The trucking trade is a essential a part of the economic system, transporting 71.6% of U.S. items, totaling $10.4 trillion in response to the U.S. Census Bureau. However vans are additionally a major supply of air pollution, having emitted 7% of U.S. GHG (greenhouse fuel) emissions in 2020. The EESI (Environmental and Vitality Examine Institute) predicts electrical vans can cut back GHG emissions, main main fleets to decide to transitioning not less than 30% of their new heavy-duty truck purchases to be zero-emission autos, together with electrical fashions, by 2030.

For instance, Volvo Vans has signed a letter of intent to promote 1,000 electrical vans between now and 2030 to Holcim, a constructing materials and answer supplier. The deal is the most important business order up to now for Volvo electrical vans.

The primary 130 heavy electrical Volvo FH and Volvo FM vans will probably be delivered to markets together with France, Germany, Switzerland, and the UK through the fourth quarter of 2023 and all through 2024. By changing 1,000 present Volvo FH diesel vans with Volvo FH Electrical vans on a typical route, as much as 50,000 tons of CO2 could possibly be saved yearly.

Each Volvo and Holcim are dedicated to the Science-based targets initiative, which drives formidable local weather motion within the personal sector by enabling organizations to set science-based emissions discount targets. Targets are thought of ‘science-based’ if they’re consistent with what the newest local weather science says is critical to satisfy the targets of the Paris Settlement—limiting international warming to 1.5°C above pre-industrial ranges. Each are additionally founding members of FMC (First Movers Coalition), a gaggle of corporations that use their buying energy to create early markets for revolutionary clear applied sciences throughout eight hard-to-abate sectors.

Final 12 months, Volvo added the three hottest 44-ton heavy-duty vans to its electrical lineup: the Volvo FH, the Volvo FM, and the Volvo FMX. With these new additions, Volvo Vans has six electrical truck fashions in collection manufacturing, giving it the trade’s most intensive portfolio of zero exhaust emission vans.

Volvo Vans noticed a robust enhance in new truck orders through the first quarter of 2023. A complete of 486 electrical vans had been ordered, which is a rise of 141% in comparison with the identical interval in 2022. Most of those orders got here from nations within the northern a part of Europe, together with the Netherlands, Germany, Norway, and Sweden.

Presently, Volvo Vans is scaling up manufacturing of electrical vans at three vegetation: in Gothenburg, Sweden; in Blainville, France; and in New River Valley, Virginia. Within the third quarter of 2023, serial manufacturing will even begin at Volvo’s largest manufacturing facility in Ghent, Belgium.

What’s an eTruck

An electrical truck refers to a business car powered by a number of electrical motors as a substitute of a fossil fuel-using ICE (inside combustion engine). It’s charged via an exterior energy supply and able to dealing with heavy-duty duties. It produces zero emissions from tailpipes and leads to a major discount in GHG (greenhouse fuel) emissions and air air pollution. It additionally presents prompt torque and facilitates higher acceleration and efficiency in city driving circumstances.

Absent incentives, EESI estimates electrical semi-trucks at present price as much as 2.8 instances extra to buy than their diesel counterparts. Falling battery prices and rising manufacturing scale will cut back this upfront price differential over time. However many corporations are holding again because of the additional upfront price of electrical vans, in addition to challenges just like the restricted availability of chargers. The IRA (Inflation Discount Act) and IIJA (Infrastructure Funding and Jobs Act) will assist handle these challenges and produce ahead the price parity of electrical and diesel vans.

Underneath the IRA, fleet operators can qualify for as much as $40,000 in tax credit for every electrical truck heavier than 14,000 kilos positioned into service. The regulation additionally features a $1 billion Clear Heavy Obligation Car Program to supply funding to states, municipalities, tribes, and nonprofit college transportation associations to impress heavy-duty fleets. A Rocky Mountain Institute evaluation discovered the IRA will carry ahead cost-parity between electrical and diesel semi-trucks for short- and long-haul functions. The IRA additionally prolonged the 30% tax credit score for electrical car provide tools and elevated the business cap to $100,000 per charger.

