Bill imaging is not a futuristic expertise straight out of Star Wars anymore. Most of us have scanned a QR code or used Google Lens OCR capabilities to translate avenue indicators in actual time. The latest developments in AI and ML have made bill imaging software program rather more sturdy, enabling AP groups to automate a number of the most tedious points of the accounts payable processes.

On this weblog publish, we’ll take a look at how bill imaging can assist automate accounts payable processing and the way Nanonets AP automation software program can automate your entire course of to avoid wasting time, cash, and assets.

What’s bill imaging?

Bill imaging is the method of digitizing invoices and extracting information from them. It is a means of changing paper invoices into digital information which might be simpler to retailer, entry, and be used for additional processing.

The bill imaging function is now constructed into bill automation instruments. Not solely do these instruments detect and acknowledge textual content, numbers, and different data from invoices, they’ll ship the extracted information to accounting methods or ERP software program for additional processing.

Bill imaging can assist streamline your entire accounts payable workflow, scale back guide effort, and save valuable time and assets. AP groups will be capable to course of invoices extra rapidly and precisely, and also you usually tend to get reductions from suppliers for well timed funds.

How does bill imaging work

Let’s be sincere — no one loves processing invoices manually. It is time-consuming, repetitive, and sometimes the least favourite a part of an AP clerk’s job. Now think about having to course of 600-800 invoices a month. The guide information entry alone would take up a lot of the crew’s time, leaving little room for extra important duties.

That is the place bill processing software program helps. The software program typically follows a three-step course of to finish the duty.

- The bodily bill is scanned to create a digital model of the doc.

- The bill information is interpreted based mostly on particular enterprise guidelines which were established.

- Be certain that the info is correct and full and ship it out to involved events to get the mandatory approval

- It’s filed into any Enterprise Useful resource Planning (ERP) system for additional processing and evaluation.

