B2B fee automation includes all the things from the automation of capturing and processing invoices to creating funds to distributors and reconciling these funds in your books. It permits what you are promoting to unencumber assets, cut back guide errors, and give attention to extra strategic duties.

A 2018 report revealed that companies in North America spend $187 billion yearly on Accounts Payable (AP) processing, and labor accounts for over 90% of those prices. What in the event you might cut back these prices by 80% and improve the pace of processing invoices by as much as 10 instances? Sounds too good to be true?

With the appropriate B2B fee automation software program, it is not. And the advantages will not be restricted to value financial savings, accuracy, and effectivity — B2B fee automation also can enhance provider relationships, guarantee compliance, keep away from fines and penalties, and supply important insights into money stream and monetary well being.

B2B fee automation is a game-changer for companies of all sizes. On this temporary information, we’ll stroll you thru the fundamentals of B2B fee automation and how one can implement AP automation in what you are promoting.

What’s B2B fee automation?

B2B fee automation is a technology-driven course of streamlining how companies deal with funds to suppliers, contractors, and different enterprise companions.

So, somewhat than your workforce manually getting into bill knowledge, checking for errors, initiating funds, and reconciling these funds in your monetary system, these duties are carried out by an answer like Nanonets.

This software program streamlines your complete course of with minimal human involvement, slicing down on time spent on these repetitive duties and considerably lowering the probability of errors and misunderstandings.

How can B2B fee automation streamline your workflow?

Investing in a B2B fee automation answer is a brilliant transfer for what you are promoting. Generally, it’s onerous to imagine the transformative influence till you witness the adjustments in motion.

So, let’s take a look at how these fee automation options automate totally different elements of the B2B fee course of.