Underneath the Infrastructure Funding and Jobs Act, the Nationwide Electrical Car Infrastructure Formulation Program requires states to make plans to construct public charging stations each 50 miles alongside different gasoline corridors. The invoice additionally funds analysis, demonstration, and deployment for low- and zero-emission transportation choices, in addition to expanded electrical car charging infrastructure (together with for heavy-duty autos).

As well as, 5 states have adopted California’s Superior Clear Truck Act, requiring producers to extend zero-emission semi-truck gross sales by 75%, and not less than 5 others are contemplating it. The California challenge will work towards creating high-power chargers that may present 100 miles of vary in lower than 10 minutes and value lower than $500 per kW. Two high-power charging demonstration websites—one close to the Ports of Los Angeles and Lengthy Seashore, and one within the Inland Empire—will present know-how and operational information.

A plan for a statewide charging hall community, together with a workforce growth technique and templates for key freight corridors will probably be below growth. The high-power charging help will prolong the vary of electrical vans and enhance their market penetration. The primary part of the challenge runs via 2025.

As an electrical truck is vitality environment friendly, environment-friendly, and whereas costing extra initially, is cheaper to take care of, they’re gaining traction within the logistics, municipal, development, and mining industries throughout the globe. The advantages of electrical vans, elevated availability of extra makes and fashions, investments in charging infrastructure, the fast enchancment of the upfront and long-term economics, and coverage incentives all level to a near-term growth of their adoption.

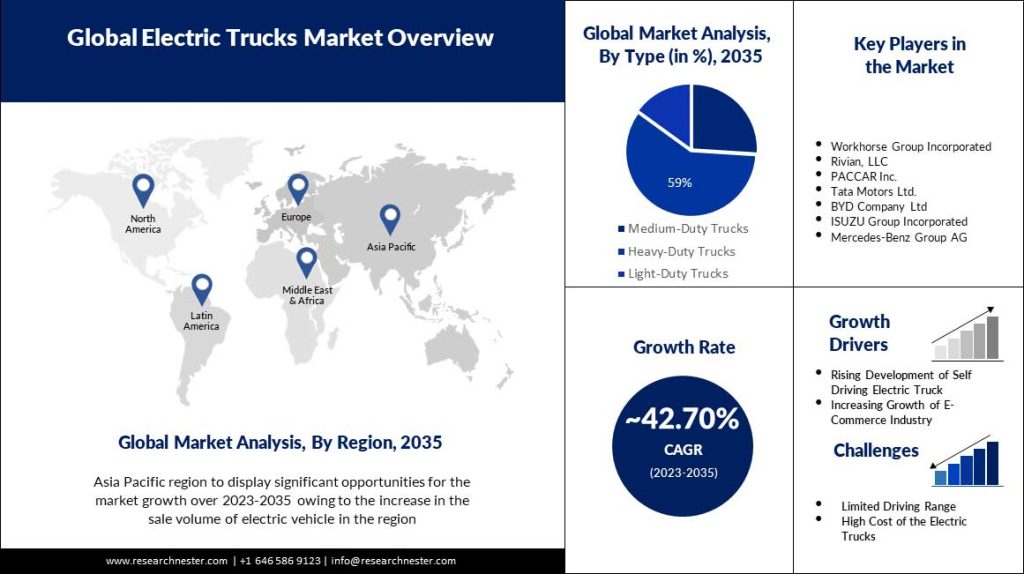

The worldwide electrical truck market measurement reached $515.1 million in 2022. Trying ahead, IMARC Group expects the market to achieve $2,556.1 million by 2028, exhibiting a CAGR (compound annual progress charge) of 32.2% throughout 2023-2028. The enlargement of on-line distribution channels, rising environmental issues, and stringent authorities laws in regards to the emission of greenhouse gases symbolize among the key components driving the market.