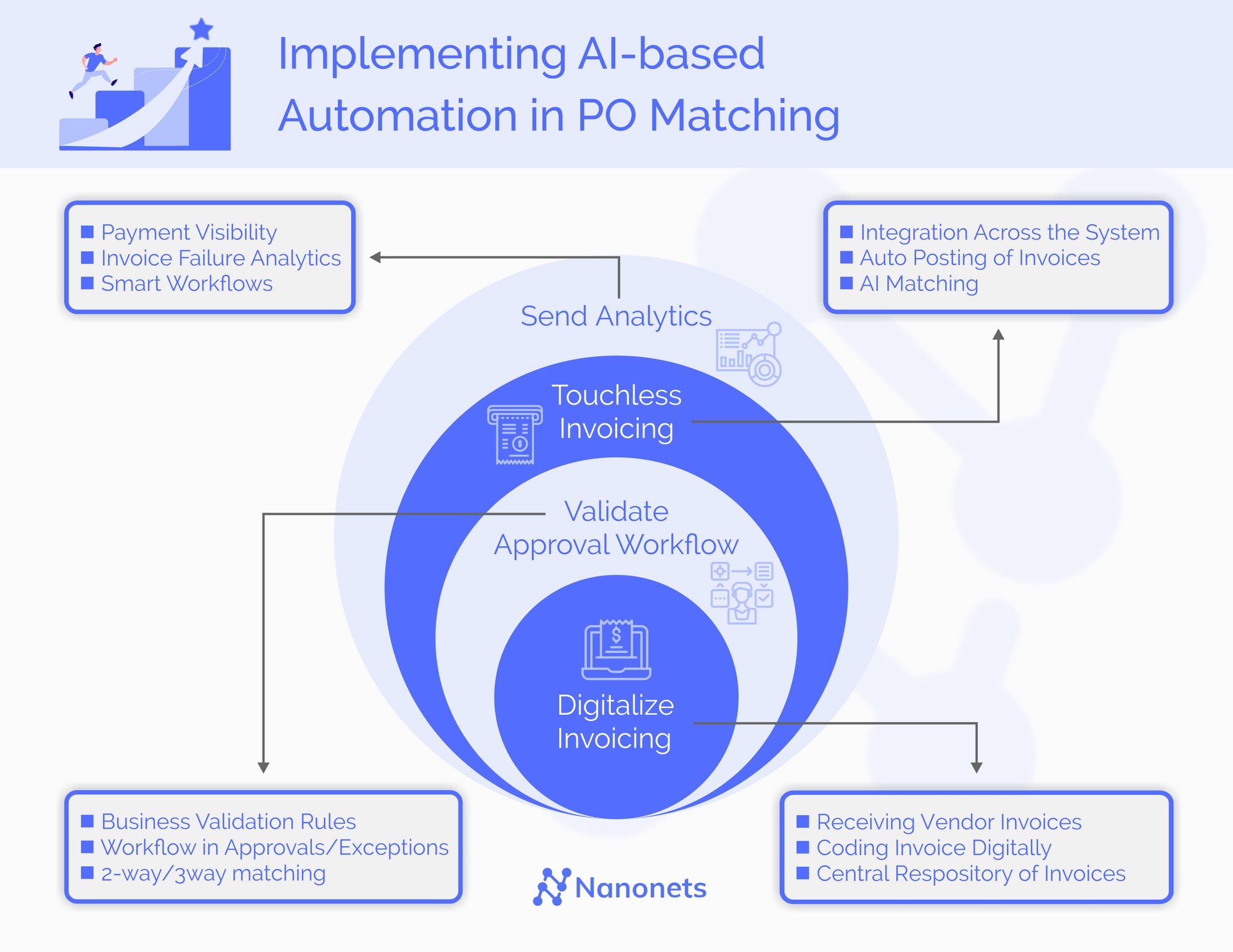

Now there are two forms of bill processing instruments on the market: Rule-based and AI-based. Rule-based methods depend on predetermined guidelines which might be based mostly on particular key phrases or patterns anticipated to be discovered within the bill. AI-based instruments use ML to find out how and predict what information to extract and course of from invoices.

A rule-based system could also be programmed to hunt out the phrase “complete” adopted by a greenback quantity to acquire the bill’s complete price. Rule-based methods may be efficient for easy bill processing duties, however they could wrestle with extra complicated invoices or these that don’t observe the anticipated format.

An clever device could acknowledge varied bill codecs and regulate its processing accordingly. Clever instruments may be extra versatile and correct than rule-based methods, however they could require extra coaching information and experience to ascertain.

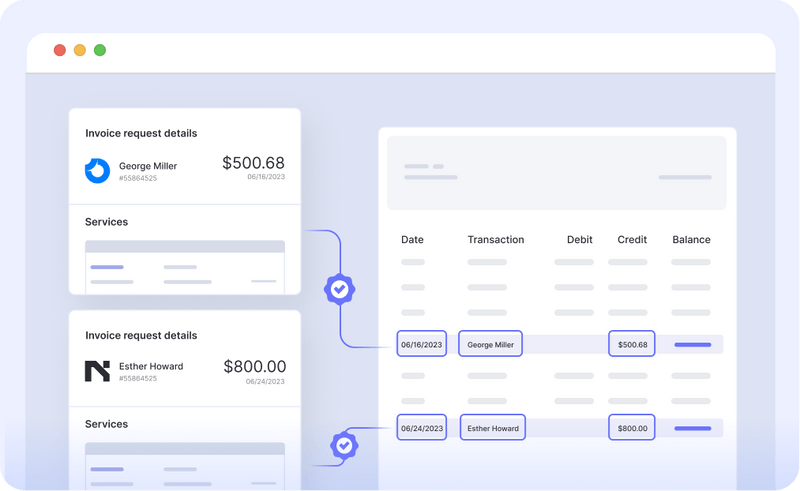

Nanonets AP automation software program comes with built-in bill imaging. You possibly can scan and add invoices in bulk, fully automate information extraction, route invoices to the fitting approvals, assign them to crew members, and pay distributors with just some clicks.

This is a step-by-by overview of how bill imaging works inside our AP automation software program:

- Add invoices into the system in any format, together with PDF and picture information.

- Extract important data from the invoices mechanically utilizing OCR and AI-based applied sciences.

- Match invoices to buy orders and items receipts.

- Route invoices to the fitting approvals.

- Robotically pay distributors based mostly on configured guidelines.

Automation frees up accounts payable groups to deal with essential duties like analyzing spending patterns, vendor relationships, compliance, and fee negotiation. This boosts effectivity and productiveness.

Causes to undertake bill imaging and automation into your AP workflow

Firms have benefited drastically from the most recent improvements in bill imaging expertise. It has made information extraction extra easy and productive than ever earlier than, a lot in order that bill automation is turning into the norm for corporations seeking to improve their AP workflows.

For distributors, this implies quicker funds and diminished threat of bill errors. Automated routing and approval workflows get rid of the necessity to observe up on funds or cope with delayed transactions, resulting in elevated belief and fewer payment-related disputes.

These benefits will not be restricted to distributors alone. Your AP crew advantages from automated information entry and easy AP duties, releasing up their beneficial time to deal with strategic duties, resulting in improved vendor relationships, higher money administration, and more practical negotiation of cost phrases.

Extra on how bill imaging automation helps each AP groups and distributors:

1. Forestall fraud

Since every bill goes by way of 2-way, 3-way, or 4-way matching of buy orders and gross sales receipts to invoices (facilitated by OCR expertise), fraudulent distributors will not be capable to make the most of your small business. It additionally prevents fraudulent funds from being processed, together with these ensuing from incorrect information entry, false billing, or fraudulent cheques.

