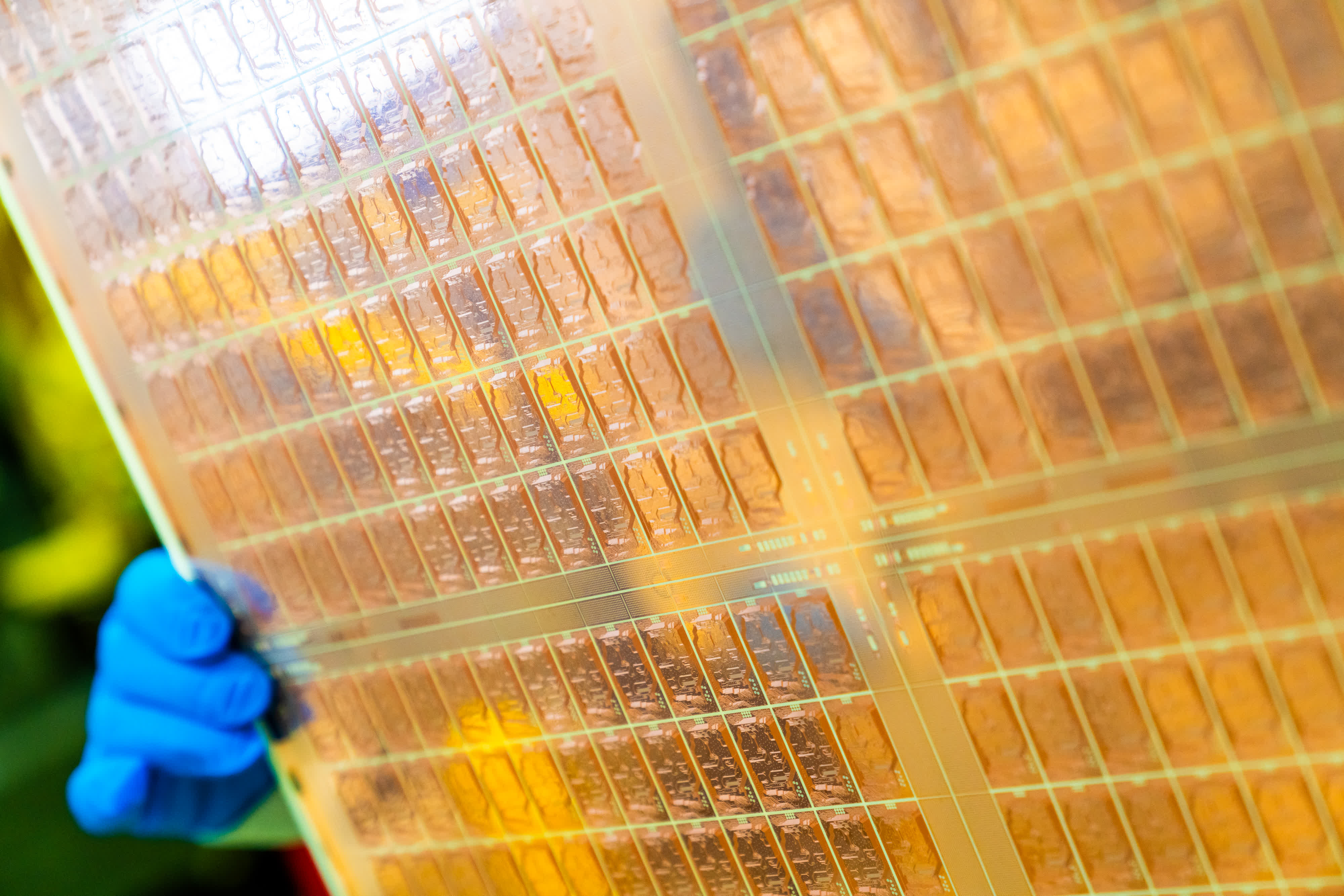

The operations persons are reluctant to do that as a result of the product is new, yields are low, so that they must produce double the quantity of wafers to get 1,000 good chips. Furthermore, the shopper needs a selected SKU or model of the chip, however the operations staff is already set to supply a special SKU. To get these 1,000 components would require them to close down the fab for just a few hours to re-tool, produce your chips, after which shut down once more to re-tool for the unique plan.

When the fab prices $30 billion to construct, a half day of downtime in all probability prices one thing like $10 million in deprecation. Beneath the previous mannequin, you didn’t care, as a result of you’ll be able to win that $1 billion order, and all these expenses will turn into rounding error for the sale.

Beneath the brand new mannequin, you now must bear the total brunt of these expenses. To illustrate this order is going down near the top of the yr, so you’ll have to take the cost on this yr’s numbers, and won’t get the acquisition order till the subsequent yr. Along with your P&L in that form, you’ll not get the steak knives, you’ll in all probability get fired, and another person will get the advantage of that buy order subsequent yr. But when you don’t place the push order you’ll doubtless lose the deal solely. What would you do on this state of affairs?

After all, this can be a extremely simplified state of affairs, nevertheless it aptly illustrates the profound cultural shift about to happen inside Intel. Intel’s earlier practices, embedded into its enterprise mannequin and gross sales methods, offered a major benefit over opponents. With out this instrument – or maybe crutch – the gross sales staff might want to lean way more on product efficiency alone.

This shift is more likely to affect their market share and income outlook in advanced methods. As our hypothetical state of affairs demonstrates, a lot will rely on particular person decision-making, group dynamics, and administration tradition. Will the salesperson’s boss undertake a long-term perspective? Will the operations staff keep any stage of flexibility? How will senior administration deal with disputes? And can administration consent to a one-time exception, which then turns into the norm, successfully nullifying the aim of the change?

Accounting may be boring, however typically it results in very fascinating developments.