Streamlining your expense declare course of is not simply nice for enterprise effectivity and accuracy — it is a sport changer on your backside line.

Give it some thought: sooner reimbursements, correct monetary data, and simpler compliance with firm and tax legal guidelines. But it surely stays to be a painful train. In line with this International Enterprise Journey Affiliation report, processing an expense report for a single-night resort keep prices a mean of $58 and takes 20 minutes!

Regardless of how stellar your enterprise mannequin is or how nice your gross sales numbers are, leaky expense declare processes is usually a gradual, silent killer on your funds. And when you’re a brand new or rising enterprise, that is successful you possibly can’t afford.

The excellent news is that automating your expense declare course of could make it sooner, extra correct, and less expensive. If you would like a fast, impactful increase to your funds, it is best to concentrate on this space.

This text will spotlight the best way to automate and handle your expense claims higher.

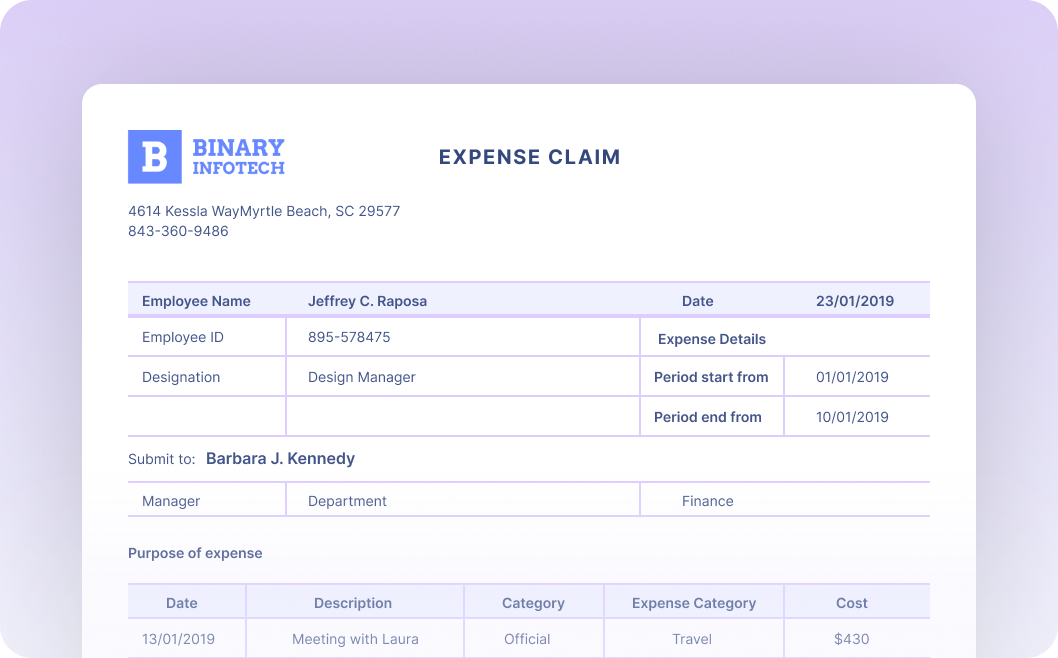

What’s an expense declare?

An expense declare is a proper request raised by an worker to get reimbursed for bills incurred on behalf of the corporate. These may very well be journey bills, meals, workplace provides, or some other prices that an worker has paid for out-of-pocket.

Other ways expense claims are generated

In case your staff member will get a site visitors ticket whereas on a enterprise journey, that is not a enterprise expense. But when they’ve handled a consumer to a elaborate dinner or booked a resort, then they’ll declare for that.

The IRS has a easy rule about what counts as a legit enterprise expense. It must be strange and vital. Strange means it’s normal in your line of labor, and vital means it is useful and appropriate for your enterprise.

Expense claims can come from varied locations, like journey, workplace provides, or consumer relationship constructing.

Let’s break it down:

1. Journey bills: Suppose airfare, resorts, rental automobiles, and gasoline when the staff are on the street for enterprise.

2. Meals and leisure: This might embody your gross sales staff assembly potential shoppers for meals or grabbing tickets to a networking occasion.

3. Workplace bills: All the pieces out of your each day workplace provides to the web invoice falls beneath this class.

4. Lodging: Any prices for in a single day stays, like resort rooms or rented residences, rely right here.

5. Surprising associated bills: These embody unexpected prices shouldered by workers, like emergency repairs or authorized charges, which aren’t a part of the common operations however are vital for the enterprise.

There are a number of ways in which expense claims will be generated:

Receipts: Probably the most conventional method, workers save their receipts from business-related purchases and submit them together with their expense declare studies.