Moreover, automated bill approvals and an audit path for the accounting crew and auditors may be arrange so as to add one other layer of safety towards fraudulent actions.

2. Cut back human errors

Guide information entry is liable to errors, resulting in incorrect funds, penalties, and strained relationships with distributors. With bill imaging and automation, these errors are considerably diminished because the software program precisely captures and processes bill information.

This additionally ensures that no invoices are misplaced or forgotten, additional bettering the reliability and effectivity of your AP course of. You possibly can appropriately estimate your money stream and take the mandatory steps to take care of a wholesome money stream stability.

3. Guarantee compliance

Audits turn into much less daunting as all mandatory documentation is available, accessible in a central location, and traceable. Furthermore, the integrations with the ERP system be sure that all transactions are recorded and tracked in real-time.

The reviewal and approval routing processes be sure that each bill is verified as per firm and regulatory insurance policies. Furthermore, you possibly can arrange taxation guidelines and rules within the software program to mechanically calculate and apply the right tax charges to invoices, guaranteeing compliance with native and worldwide tax legal guidelines.

4. Keep higher vendor relationships

Distributors respect immediate responses and correct funds. And automatic bill processing ensures that every one invoices are paid on time. Furthermore, because the system retains them within the loop with automated notifications, they really feel safer about their transactions with your small business — and this reduces the necessity for follow-ups.

This stage of transparency can result in higher negotiation of phrases, reductions, and probably even unique offers. This additionally makes it simpler to resolve any disputes or points that will come up, resulting in stronger, extra collaborative relationships.

5. Monitor vendor efficiency higher

With all vendor data centralized, monitoring their efficiency and making data-driven selections turns into extra manageable. Surprising delays in inventory replenishment may be averted because the system can predict and notify when a restock is important based mostly on the seller’s historic information.

This stage of foresight not solely ensures a easy provide chain but additionally reduces the danger of overstocking or understocking, thus optimizing stock administration.

6. Improve the AP crew’s morale and productiveness

Think about telling an AP crew member that they will not should chase their colleagues or teammates from different departments for approvals. Or that they will not have manually course of invoices ever once more. That is exactly what bill imaging and automation can present.

Eliminating tedious and repetitive duties can enhance job satisfaction and better productiveness ranges. Plus, with the fast and correct processing of invoices, the crew can keep away from the stress of last-minute rushes and obtain a greater work-life stability.

7. Improved monetary forecasting

With real-time updates on bill funds, AP groups can get a transparent image of the corporate’s money stream. This permits higher monetary forecasting and planning. For example, realizing when a big cost is due can assist regulate the price range and keep away from any potential money stream points.

8. Enhance profitability

By automating the bill course of, corporations can considerably scale back the price of processing every bill. This, coupled with benefiting from early cost reductions and avoiding late cost fines or compliance-related penalties, can result in a noticeable enchancment within the firm’s backside line.

Moreover, the power to precisely forecast money stream and price range successfully can even contribute to elevated profitability. By clearly understanding the corporate’s monetary state of affairs, higher selections may be made that may positively have an effect on the enterprise’s profitability.

Automating bill imaging boosts AP effectivity

Automating bill imaging and processing has proved to be a game-changer for our purchasers, leading to important price and time financial savings.

Maryland-based full-service atmosphere remediation contractor, ACM Companies, is a primary instance of this transformation. They built-in the Nanonets OCR resolution into their operations, and the outcomes had been good — a whopping 90% reduce of their bill processing time.

What was a 20-hour weekly chore changed into a job that might be wrapped up in a single day. Not solely did this pace up the bill extraction course of, but it surely additionally led to a happier work atmosphere. The price of processing invoices plummeted for ACM Companies. Plus, by settling their invoices promptly, they had been in a position to seize early cost reductions from their distributors.

Ascend Properties, a UK-based property administration firm was in a position to save 80% in bill processing prices after implementing an automatic bill imaging system. That they had 5 full-time staff devoted to guide bill processing. After automation, they wanted just one, releasing up the remainder of the crew to deal with extra strategic duties.

Last ideas

When you’re contemplating implementing an automatic bill imaging system, selecting an answer that matches your small business wants is important. Search for a system that provides real-time monitoring, integration together with your ERP system, and customizable approval workflows.

Keep in mind, the objective is to streamline your AP course of, scale back guide duties, and enhance your backside line. With the fitting resolution, you possibly can obtain these targets and extra.

Try Nanonets OCR and AP automation resolution for a complete, easy-to-use, and environment friendly option to automate your bill imaging course of. With our superior AI expertise, you possibly can drastically scale back bill processing time, enhance accuracy, and improve your crew’s productiveness.