Extremely anticipated: Christmas is available in August this yr. Arm filed for Nasdaq itemizing in what could possibly be the yr’s largest IPO. The itemizing’s prospectus is a doc that we have been keenly awaiting for a very long time. However like so many presents, this was not all that we had hoped for. Now we have learn by means of the doc, and we’ll must undergo it a couple of extra to essentially get into it. Nonetheless, we have now have some clear first and second impressions.

In the beginning, Arm didn’t develop final yr, with income declining from $2.7 billion to $2.6 billion and alter. The doc describes this as flat which is honest, however with all of the markets and future expertise Arm likes to speak about, this isn’t encouraging. Greater than the rest, that is possible indicative of an organization that is still closely reliant on the smartphone market, and that market will not be doing notably properly proper now.

Editor’s Observe:

Visitor creator Jonathan Goldberg is the founding father of D2D Advisory, a multi-functional consulting agency. Jonathan has developed progress methods and alliances for firms within the cell, networking, gaming, and software program industries.

Second, the corporate continues to extract a small share from the worth it contributes. Arm mental property (IP) powers all cellphones, and plenty of different gadgets. And but they don’t make a lot cash from that.

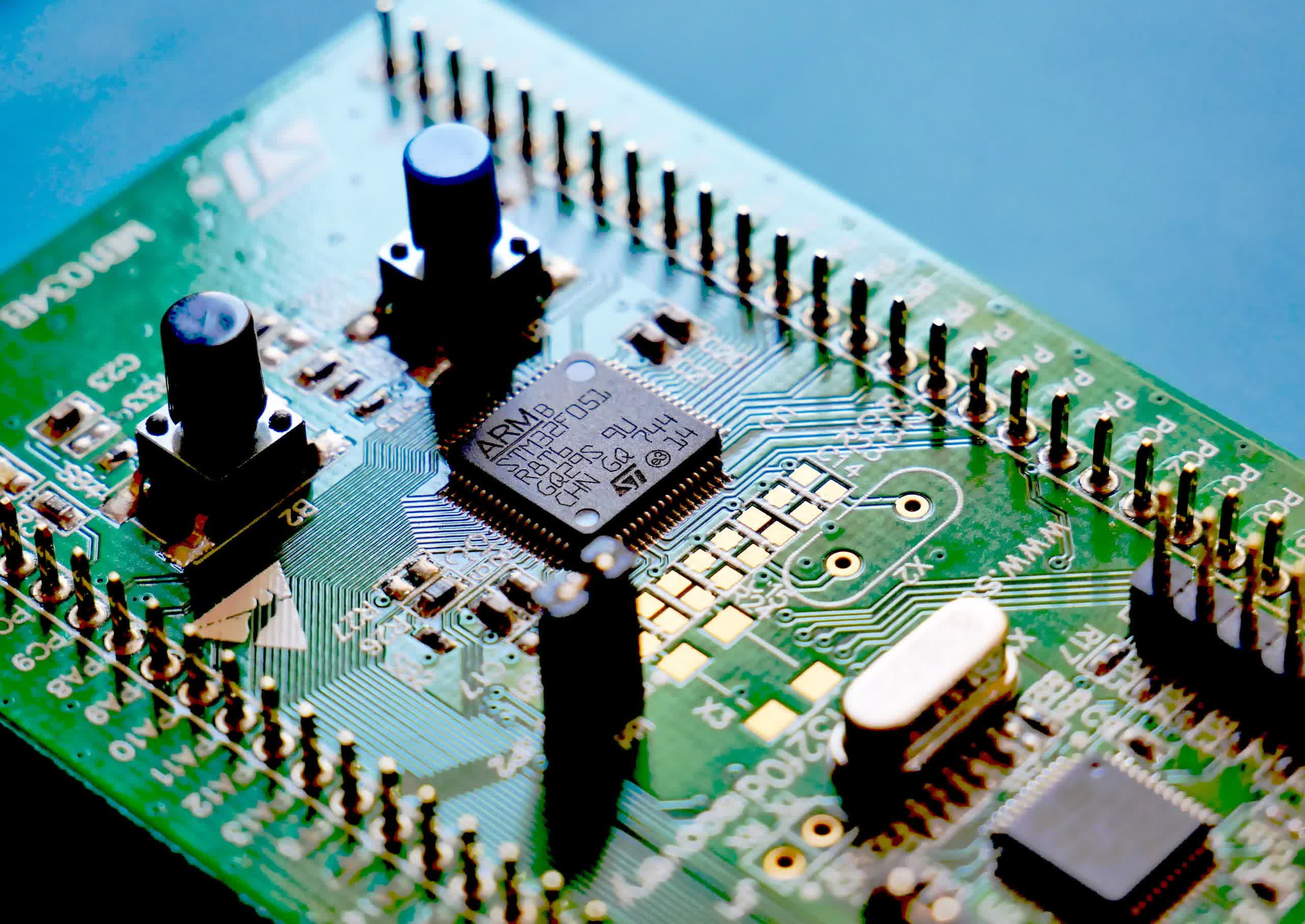

Within the final fiscal yr, licensees shipped 30 billion Arm-powered chips, price $98,9 billion, however Arm generated solely $0.11 per chip, a 2.7% royalty fee. This isn’t per core, however per chip. Now we have written up to now that Arm’s pricing mannequin is damaged, its largest clients have huge quantity reductions constructed up over time, which along with resulting in financials like this additionally makes it a lot tougher for brand new chip firms to undertake Arm and pay full value. Therefore the expansion of RISC V.

| Models | GBP | USD (@$1.28/GBP) | |

| Chip income | 77,265,625,000 | 98,900,000,000 | |

| Arm income | 2,679,000,000 | 3,429,120,000 | |

| Chips | 30,000,000,000 | ||

| Arm rev/chip | 0.09 | 0.11 | |

| Chip ASP | 2.58 | 3.30 |

Admittedly, IPO prospectus filings have to evolve to tight authorized necessities favoring historic over potential matters. And we have now not but seen the corporate’s roadshow supplies.

Arm has publicly and behind the scenes taking steps to alter its enterprise mannequin, as an example working straight with finish clients in addition to what they discuss with as “holistic” options. These could possibly be crucial in shifting the corporate’s prospects, however any point out of them on this submitting is indirect.

Maybe the most important shock within the doc was the dialogue of Arm China, together with an attachment to the submitting exhibiting the settlement between the 2 firms (we have now simply begun to scan the Arm China settlement which is dense legalese).