Bank card statements: If the corporate gives a enterprise bank card, bills will be tracked immediately from the cardboard assertion.

Cell apps: Many companies now use expense administration apps that permit workers to snap an image of their receipt and submit it immediately.

Per diem allowances: In some instances, companies could present a each day allowance for workers to cowl their bills. Any spending past this allowance would have to be claimed individually.

All these strategies have execs and cons, and the only option usually will depend on the dimensions and desires of your enterprise.

How companies observe and handle expense claims

Historically, corporations have relied on handbook processes for monitoring and managing expense claims. This normally includes workers filling out paper expense studies, attaching bodily receipts, and submitting them to their supervisor or a controller.

The supervisor then evaluations and approves the claims. After that, the studies are forwarded to the accounting division for additional processing. The accounting staff enters the information into the accounting system, verifies the bills, and points reimbursements to the staff.

Feels like a number of work, does not it? And it’s. However that’s not even the worst half. Take into consideration all of the hassles and potential errors that might happen.

- Staff should maintain observe of all their receipts and submit them on time.

- Managers should overview and approve every declare individually, losing precious time that may very well be higher spent elsewhere.

- Faux or inflated claims can slip by means of, inflicting monetary losses.

- Accounting errors can happen when manually getting into knowledge, resulting in discrepancies in monetary data.

- Delays in processing can result in late reimbursements, inflicting worker dissatisfaction.

- The accounting staff has to extract and categorize the information for tax functions, which will be time-consuming and error-prone.

- Inaccurate knowledge may hamper monetary planning and budgeting, resulting in poor enterprise selections.

With all these hurdles, it is no shock that many companies are embracing automated expense administration options. These instruments streamline the complete course of, from submission to approval to reimbursement. They’ll additionally combine together with your accounting system, making monitoring and categorizing bills simpler.

Why do you have to think about automating your expense declare course of?

Image this: an worker snaps a receipt and uploads it to a web-based platform. It routinely extracts the information, categorizes the expense, and submits the declare. The declare is then routinely routed to the suitable supervisor for approval, adopted by the accounting division for processing. The worker will get reimbursed, and the expense knowledge is routinely recorded and categorized within the accounting system.

With an automation resolution like Nanonets Expense Declare OCR, this isn’t a hypothetical state of affairs however a actuality. You’ll be able to get rid of the necessity for handbook knowledge entry, cut back the danger of errors, and pace up the complete expense declare course of.

There are a number of the reason why it is best to think about automating your expense declare course of:

1. Improves processing pace: Automation eliminates handbook knowledge entry, accelerates approval instances, and ensures sooner reimbursements. Your staff can concentrate on extra vital duties as an alternative of getting slowed down with paperwork.

2. Minimize down handbook intervention: Since guidelines and workflows are set proper initially, managers and accounting groups do not should spend as a lot time reviewing and approving every declare. This reduces the danger of human error and ensures consistency within the course of.

3. Reduces inaccuracies: Invalid knowledge, duplicate entries, and fraudulent claims are flagged routinely and will be handled instantly. This ensures that your monetary data are correct, dependable, and compliant.

4. Enhances visibility: With automation, you get real-time visibility into your bills. You’ll be able to observe spending tendencies, determine areas of excessive expenditure, and make knowledgeable selections to regulate prices.

5. Ensures compliance: Automated programs will be programmed together with your firm’s expense insurance policies and IRS rules. This ensures all claims are compliant, decreasing the danger of audits and penalties.

6. Simplifies reporting: Automated instruments generate detailed studies, making it simpler to research knowledge and acquire insights into your spending patterns. This can assist in budgeting and monetary planning.

7. Improves worker satisfaction: Staff don’t wish to file tons of of expense studies or wait weeks to get reimbursed. With an automatic system, they’ll submit their bills simply and get reimbursed rapidly; no extra chasing after approvals or worrying about misplaced receipts.

8. Environmentally pleasant: No extra printer and copier utilization. By going digital, you are decreasing your carbon footprint and contributing to a extra sustainable setting.

9. Scalable: As your enterprise grows, so will your bills. Not like handbook processing, automated programs can simply scale to accommodate extra customers and transactions, guaranteeing clean operations as your organization expands.

10. Saves cash: Certain, there is a price ticket on automating your system, however think about this: No extra bills on paper, ink, and different sundries. No extra paying for hours spent on tedious handbook knowledge entry and processing. Plus, enhancing accuracy and decreasing duplicate and fraudulent claims can prevent more cash in the long run.

Tips on how to automate your expense declare course of

Your corporation could have distinctive wants and necessities. A small enterprise may solely want an OCR software to seize receipt knowledge. The remaining may very well be managed utilizing a spreadsheet.

