Within the 12 months since President Biden signed the CHIPS and Science Act, there was vital consideration paid to this landmark laws to rebuild the U.S’ semiconductor trade. We’ve seen quite a few bulletins of historic private-sector investments targeted on strengthening home semiconductor manufacturing, provide chain and R&D. But a lot of the nationwide dialog has targeted on logic chips.

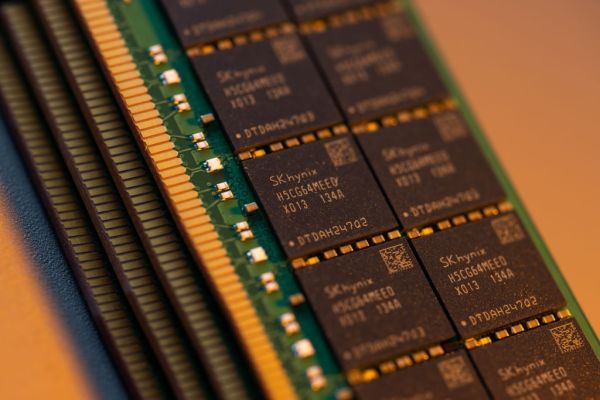

There’s one other class of semiconductors that’s vulnerable to being forgotten: reminiscence chips. Because the invention of the primary commercially viable “dynamic random-access reminiscence” (DRAM) within the early Seventies, reminiscence has been one of many key enablers of recent computing programs, serving to drive the general semiconductor trade. Nearly all fashionable electronics, together with cell telephones, automobiles, medical gear, army programs, and cloud knowledge facilities, are depending on giant quantities of reminiscence to securely retailer the knowledge on which we rely. And given the insatiable calls for of as we speak’s aptly named “knowledge financial system,” this dependence grows stronger yearly: Reminiscence is mission-critical to the applied sciences of the longer term, equivalent to AI and supercomputing.

Reminiscence applied sciences are on the coronary heart of enabling and sustaining our nation’s innovation aggressive edge, but lower than 2% of the world’s reminiscence provide is manufactured inside the U.S., and all of that comes from a single firm, Micron Know-how. At present, each modern reminiscence fab is positioned in Asia, with extra being constructed yearly as nations understand the significance of reminiscence. This has shaped an overconcentration of producing capability and provide chain danger that’s considerably extra harmful than that discovered within the logic trade.

Semiconductor reminiscence is foundational to our nation’s technical management and but is extra in danger than ever.

Home manufacturing of safe reminiscence know-how is essential to U.S. know-how management, jobs and financial development, in addition to our nationwide and financial safety, and thus requires speedy consideration.

As somebody who constructed a profession in reminiscence and serves as an adviser to corporations and the federal government, I can vouch that reminiscence is a brutally aggressive enterprise. Final 12 months, reminiscence represented about 28% of the worldwide $556 billion semiconductor market, about the identical proportion as logic. Nevertheless, whereas typically overshadowed by the bigger promoting and branding budgets of logic corporations, the workhorse reminiscence trade drives a far bigger share of the trade’s capital spending.

New reminiscence fabs have to be constructed considerably bigger than most logic fabs to be aggressive. Maintaining with probably the most superior know-how drives huge R&D payments, in addition to steep ongoing capital reinvestment. And these investments have to be made yearly, regardless of profitably that’s far decrease on common and rather more risky than discovered within the logic trade.

Sadly, U.S. corporations aren’t competing on a degree enjoying area. The reminiscence trade owes its begin to U.S. innovation, however as we speak is concentrated in Asia the place governments have responded to the trade’s economics by subsidizing reminiscence manufacturing and R&D.

Securing the provision chain for these important system substances must be cause sufficient for the U.S. to put money into reminiscence. The integrity of each computing system we depend on is straight depending on units that retailer our essential data. Geopolitical disruption of the reminiscence provide chain can be catastrophic to each section of the financial system, however investing in reminiscence has extra great advantages for the U.S.

First, reminiscence drives the lion’s share of the demand for manufacturing semiconductor tools. Whereas the U.S. nonetheless leads this trade, the profit goes to offshore nations intent on monopolizing reminiscence. A U.S. reminiscence funding would assist guarantee this tools allows our personal manufacturing first, along with offering the massive home quantity demand for all the things from uncooked supplies to silicon wafers to the chemical substances and gasses on which semiconductor manufacturing depends.

Second, the dimensions and scale of reminiscence fabs would enable the U.S. to really revitalize the home abilities base in fab development and operation, offering a steady base of well-paying jobs that can’t depend on logic fab development alone for sustainability.

Lastly, elevated funding in new reminiscence fabs can be giant sufficient to economically remodel complete communities and areas. And the stimulus advantages of the core funding are multiplied by the financial exercise generated in native communities and alongside the provision chain.

We’re at a essential juncture, and the Biden administration should be sure that among the largest alternatives created by the CHIPS and Science Act are leveraged on behalf of the reminiscence trade. Semiconductor reminiscence is foundational to our nation’s technical management and but is extra in danger than ever. As policymakers debate the deserves of various semiconductor initiatives, the financial and nationwide safety advantages of a historic funding in modern reminiscence manufacturing are positive to repay for the U.S. We can’t neglect about reminiscence.