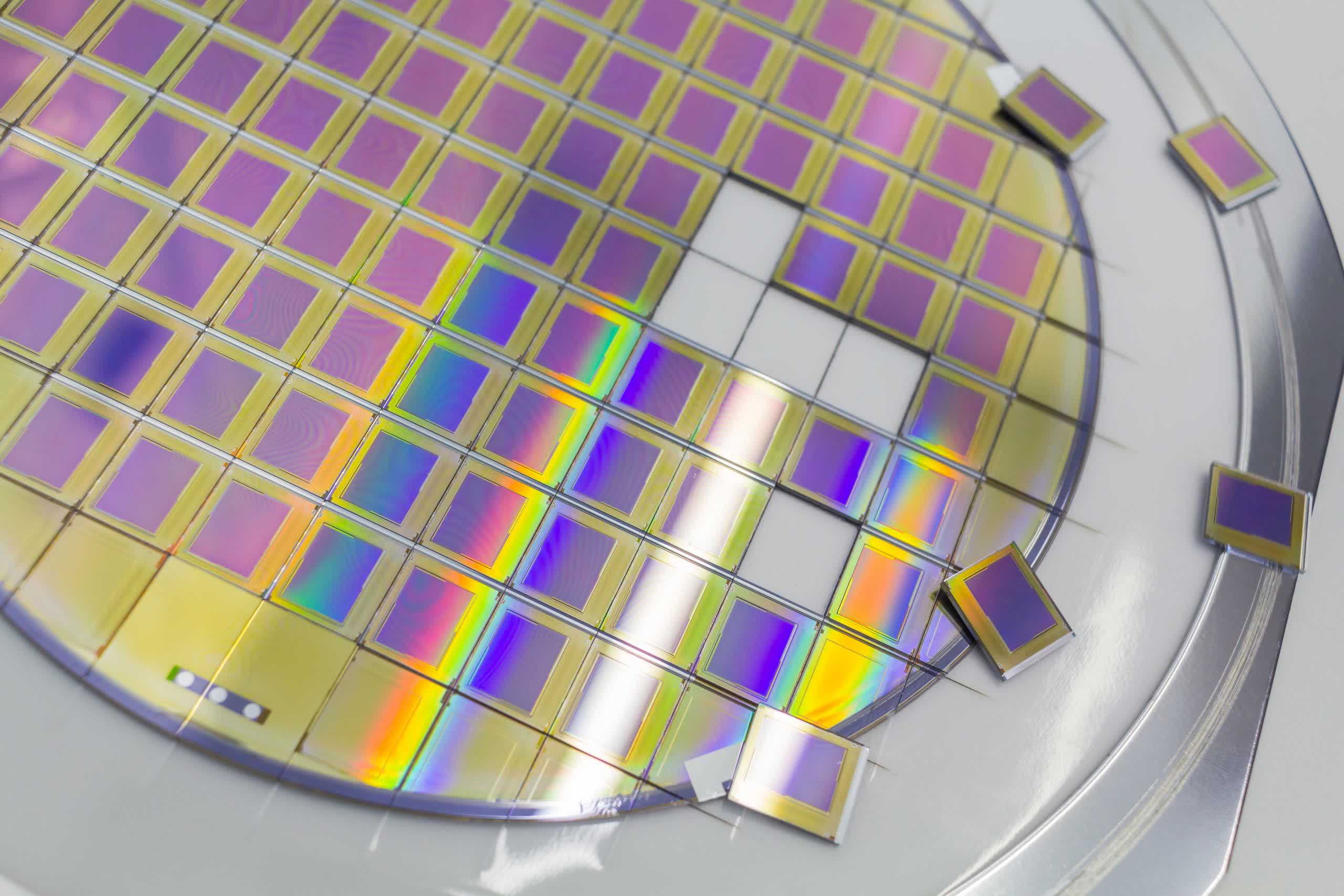

Rumor mill: Intel has been outsourcing its Arc GPU manufacturing to TSMC since 2022. In accordance with latest speculations from a outstanding funding financial institution, Intel would possibly considerably enhance its reliance on the Taiwanese foundry over the following few years.

Goldman Sachs analysts, quoted by the Taiwanese media outlet Business Occasions, recommend that Intel is prone to broaden product outsourcing to TSMC in 2024 and 2025. The “complete addressable market” for Intel’s outsourcing orders is projected to be $18.6 billion in 2024 and $19.4 billion in 2025, the analysts acknowledged. It is possible that TSMC will obtain manufacturing orders from Intel amounting to $5.6 billion within the subsequent 12 months and $9.7 billion in 2025.

Goldman Sachs’ assumptions appear to be primarily based on the challenges Intel has confronted with smaller and extra superior manufacturing processes for the reason that 10-nanometer node. Furthermore, the US chipmaker lately selected to ascertain a “foundry-like” relationship between its manufacturing teams and its inside product enterprise models, as famous by the analysts.

Opinion: Is Intel turning a nook?