Arm China, a separate firm, is Arm’s largest buyer contributing 24% of income. The submitting presents this as a simple relationship, however we all know it’s really the results of a protracted, fascinating drama. The newest materials is sort of a bonus season after the conclusion of a beloved TV present which everybody had thought was lengthy over.

One factor that jumped out at us was a number of the element of the construction of Softbank’s possession of Arm. That is held by means of an entity named Kronos. Final yr, Kronos took out an $8 billion mortgage in opposition to its Arm shares. In concept, Arm is now on the hook to repay that mortgage within the occasion Kronos defaults. Provided that the mortgage is collateralized by Arm shares, it’s unlikely Arm itself will ever must assume that debt. Nonetheless, that is the form of construction that non-public fairness firms like to make use of to extract most worth from their portfolio holdings, and might be one thing for everybody to maintain behind their heads within the occasion Arm suffers a chronic interval of a weak inventory.

Our impression is that Arm resembles a low-growth firm coming to market to fulfill the liquidity wants of its personal fairness homeowners.

Our impression is that Arm resembles a low progress firm coming to market to fulfill the liquidity wants of its personal fairness homeowners. We’re sure that there’s extra to the story, and that Arm has some attention-grabbing expertise and enterprise mannequin adjustments within the works. And their place in lots of market stays elementary. That being stated, our hope was that after seven years as a non-public firm and a brand new administration group with some massive concepts, that the expansion prospects could be slightly extra clear.

As we continued to parse the Arm IPO prospectus, we steadily got here to some extra conclusions. Spoiler alert – we’d like a thesaurus to search out options to the phrase “difficult” – nonetheless, as we work by means of the submitting we proceed to search out many attention-grabbing items of data.

First is that this gem:

“We is not going to obtain any of the proceeds from the sale of ADSs by the promoting shareholder on this providing (together with any proceeds from any sale of ADSs pursuant to the underwriters’ choice to buy further ADSs). All internet proceeds from the sale of ADSs on this providing will go to the promoting shareholder.”

Which if you concentrate on it sums up the entire train. Arm will get not one of the proceeds. We recall an Arm government warning that if the Nvidia deal failed and the corporate needed to go public it must considerably reduce prices. Now we all know what he actually meant.

Nonetheless, way more encouraging (form of) the corporate additionally offered us with a market share evaluation of every of their end-market segments. their whole addressable market (TAM). For some cause they offered this in textual content kind, so we put collectively the chart beneath.