1. Bill processing

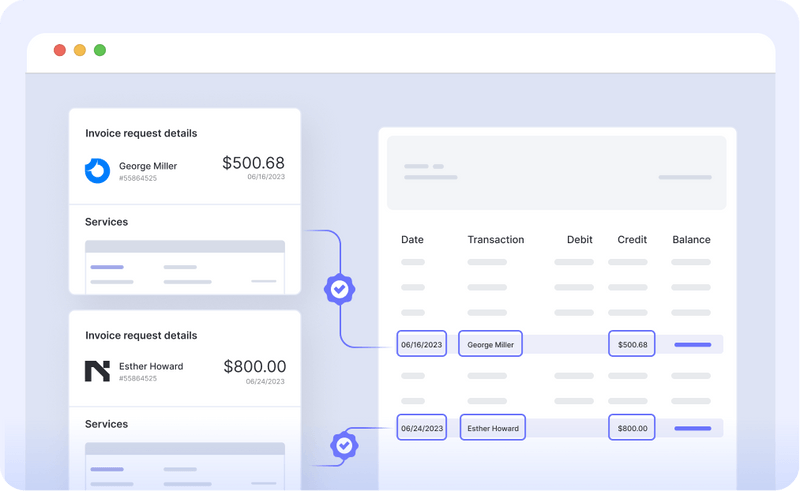

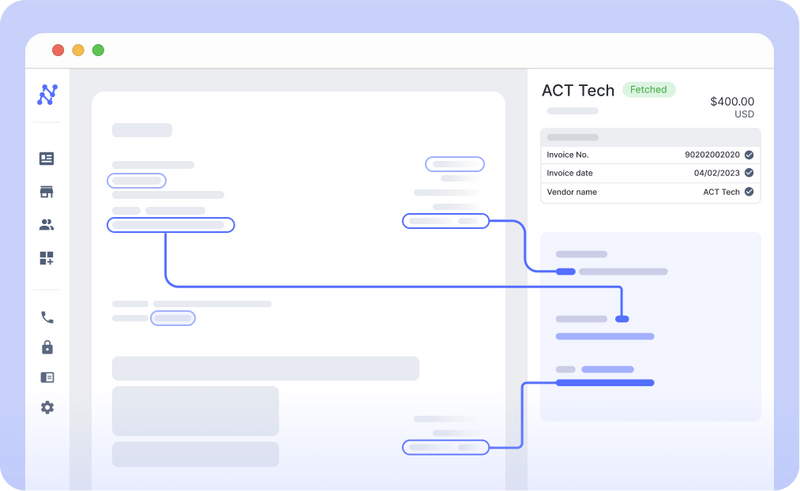

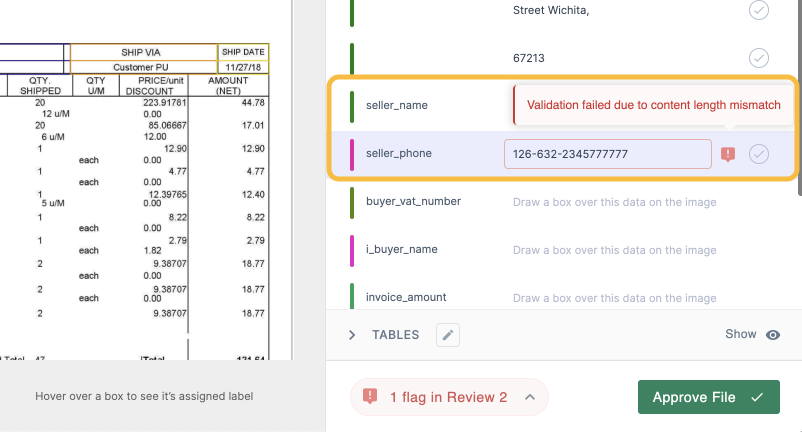

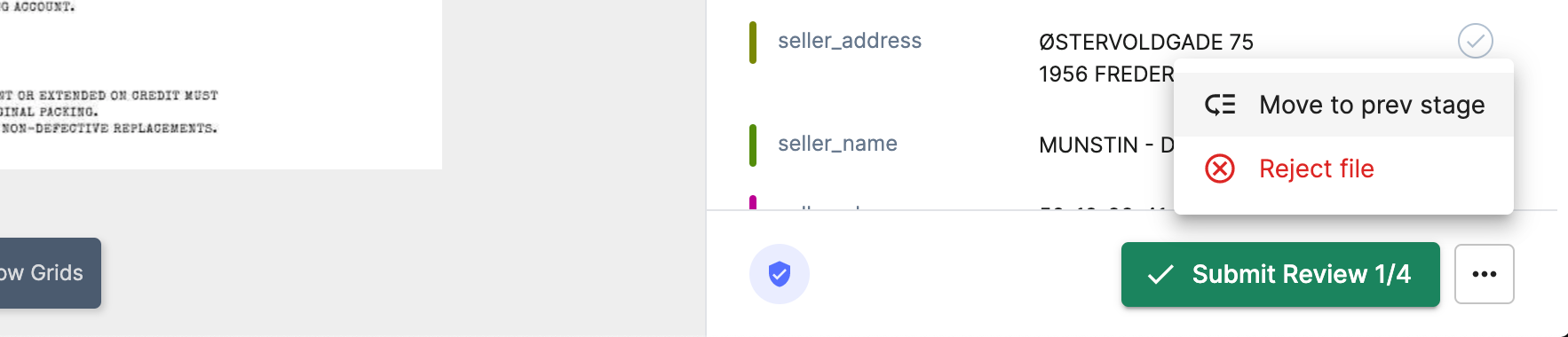

B2B fee automation options can seize and extract knowledge from invoices and evaluation them to make sure accuracy and completeness. It extracts important knowledge like bill quantity, date, provider identify, and quantity due and matches it with corresponding buy orders and contracts.

If there’s a mismatch, the software program mechanically flags the bill for guide evaluation. Your workforce can evaluation it and route it again to the provider for correction and resubmission in a matter of some clicks.

This automated course of dramatically reduces the time spent on guide knowledge entry and evaluation, resulting in quicker bill processing instances.