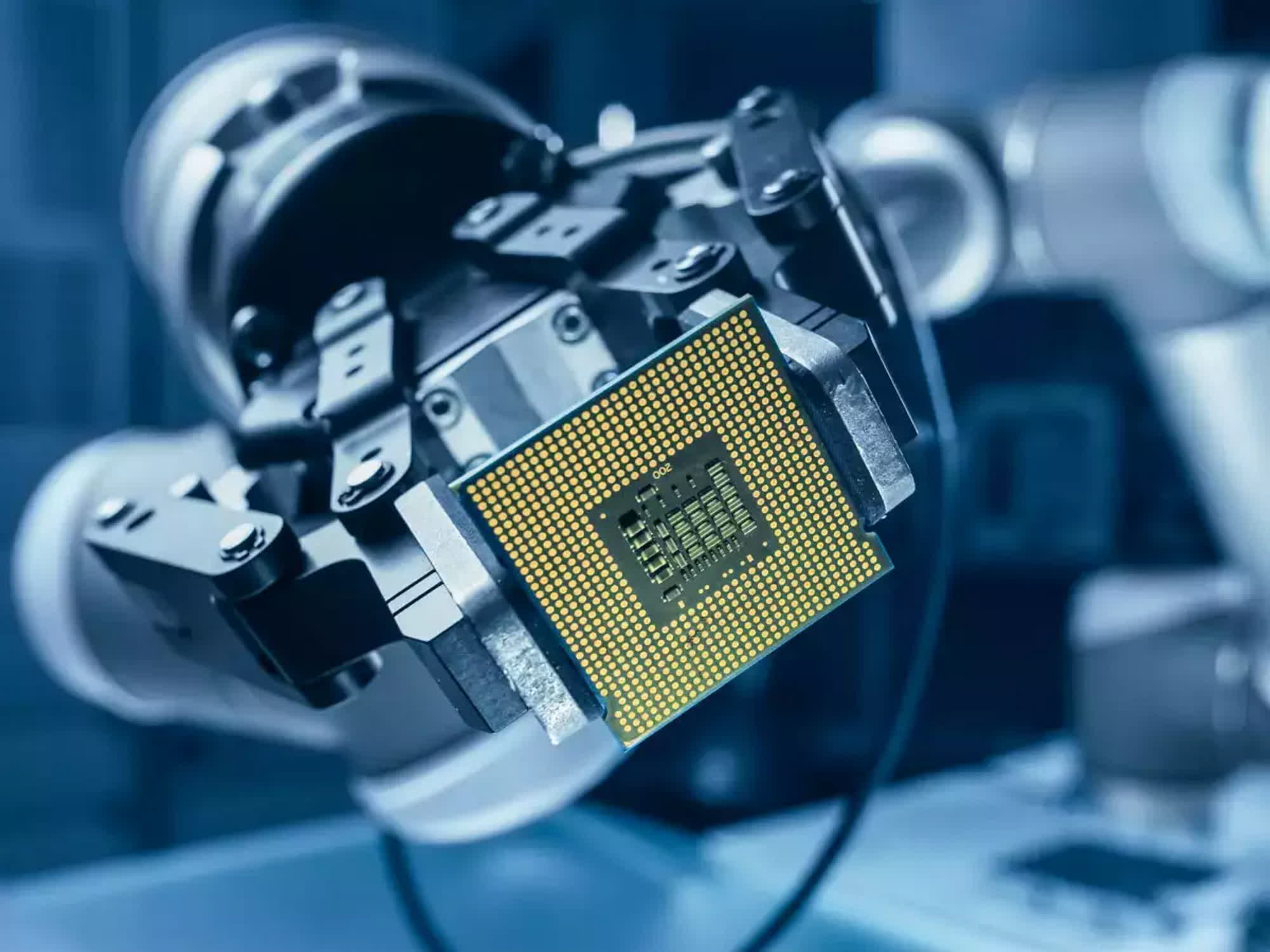

Semiconductor trade analyst Andrew Lu believes this relationship will evolve additional. Intel’s chip manufacturing arm straight competes with TSMC, whereas its design division is working laborious to take care of its footing within the more and more aggressive semiconductor sector. Intel chip designers seem wanting to domesticate a more in-depth collaboration with the Taiwanese foundry.

Lu even speculates a few potential separation inside Intel’s competing enterprise arms, predicting that the Santa Clara-based chip maker would possibly cut up into two distinct corporations within the coming years. Intel is more and more adopting a chiplet design for its upcoming CPUs, with some chiplet parts anticipated to be outsourced to exterior foundries by the top of 2023.

Setting speculations apart, it is doubtless that each one of TSMC’s manufacturing capacities for 2024 and 2025 are already reserved. If Intel plans to outsource a good portion of its semiconductor merchandise to the Taiwanese agency, contracts would have been finalized by now.

Assuming the figures offered by Goldman Sachs analysts – $5.6 billion and $9.7 billion – are correct, Intel’s orders may symbolize roughly 6.4% and 9.4% of TSMC’s general revenues for 2024 and 2025, respectively. But, regardless of the numerous sums concerned, neither Intel nor TSMC have publicly confirmed or refuted these claims.