When the Apple Card Financial savings Account launched earlier this yr, some customers complained that they confronted weeks-long delays attempting to withdraw their cash from their new Goldman Sachs-backed account.

A report at this time reveals that Apple and Goldman Sachs have now made adjustments to how these transactions are dealt with to keep away from some of these delays going ahead.

Following the preliminary report from the Wall Avenue Journal in June, Apple issued a $100 “goodwill” credit score to at the least some Apple Card Financial savings Account customers. The corporate additionally made adjustments to the wonderful print to additional make clear how deposits and withdrawals are dealt with by Goldman Sachs.

The Info now experiences on a handful of adjustments Goldman Sachs has made to the way it manages Apple Card Financial savings Account transactions. In line with the story, Goldman’s preliminary system for managing withdrawals was overly delicate to “potential dangerous exercise” that led to delays, notably for big withdrawals.

In response to the blowback from customers, Goldman Sachs has now “adjusted its strategy to chop down the variety of, or cut back the severity of, these points.” The adjustments, in response to at this time’s report, have already led to a drastic discount in complaints from customers.

The report explains that there’s now a cap on what number of days a withdrawal ought to take, in addition to new methods of speaking with prospects about these delays:

Now, if a buyer with a big amount of cash tries to maneuver a small portion of their financial savings to an outdoor account, the system shall be much less more likely to flag these transactions. Goldman additionally put in place a cap on the variety of days withdrawals ought to take and prioritized higher communication with prospects whose transactions had been flagged or are experiencing delays, one of many individuals stated.

Goldman Sachs and Apple are additionally reportedly “emphasizing the choice for a three-way-call among the many name heart and the financial institution to which the shopper is attempting to switch” to assist expedite transfers which will get flagged for evaluation.

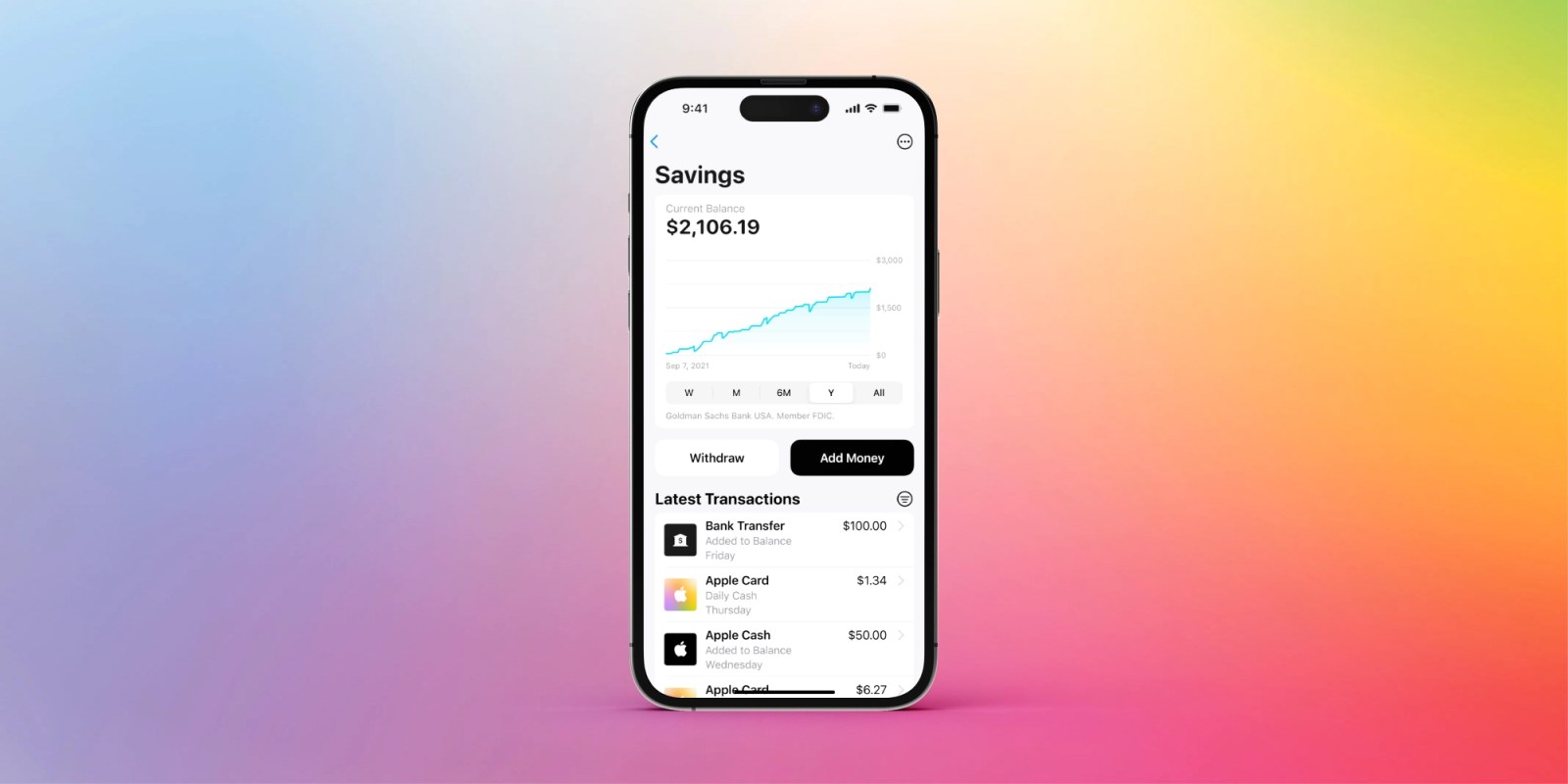

The Apple Card Financial savings Account launched in April, giving Apple Card customers the choice to open a devoted high-yield financial savings account to earn 4.15% on their cash. In August, Apple revealed that the platform has already attracted greater than $10 billion in deposits.

Comply with Probability: Threads, Twitter, Instagram, and Mastodon.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.