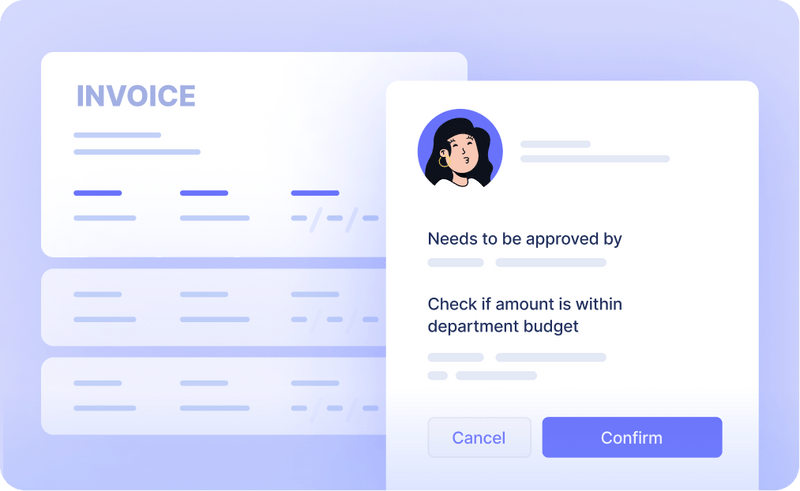

2. Approval workflows

As soon as the bill is matched, it’s mechanically routed to the designated approver(s) for evaluation and approval. The fee automation system sends reminders and escalations for overdue approvals, decreasing the probabilities of delayed funds whereas rising the probabilities of getting early fee reductions and higher companion relationships.

Your companions will have the ability to observe the standing of their invoices in real-time, which reduces the variety of queries your AP workforce has to cope with. This stage of transparency fosters belief and improves what you are promoting relationships.

3. Cost execution

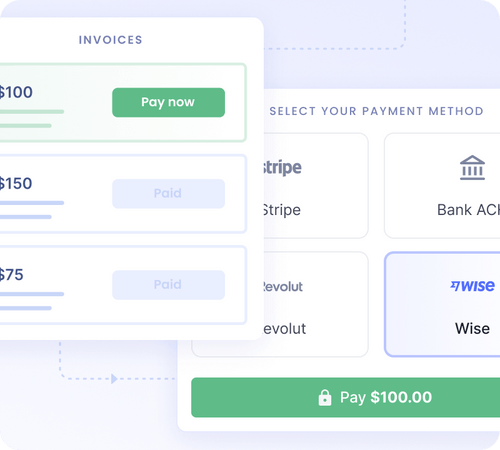

Cost automation software program then initiates funds based mostly on the accepted invoices and fee phrases. The software program creates fee information for numerous fee strategies like ACH, digital playing cards, and checks and sends them to the financial institution or fee processor.

Nonetheless, it is very important word that the effectiveness of fee automation will depend on the standard of the software program and the way effectively it’s built-in into your present fee methods. Because the invoicing and fee processes range from enterprise to enterprise, selecting a fee automation answer that may be personalized to fulfill your particular wants is essential.