Governments of varied nations are implementing stringent laws to scale back CO2 (carbon dioxide) emissions from heavy-duty autos. This, with the enlargement of charging infrastructure and growth of testing services for analyzing electrical motors, controllers, and battery chargers, is providing progress alternatives to key market gamers working worldwide.

EU (European Union) laws now require new vans to scale back carbon emissions 30% by 2030. California’s latest Superior Clear Truck regulation requires producers of business autos to start out promoting etrucks in 2024 and restricts all gross sales of recent vans to electrical fashions by 2045.

At present, etrucks have gotten extra economical for producers to provide and for customers to buy and personal. Because of enhancements in electrical powertrain know-how and declining battery prices, McKinsey predicts throughout the subsequent few years, the complete price of possession for a lot of etrucks, relying on the precise use case, will probably be much like or higher than that of conventional ICE vans.

Key market gamers are specializing in bettering the motor effectivity of electrical vans. They’re additionally collaborating with the private and non-private sectors to develop, display, and deploy applied sciences that improve the efficiency of electrical drive autos, which is fueling the market progress. The rising costs of petroleum merchandise and the simple availability of electrical vans are contributing to the market progress.

Electrical car charger analysis is ongoing in a number of areas. Right now, there are a number of courses of EVs below growth, requiring totally different chargers, some immediately involving heavy obligation vans:

- BEVs (battery electrical autos) are powered by rechargeable electrical batteries. BEVs produce no tailpipe emissions and haven’t any combustion engine.

- PHEVs (plug-in hybrid electrical autos) are powered by an electrical motor in addition to a small combustion engine. They’ve an all-electric vary from 20 to 60 miles and could be charged at a charging station.

- HEVs (hybrid electrical autos) have an internal-combustion engine and an electrical motor that assists solely at low speeds. The battery is charged both by the combustion engine or via recuperation when braking.

- FCEVs (gasoline cell electrical autos) use electrical motors. The electrical energy is generated in gasoline cells and could be saved in a small buffer battery. Gasoline cell autos require hydrogen (compressed into tanks) as gasoline.

McKinsey expects gasoline cell electrical vans, powered by hydrogen, will even penetrate the commercial-vehicle trade, particularly in heavy-duty functions and long-haul use instances, the place pure battery electrical powertrains may need limitations given battery measurement and weight.

At first look, standard vans have a considerable benefit in terms of vary. They will journey as much as 2,000 miles with out refueling, in comparison with as much as claimed 500 miles for Tesla’s Semi electrical truck. However as a result of long-haul truck drivers are required to take breaks, these relaxation intervals could possibly be used to recharge electrical truck batteries. Charging throughout obligatory breaks and through loading instances permits electrical semi-trucks to take care of environment friendly schedules.

And whereas the limitation of distance per cost, given the standing of the EV charging community at this time, is a significant concern for over-the-road fleet consumers, the Infrastructure Funding and Jobs Act has almost $7.5 billion allotted to construct a community of 500,000 electrical car chargers nationwide. The rising funding within the electrical car charging station infrastructure is projected to enhance the expansion of the worldwide electrical vans market.

Harbor Analysis explains there are three ranges of EV charging options:

Degree 1 makes use of adapters included with most EVs to immediately plug autos into wall sockets or shops. Degree 1 is sluggish—a most of about 5 miles RPH (range-per-hour), and until a separate meter is put in these chargers sometimes haven’t any HMI (human-machine interface) and lack even essentially the most fundamental options like vitality consumption monitoring or computerized shutoff.

Degree 2 allows sooner charging utilizing 240V shops. It requires devoted {hardware}, often SAE J1772 EV plugs and adapters, and expenses between 12-25 miles RPH. Attainable options of Degree 2 embody load balancing, distant cost and pricing, app-based wayfinding, and distant upkeep and updates.