A mid-sized firm, alternatively, may want a extra complete resolution. One which handles every little thing from knowledge seize to approval workflows to integration with accounting software program.

Be sure you perceive your necessities clearly earlier than you consider automation.

Right here’s a fast rundown of the steps you possibly can comply with to automate your expense declare course of:

1. Establish your wants

Decide what you wish to obtain with automation. This may very well be sooner processing instances, decreased errors, higher compliance, or all the above.

Additionally, think about elements corresponding to:

- The dimensions of your organization

- Your expense coverage

- The amount of bills claims you deal with

- The technical capabilities of your staff

- Your price range

- Hurdles within the present workflow

2. Consider obtainable options

Analysis the marketplace for obtainable expense administration options. Search for options that align together with your wants:

- OCR for knowledge seize and processing

- Rule-based approvals for sooner processing

- AI-powered anomaly flagging

- Self-learning algorithms for categorizing bills

- Integration together with your accounting software program

- On-the-go expense submission

- Customizable approval workflows

- Compliance checks and alerts

- Detailed reporting and analytics

3. Select an expense administration resolution and implement it

Take into account elements corresponding to user-friendliness, coaching required, scalability, safety measures, value, and buyer help whereas selecting an answer.

Slim down your choices. Request a demo or a trial interval. This will provide you with hands-on expertise with the software program and allow you to decide whether or not it suits your enterprise nicely.

As soon as you have discovered the best resolution, you possibly can implement it in your group. This will contain:

- Coaching your workers

- Defining the eligible bills, approvers, approval limits, and workflows

- Establishing the roles and system to conform together with your expense coverage and rules

- Integrating it together with your present programs (accounting, payroll, HR, and so on.)

4. Monitor and optimize the efficiency

Examine the accuracy of information seize, approval instances, and reimbursement instances. Learn the way usually handbook intervention is required and whether or not the system accurately flags anomalies. Replace the roles and guidelines as vital.

Hold observe of person suggestions. Are your workers discovering the system simple to make use of? Are they in a position to submit their bills and get reimbursed rapidly? You should utilize their suggestions to make enhancements.

Additionally, monitor the system’s affect in your backside line. Are you saving money and time? Is the software serving to you management prices and cut back fraud?

How Nanonets can assist automate your expense declare course of

Expense declare processing will get lots simpler with Nanonets. You’ll be able to automate the complete expense declare course of, from receipt seize to expense approval and fee processing.

Here’s a fast overview of how Nanonets can assist:

1. Automate knowledge seize: Staff can add their receipts in bulk and have all the data routinely extracted and categorized. No worrying about formatting or handbook knowledge entry errors.

2. Centralize expense administration: All of the expense declare is saved in a single place, making it simple to trace, handle, pay, and audit. You’ll be able to simply export the parsed knowledge as CSV or Excel information for additional evaluation or reporting.

3. Work with an clever mannequin: Our expense declare processing mannequin learns out of your actions over time. This helps enhance the accuracy of information extraction and categorization, making the method extra environment friendly over time.

4. Customise the workflows: You’ll be able to arrange approval workflows that align together with your firm’s insurance policies. This ensures all expense claims undergo the mandatory checks and balances earlier than approval.

5. Mechanically flag anomalies: Establish uncommon expense claims primarily based on historic knowledge and flag them for overview. This helps in stopping fraud and sustaining compliance with firm insurance policies.

6. Combine with present programs: Seamlessly combine with instruments like Google Drive, Zapier, Xero, Sage, Gmail, QuickBooks, and extra. Neglect about countless knowledge migration and revel in a clean transition.

7. Entry real-time analytics: Get insights into your spending patterns, determine tendencies, and make data-driven selections. Monitor your expense claims in actual time and take immediate motion when vital.

8. Guarantee compliance: With built-in compliance checks and alerts, you possibly can make sure that all expense claims adhere to your organization’s insurance policies and rules. Sustaining an audit path turns into easy, and you’ll keep away from any potential authorized points.

Last ideas

Managing expense claims is important to any enterprise. Nonetheless, it’s simple to lose observe of bills, particularly if you’re chasing progress and enlargement.

The excellent news is that automating the expense declare course of helps. It not solely saves you money and time but in addition retains your operations operating easily.

It reduces handbook errors, ensures compliance, improves budgeting accuracy, and gives a transparent view of your organization’s spending. This is not nearly value management — it is about making clever, knowledgeable enterprise selections.

Nanonets can help you on this journey by offering an clever, dependable, safe, and environment friendly resolution for expense declare processing. Our platform is designed to adapt to your enterprise wants, making the shift to automated expense administration clean and painless.

Schedule a demo with Nanonets right this moment and allow us to allow you to streamline your expense administration.