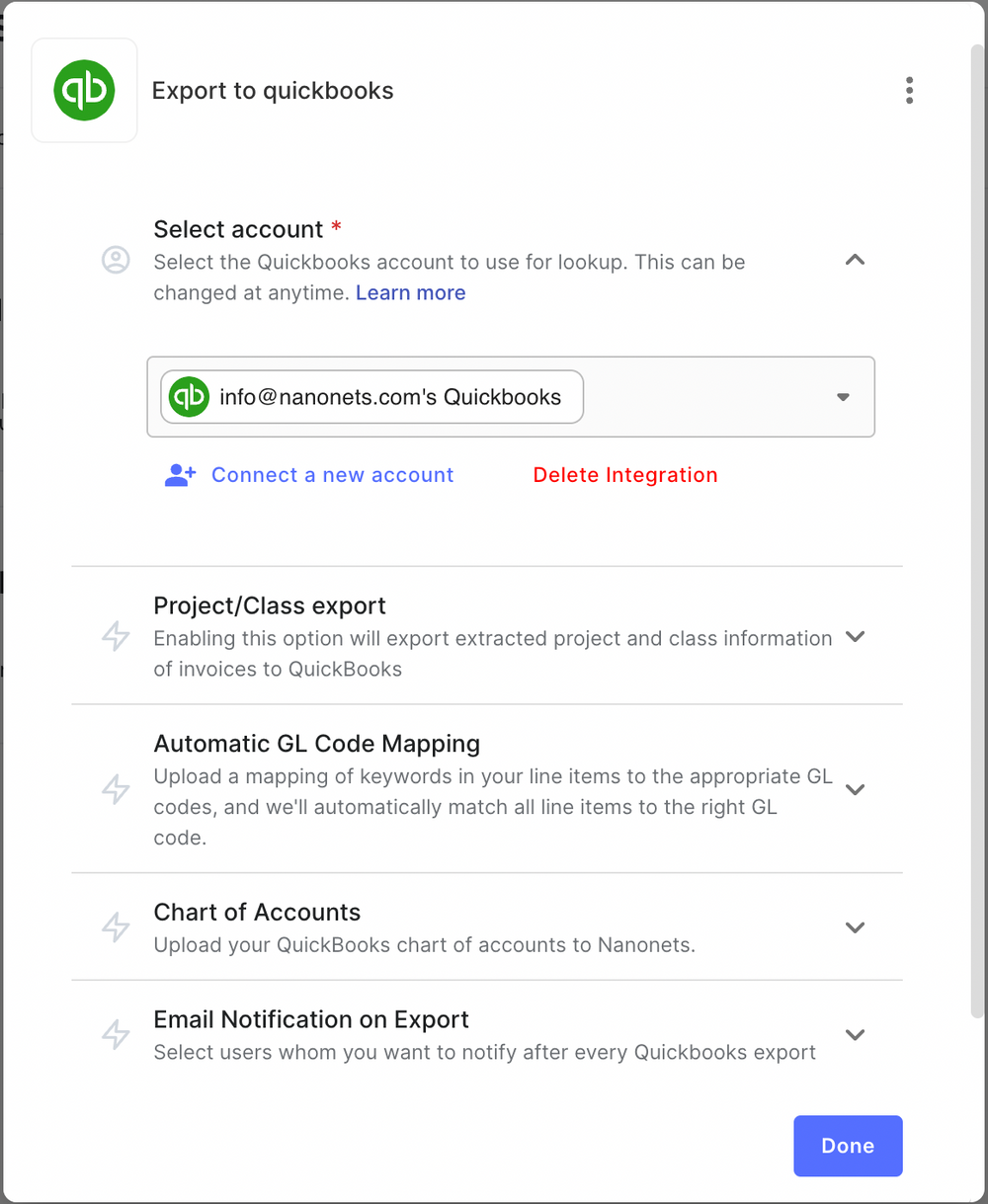

Take Nanonets, for instance. It might learn invoices and buy orders from numerous sources like e-mail, scanned paperwork, digital information/photographs, and cloud storage — enabling you to go utterly touchless and match and reconcile bills with out guide intervention. You’ll be able to simply join it together with your present accounting methods, together with QuickBooks and Sage, so it does not disrupt your present processes.

4. Cost reconciliation

As soon as the funds have been executed, the automation software program will then reconcile them. It’ll cross-reference the funds made with the accepted invoices, guaranteeing that each one funds are correct and accounted for.

Any discrepancies might be instantly flagged, permitting your workforce to research and resolve them promptly. GL codes are mechanically utilized, enabling seamless integration together with your accounting system and making the reconciliation course of quicker and extra environment friendly.

5. Reporting and analytics

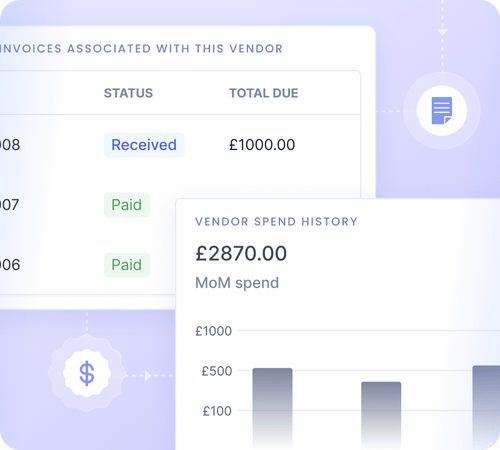

B2B fee automation software program does not simply automate guide duties; it additionally supplies beneficial insights into what you are promoting’s monetary well being. It generates complete experiences in your fee actions, showcasing tendencies, figuring out bottlenecks, and highlighting alternatives for enchancment.

This data-driven method lets you set extra correct finances forecasts, determine cost-saving alternatives, and make strategic choices based mostly on real-time monetary knowledge.

Why do you have to implement B2B fee automation?

So it could possibly streamline your workflow. However how does that translate into tangible advantages for what you are promoting?

Listed here are some compelling causes to think about implementing B2B fee automation:

1. Price financial savings

A latest report revealed that nearly 92% of companies use checks for funds. With the median processing value between $2.01 and $4, processing every examine manually will be very costly for corporations.

