Mr. Cooper, the biggest residence mortgage servicer in the USA, says it discovered proof of buyer information uncovered throughout a cyberattack disclosed final week, on October 31.

The mortgage mortgage large’s discover says it is nonetheless investigating the character of the compromised information and can present affected clients with extra data over the approaching weeks.

Mr. Cooper stated the attackers couldn’t entry clients’ monetary data because the impacted methods didn’t retailer such information.

“Please word that Mr. Cooper doesn’t retailer banking data associated to mortgage funds on our methods,” the nonbank mortgage servicer stated.

“This data is hosted with a third-party supplier and, primarily based on the knowledge we now have thus far, we don’t consider it was affected by this incident. Consequently, we don’t consider that any of our clients’ banking data associated to mortgage funds was impacted.”

The corporate has not disclosed whether or not the attackers issued a ransom demand after final month’s safety breach.

Mr. Cooper additionally urged clients to watch their credit score experiences and financial institution accounts, with any indicators of suspicious or unauthorized exercise promptly reported to their financial institution.

People probably affected by the incident had been additionally suggested to put a ‘fraud alert’ on their credit score bureau information as a precautionary measure and to be alerted about any makes an attempt to open new accounts utilizing their Social Safety quantity.

Breach contained through IT shutdown

The October 31 safety breach pressured the corporate to close down IT methods, together with entry to cellphone traces, help chatbot, and the net fee portal.

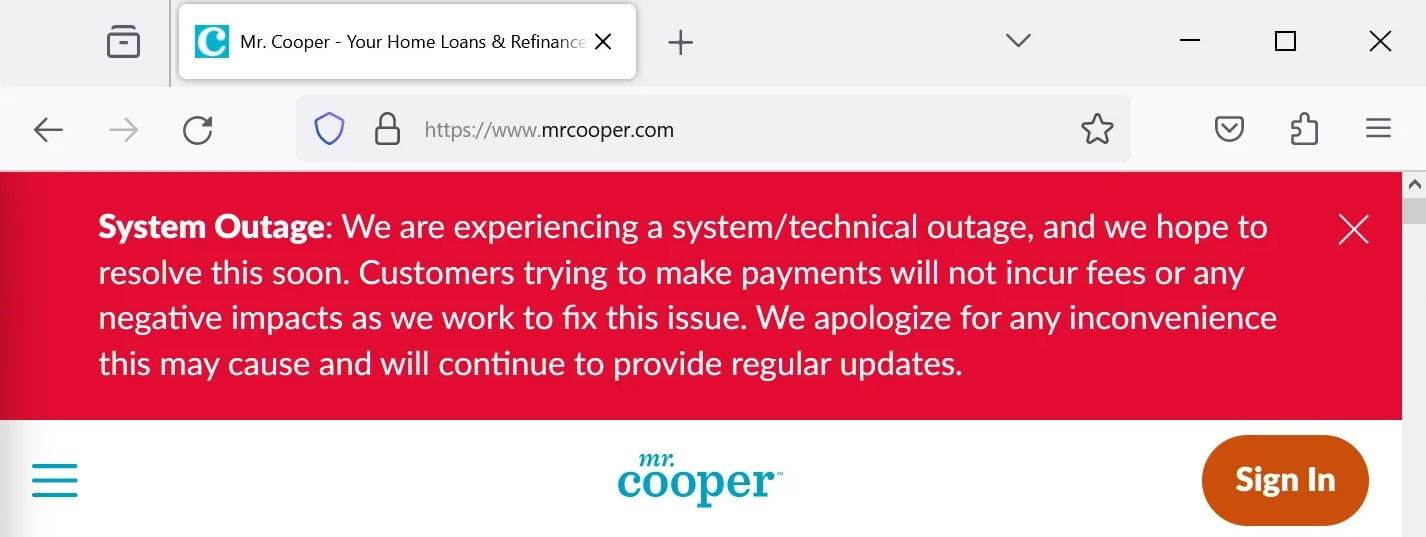

“We’re experiencing a system/technical outage, and we hope to resolve this quickly,” a system outage banner on Mr. Cooper’s web site warned.

“Prospects making an attempt to make funds won’t incur charges or any damaging impacts as we work to repair this problem. We apologize for any inconvenience this will trigger and can proceed to offer common updates.”

Later that day, the corporate instructed BleepingComputer that the outage resulted from a cyberattack. It additionally promised to not cost any charges, penalties, or damaging credit score reporting associated to late funds till it completed restoring impacted methods.

Mr. Cooper, previously Nationstar Mortgage LLC, is a mortgage lending firm headquartered in Dallas, Texas, with round 9,000 staff.

The house mortgage servicer says it has a buyer base of 4.1 million and is managing loans totaling $937 billion, in keeping with Q3 2023 outcomes reported in October.