Degree 3, additionally known as DCFC chargers, are costly to put in, requiring a separate station often in public venues, however they gasoline a car a lot sooner than Degree 2 (100+ miles RPH). At present, most Degree 3 charging stations are unconnected wall-box options or commonplace 50kW merchandise. Nonetheless, new fashions are being developed which have greater vitality outputs, 5G connectivity, infotainment shows utilizing LCD/LED touchscreens, and AI-level functions like analytics-based load balancing, AC/DC energy inversion, and DER (distributed vitality assets) storage and integration.

As gamers align to seize the fast-growing EV market, EV charging station suppliers are taking two paths: Promoting EV charging {hardware} and parts, and an app-based subscription to public EV charging networks.

As extra nations mandate the manufacturing and use of EVs, the rising gasoline demand will necessitate the substitute of conventional car fueling strategies with EV charging stations. Whereas Degree 2 will dominate residential charging, Degree 3 DCFC stations in public settings will exponentially enhance.

Degree 3 EV charging requires excessive infrastructure investments and a brand new fueling mannequin for customers. However solely superior DCFC stations will be capable to defend marketshare in opposition to EV dealerships (e.g., Tesla) and offset misplaced retail revenues resulting from customers charging their EVs at house versus the traditional mannequin of filling up at a station.

EV charging stations function the essential bridge between utilities energy distribution and electrical car energy consumption. Functions corresponding to energy inversion, off-grid energy storage, and grid interactivity can optimize this bridging course of, serving to to keep away from overload by the huge demand for EV charging that can quickly be upon us.

Public EV charging station networks are inherently a high-technology digital enterprise. They displace the legacy fueling mannequin with a distributed, subscription-based strategy enabled by software program, analytics, and vitality administration to forestall EV charging from crippling the grid. Business teams ought to proceed to advertise EV charging interoperability via open requirements, and collaborate with OEMs and utilities to deploy sooner, cheaper charging stations with vitality storage and cargo balancing, thereby accelerating the shift to EVs.

A research from Juniper Analysis discovered income from EV charging will exceed $300 billion globally by 2027, up from $66 billion in 2023. The report, EV Charging: Key Alternatives, Regional Evaluation & Market Forecasts 2023-2027, discovered fragmentation in charging networks is limiting EV adoption.

Chargers are overwhelmingly situated in city areas; resulting in widespread vary anxiousness amongst potential drivers. That is coupled with the problem of accessing charging factors by way of totally different apps and playing cards, in addition to the shortage of requirements for charging autos on the similar charge. As such, EV charging networks should simplify entry and work with native authorities to roll out chargers to a wider vary of places, or the EV market, vehicles, and vans, will battle to speed up.

The U.S. Dept. of Vitality just lately introduced $7 million in funding for seven initiatives centered on creating regional infrastructure plans to help electrical charging and hydrogen fueling for medium- and heavy-duty vans alongside the nation’s most closely trafficked corridors. The NREL (Nationwide Renewable Vitality Laboratory) will collaborate with trade companions on 4 of the seven initiatives, which can finally inform plans for zero-emission charging infrastructure throughout greater than half of the US.

The electrification and hydrogen fueling hall planning initiatives are a essential step towards formidable federal clear vitality targets, together with decarbonizing the U.S. transportation sector by 2050 and deploying greater than 500,000 EV chargers nationwide by 2030. The transportation sector is now the most important supply of greenhouse fuel emissions in the US, and medium- and heavy-duty autos—which embody all the pieces from semitrucks and cement mixers to transit buses and supply fleets—are among the heaviest emitters on the highway.

Creating the infrastructure to help battery-electric and hydrogen-fueled autos might have an outsize affect in decreasing carbon emissions. In flip, improved air high quality can profit those that stay and work close to freight corridors: the highways that join items, companies, and other people. Analysis predicts by 2027, the full variety of plug-in autos will surpass 137 million globally; up from 49 million in 2023. As this adoption grows, EV charging stations will turn out to be as frequent because the fuel stations we now depend on.

Wish to tweet about this text? Use hashtags #development #sustainability #infrastructure

The submit Right here, There, EVerywhere appeared first on Related World.