Automated B2B fee processing can cut back the necessity for guide labor and paper-based processes, considerably decreasing prices related to printing, transport, and storing paper checks.

2. Improved accuracy

Handbook fee processing is vulnerable to errors, resulting in surprising prices and delays. Duplicate funds, incorrect quantities, and missed deadlines are only a few examples of the inaccuracies that may happen with guide processing.

B2B fee automation might help remove these errors by automating duties like knowledge entry, matching funds with invoices, and figuring out discrepancies. In a latest survey, nearly 62% of organizations cited elevated effectivity as the highest precedence in fee automation and digital funds.

3. Sooner fee processing

With automated bill processing, bill approval workflows, and fee execution, the time it takes to course of a B2B fee will be lowered from weeks to a couple days and even hours. Invoices will be accepted from any location, and fee will be processed instantly, permitting quicker turnaround instances and improved money stream.

4. Stronger provider relationships

Late funds, disputes, and different payment-related points can injury provider relationships. B2B fee automation helps companies keep away from these points by guaranteeing well timed funds and correct fee information. This might help companies foster stronger provider relationships, resulting in potential reductions, improved phrases, and enhanced collaboration.

5. Scalability and development

B2B fee automation allows organizations trying to scale their operations to take action extra effectively. As distributors and invoices pile up, manually processing them generally is a bottleneck for development.

Automated B2B fee processing helps companies sustain with the amount of invoices and funds whereas decreasing errors and rising effectivity. Not solely would this assist companies plan their actions with out worrying about delays in buying uncooked supplies or important provides, but it surely additionally focuses on extra strategic duties that may drive development and profitability.

6. Much less inclined to fraud

By automating vendor bill processing, approval workflows, and fee execution, fee automation software program can present companies with a complete view of their fee actions, permitting them to determine any uncommon transactions or actions.

Moreover, B2B fee automation software program can implement safety measures like multi-factor authentication, person permission controls, and audit trails, offering companies with higher safety towards fraud.

7. Enhanced compliance

Creating audit trails and sustaining detailed fee information will be difficult with guide processes. Every companion might have their very own system and algorithm for recording transactions. You find yourself with haphazardly maintained logs, which may pose an issue throughout audits or when complying with laws.

With fee automation, every transaction is logged systematically and will be simply traced. Furthermore, the software program will be programmed to adjust to numerous worldwide, nationwide, or industry-specific laws, decreasing the chance of non-compliance. This not solely simplifies audits but in addition supplies a structured manner of dealing with compliance-related points.

8. Higher visibility and management

Whenever you automate your B2B funds, you achieve higher visibility into your spending. A complete view of your fee actions permits you to determine tendencies, spot inefficiencies, and make data-driven choices. This might help to optimize your money stream, handle your finances extra successfully, and plan for future development.

Moreover, automation supplies you with better management over your funds. You’ll be able to arrange approval workflows, automate reminders for upcoming funds, and obtain alerts for any uncommon exercise. This ensures that you just’re all the time within the loop and might intervene when needed.

9. Elevated worker productiveness and higher morale

Handbook fee processing is not only time-consuming, but it surely additionally includes tedious duties, which generally is a drain in your workers’ productiveness and morale. Automating B2B funds can unencumber your employees’s time to give attention to extra strategic duties and initiatives that may contribute to the expansion of what you are promoting.

Moreover, they received’t should chase after senior colleagues for bill approvals, spend hours reconciling funds, or fear about misplacing vital paperwork. Retaining and motivating workers turns into simpler after they really feel their expertise and time are getting used for significant work.

The way to implement B2B fee automation in your group to drive development?

Change is rarely straightforward. However in the event you’re in a position to implement B2B fee automation inside your group successfully, you may streamline your fee processes, save money and time, and enhance provider relationships.

Listed here are just a few suggestions to remember when implementing fee automation inside your group:

1. Assess your present fee processes

From submitting receipts to importing and consolidating knowledge, work out which points of your B2B fee processing are nonetheless guide. For instance, email-based invoices are nonetheless being manually entered into your accounting system, or a sure vendor’s invoices are printed and mailed for approval.

Figuring out these guide processes might help you identify which elements of your fee processing will be automated and what sort of fee automation answer would greatest match what you are promoting.