Observe the greenback quantities discuss with the gross sales of their buyer’s chips – as we famous earlier, Arm solely captures a small share of this. The portion of the market they really promote into (the Serviceable market or SAM) is $98 billion, which suggests they’ll faucet into about 50% of all logic semis income.

| ($ billions) | 2022 | 2025 | ARM Share | 2022 CAGR |

| Client Electronics | $46.9 | $53.2 | 19.0% | 4.3% |

| Industrial/Embedded | $41.5 | $50.5 | 64.5% | 6.7% |

| Cellular Processor | $29.9 | $36.0 | 99.0% | 6.4% |

| Automotive | $18.8 | $29.1 | 40.8% | 15.7% |

| Networking | $18.2 | $17.2 | 25.5% | 1.8% |

| Cloud | $17.9 | $28.4 | 10.1% | 16.6% |

| Connectivity/Different cell | $17.6 | $17.5 | 99.0% | -0.2% |

| HPC/Different | $12.7 | $13.7 | 16.2% | 2.7% |

| Whole | $202.50 | $246.60 | 48.9% | 6.8% |

This desk tells us lots concerning the firm’s prospects. Automotive and Information Heart are the quickest rising segments for the corporate, however we think about each extremely aggressive. The automotive market is present process vital change, and whereas Arm is properly positioned with many chip distributors right here, the race has a protracted strategy to go, and Arm’s place is under no circumstances sure.

Not for nothing, we suspect that a lot of Arm’s market share right here consists of Qualcomm design wins, and they’re, after all, suing Qualcomm. Information Heart can also be rising, and the truth that they’ve carved out 10% here’s a massive achievement. Nonetheless, a lot of that’s constructed on the again of simply two firms – AWS Graviton and Ampere.

We additionally wish to level out we don’t consider the numbers for Industrial/Embedded – this market is rising strongly proper now with Chinese language chip designers piling in, and they’re largely utilizing RISC V. We predict that market is rising a lot quicker than 6.7% (a minimum of by way of items) however that Arm’s share is considerably decrease.

Total, we see this information because the proverbial 50% glass. Glass half full – they’re rising share within the quickest rising markets. Glass half empty – they’re closely reliant on a number of the slowest rising markets.

Transferring on, the Threat Elements part of the submitting is stuffed with attention-grabbing particulars.

- Arm lists RISC V as a aggressive danger issue, however makes pretty few mentions of it, highlighting x86 in addition to internally developed options equally.

- The corporate cautions that US commerce restrictions on semis exports to China could develop to cowl Arm IP or crimp clients’ gross sales. To date the US authorities has remained silent on the subject of IP, nevertheless it definitely is a danger.

- Softbank will maintain all board seats at Arm, till it drops beneath 70% management, no impartial administrators required. Softbank additionally has full dilution safety. Add to this the truth that Arm is technically itemizing ADS not widespread shares. ADS have totally different voting rights, and whereas that is customary apply the layer does add an extra wrinkle to future governance issues for the corporate.

- As we famous above, a Softbank affiliate has taken out an $8.5 billion mortgage collateralized by the 75% of Arm shares it owns. After the IPO this shall be rolled into a brand new facility which incorporates covenants about margin calls within the occasion Arm’s shares decline by an undisclosed quantity. This might get messy…

- Softbank’s inside valuation of Arm is $64 billion, which is a quantity the press has cited because the goal for the IPO. This might additionally get messy…

- Qualcomm contributed 11% of Arm’s income final yr, roughly $300 million.

Within the dangers part there’s a tantalizing point out of Arm designing customized chips. It has been extensively rumored that Arm goes to enter the enterprise of chip design as a strategy to transfer up the worth chain. They warn that that is dangerous and will trigger conflicts with current clients, after all it seems within the danger part so all draw back is to be anticipated. That stated, possibly Arm has one thing extra attention-grabbing within the works right here.

One remaining be aware. Arm was an early investor in privately-held Ampere, designer of knowledge heart server CPUs. Arm owns 6.8% of Ampere, they usually worth that stake at $416.2 million (they’ve written that right down to $389 million). This suggests Ampere’s worth is $6.1 billion. Related partly as a result of we’re extremely keen on Ampere, but in addition necessary as a result of the destiny of Arm’s IPO will weigh closely on Ampere’s prospects for going public subsequent yr.

For additional studying, we have now one further piece discussing Arm’s rumored $64 billion valuation. Put merely, this can be a suicidal determine. An outdated truism amongst traders is that good firms don’t at all times make for good shares. That holds true for Arm. They’re a very good firm, however they aren’t a excessive flying tech firm. They emerged from years of sleepy, personal possession with no main adjustments, no added pleasure. They are going to develop, Arm processors stay necessary for semiconductors, however neither their progress nor their present economics benefit a high-flying valuation.