2. Guarantee there may be minimal guide validation required

In case your workforce has to manually validate every bill knowledge, you are not really automating your fee processes. It might result in invoices being cleared on the subsequent enterprise day, which resulted in an undesirable delay in operations.

Select a B2B fee automation software program that may cut back the time required to clear invoices to mere seconds. This fashion, what you are promoting can ship a superior and reliable vendor expertise.

3. Construct a universally accessible data base

Making a data base accessible to all of the related workforce members can go a great distance in guaranteeing the profitable implementation of fee automation. It ought to comprise detailed info on the B2B fee automation software program you have chosen, the way it works, person privileges, approval routing, and any insurance policies or procedures that should be adopted.

This information base ought to be up to date often to mirror any adjustments in your fee automation processes to maintain everybody on the identical web page.

4. Take compliance and safety severely

B2B fee automation includes delicate monetary knowledge, making compliance and safety paramount. Your B2B fee automation software program ought to be compliant with related laws and worldwide requirements corresponding to PCI-DSS and ISO 27001, guaranteeing that your and your companions’ monetary knowledge is protected and safe.

As well as, you need to implement acceptable safety measures corresponding to two-factor authentication, person permissions controls, and audit trails. You could possibly additionally set up a devoted workforce or rent a third-party auditor to observe safety and compliance.

5. Be sure that B2B fee automation works effectively together with your present methods

Say you already use SAP’s enterprise useful resource planning (ERP) system to handle what you are promoting processes. You must be sure that the B2B fee automation answer you select can combine seamlessly together with your present methods. This may assist to streamline your workflow and keep away from any potential points or disruptions in your operations.

If the software program does not combine effectively together with your ERP system, your employees might need to manually switch knowledge between the methods, defeating the aim of automation. Subsequently, search for an answer that provides APIs or pre-built integrations with fashionable enterprise software program.

6. Prepare your workforce successfully

Automation boosts productiveness, however provided that your workforce can wield it successfully. So, it is essential they perceive when to manually step in, acknowledge numerous alerts, know the place knowledge is saved, and troubleshoot typical points.

This may assist your workforce implement fee automation with goal. It wouldn’t be seen as a shiny new device however somewhat an integral a part of their workflow. Common coaching periods, webinars, or workshops will be organized to familiarize the workforce with the software program’s options, capabilities, and advantages.

7. Frequently evaluation and replace your workflows

Automation doesn’t imply setting it and forgetting it. Periodically evaluation the automated workflows. Determine the frequent bottlenecks. It may very well be operational points like software program failing to extract knowledge from scanned invoices precisely or strategic points like channel companions refusing to undertake digital invoicing.

Acquire suggestions from workers and different stakeholders and metrics like error charge, processing time, bill cycle time, and many others. Use this knowledge to optimize your workflows, making needed tweaks and enhancements. It ensures that your fee automation system evolves with what you are promoting wants and stays environment friendly and efficient over time.

Right here’s a fast guidelines that can assist you choose the appropriate B2B fee automation answer on your group:

- Does it combine effectively together with your present accounting and ERP methods — QuickBooks, Xero, SAP, Oracle, and many others.?

- Does it include AI capabilities for bill knowledge extraction and automatic validation, and might it be taught from guide inputs to reinforce its accuracy over time?

- Does it assist a variety of fee strategies — ACH, wire transfers, bank cards, checks, wallets, and many others.?

- Does it provide options like dynamic discounting and provide chain financing?

- Does it assist multicurrency funds and worldwide transactions?

- Does it have sturdy safety measures and compliance certifications?

- Does it let you customise the approval workflows based mostly on what you are promoting wants? Does it have a scalable structure that may develop with what you are promoting?

- Are you able to make funds to distributors instantly from the platform while not having to make use of a third-party fee gateway?

- Does it have a user-friendly interface that your workforce can simply navigate and use?

- Does it provide real-time reporting and analytics that can assist you monitor and optimize your fee processes?

- Does it provide automation of recurring funds to avoid wasting time and cut back errors?

- Does it assist automated reminders for pending funds and overdue invoices?

- Does it let you set person permissions and approval hierarchies based mostly in your organizational construction?

- Can it learn and extract knowledge from invoices with totally different codecs, layouts, and languages?

- Does it elevate alerts for any discrepancies or potential fraud detected within the fee course of?

- Does it present an audit path for all transactions to make sure transparency and help in compliance?

- Does it come at a value that matches inside your finances with out compromising the options you want?

What particular insights into monetary well being can B2B fee automation software program present?

Think about utilizing an Excel sheet to handle funds. Even in the event you overlook in regards to the trouble of all of the guide knowledge entry, the dearth of real-time insights makes it troublesome to make knowledgeable choices shortly.

With B2B fee automation software program, it is possible for you to to centralize all of your monetary knowledge in a single place and entry real-time experiences and analytics. It gives you real-time insights into:

- The reductions acquired from every vendor for early funds

- The common time taken to course of invoices and funds

- The excellent funds and overdue invoices

- The overall spend by class, division, or vendor

- The money stream forecast for the upcoming months

- The proportion of invoices which have discrepancies or potential fraud

- The general value of processing every bill and fee

- The working capital optimization and the way successfully it’s being managed

- The effectivity of your approval workflows and any potential bottlenecks

- The proportion of funds made by way of totally different strategies (ACH, wire transfers, bank cards, checks, wallets, and many others.)

- The variety of worldwide transactions and the related prices and the influence of alternate charges in your multicurrency funds

- The finances utilization and any variances between the precise spend and the budgeted quantity

This isn’t an exhaustive record however a glimpse into the type of insights you may get with the appropriate automation software program. Such data-driven insights might help you determine inefficiencies, cost-saving alternatives, and areas of enchancment.

They will information your strategic choices, serving to you negotiate higher vendor phrases, optimize your working capital, and enhance your money stream administration.

How B2B fee automation has benefited companies?

So, on paper getting a B2B fee automation answer looks like a no brainer. However, you may nonetheless be questioning about its precise influence on companies.

Listed here are some real-life tales of companies that applied Nanonets B2B fee automation and skilled vital enhancements:

1. Ascend Properties’ AP workforce grew to become 5x extra environment friendly

This UK-based property administration firm saved 80% of its bill processing prices utilizing Nanonets. The AI-powered OCR know-how of Nanonets enabled them to automate knowledge extraction, approval routing, and add to the CRM software program course of.

They had been in a position to scale from 2000 properties to 10,000 properties while not having to extend their AP workforce dimension. Furthermore, from 5 full-time workers engaged on bill processing, they had been in a position to cut back it to just one part-timer, liberating up the opposite workforce members to give attention to extra strategic initiatives.

2. SaltPay achieved 99% time-saving on bill processing

This London-based fintech firm used Nanonets to automate its bill extraction and approval course of. Previous to utilizing Nanonets, the SaltPay workforce spent a major period of time manually inputting bill knowledge into their SAP system.

Nanonets automated the info extraction course of, validated the info towards required circumstances, and instantly uploaded the info into the SAP system. SaltPay efficiently improved the accuracy of its bill processing and scaled its operations to serve purchasers from 26 nations.

3. ACM Companies lowered guide bill processing by 90%

ACM Companies, a remediation contractor, turned to Nanonets to streamline their bill extraction course of. Earlier than utilizing Nanonets, they struggled with a cumbersome, guide course of involving time-consuming knowledge entry.

By integrating Nanonets into their workflow, they automated knowledge seize and vendor-GL code matching, decreasing guide bill processing by 90%. The AP workforce was in a position to course of all their invoices in a fraction of the earlier time, decreasing errors and rising their general productiveness. The export to CSV possibility additionally made it simpler for them to add knowledge into their accounting system.

To sum up, Nanonets’ AI-powered bill administration answer automates bill processing with an accuracy charge of over 90%. Our answer can mechanically extract bill knowledge from totally different codecs, together with scanned PDFs and pictures, and combine together with your present accounting methods like Quickbooks, Xero, and SAP.

Nanonets is GDPR compliant and in addition supplies enterprise-level safety. It’s scalable, straightforward to implement, and affords customizable approval workflows and detailed analytics that can assist you optimize your fee processes.

Ultimate ideas

Irrespective of your {industry}, implementing fee automation might help streamline your fee processes and drive enterprise development. By decreasing guide processes, bettering effectivity, and strengthening provider relationships, you may set what you are promoting up for fulfillment.

All the time deploy a B2B fee automation software program that matches your wants and your present methods. Your funds and workers will certainly thanks. Keep in mind, the objective is not only to automate however to automate intelligently.