Accounts payable software program is more and more being utilized by companies worldwide. Automated accounts payable software program can effectively handle giant volumes of economic transactions between an organization and its suppliers, whereas additionally automating ancillary actions similar to approvals and reconciliations.

AP automation software program that’s obtainable off the shelf as we speak is both a standalone product or a part of a full stack accounting ERP. There are a number of such instruments obtainable as we speak, with various ranges of functionalities and options.

Given the selection of accounts payable software program obtainable available in the market, it might be troublesome for firms to pick the appropriate one for themselves. An organization’s selection of AP automation software program would depend on its options and the precise wants of the corporate.

On this article, we have a look at a few of hottest accounts payable software program, their core providing, high options, person/buyer profiles, and a guesstimate of their worth vary.

The highest accounts payable software program

1. Circulate by Nanonets

2. Invoice

3. Airbase

4. Ramp

5. Stampli

6. Tipalti

7. AvidXchange

8. Melio

9. Docuware

10. QuickBooks On-line

11. Sage Intacct

12. SAP Concur

13. Lightyear

14. Different notable mentions

What’s accounts payable software program?

Accounts Payable (AP), generally referred to by accountants as “payables,” are the corporate’s pending short-term debt and liabilities owed to distributors, suppliers, or collectors.

Initially thought-about a transactional back-office operate, the AP course of is now thought-about a hub for crucial monetary knowledge processing.

The AP course of begins with the receipt of the bill, passes via numerous ranges of categorization, coding, knowledge matching, and AP approvals, and ends with the cost of the bill.

In response to Insider, guide accounts payable processes can take 30 to 90 days. This lengthy timescale arises from interoperability between the steps and the time delays in to-and-fro transitions.

The usage of accounts payable software program leads to a 73% sooner processing time. In response to a Goldman Sachs, the usage of accounts payable automation software program additionally leads to 33% discount in processing prices.

One other compelling driver of AP automation is the elimination of errors. Every AP particular person on this planet, on common, is accountable for 139 defective invoices yearly, which will be prevented with the usage of AP software program.

Not surprisingly, firms are more and more adopting software program instruments for his or her AP processes. Brainy Insights experiences that the worldwide accounts payable automation market will develop to $7.5 billion by 2030.

As with all enterprise workflow optimization device, there isn’t a one-size-fits-all resolution to accounts payable automation. A compulsory function for your online business is likely to be completely pointless for another person’s. Because of this customization, intensive documentation, and world-class buyer help are often major necessities when companies supply accounts payable instruments.

One of the best platforms supply as a lot customization as your online business wants, so you should use or discard particular options based mostly in your operational wants, dimension, order and vendor quantity, and distinctive documentation necessities.

Because you anticipate important customization out of your accounts payable software program, you’ll additionally must search for a platform with ample documentation as you adapt to the software program. Even probably the most well-designed person interfaces nonetheless have a studying curve, and it’s best to be capable of use current manuals and assets to navigate the platform and adapt it to your wants simply.

After all, you’ll inevitably want reside buyer help when integrating accounts payable automation platforms into your online business ecosystem. Even in the event you can create a construct that meets all of your wants, it’s best to nonetheless make sure that your service supplier has reside buyer help standing by in the event you encounter any points throughout preliminary phases or as you deploy the platform and operationalize your accounts payable workflows.

These are the naked minimal necessities it’s best to search for when sourcing an accounts payable automation resolution. Past that, once more, is determined by your distinctive necessities – however these are a number of the most necessary and customary key options of AP automation software program:

Doc administration

Your platform ought to simply type, filter, and retailer invoicing, order documentation, and every thing else it’s worthwhile to reference or pull sooner or later. This helps preserve compliance with industry-specific laws and shields your online business towards potential audits. Complete documentation administration can also be a greatest apply for companies generally.

Bill and vendor administration

The software program ought to combine along with your distributors and suppliers simply as a part of your onboarding course of. Afterward, the instruments ought to assist streamline invoicing and funds, handle contract phrases, and preserve tabs on how nicely your distributors meet these phrases. In case you use bodily bill processing, your instruments ought to simply combine scanned documentation whereas providing optical character recognition to stop your workers from migrating data manually.

Analytics – Provide strategic perception

It is best to be capable of pull depths of information and analytics into an simply digestible dashboard report advanced sufficient to derive recent insights whereas remaining easy sufficient to be actionable.

Efficient cost processing

The meat and potatoes of accounts payable software program, the system needs to be a complete, one-stop-shop for vendor cost. The instruments ought to help the complete spectrum of frequent cost strategies like examine, wire, and ACH, be simply built-in along with your current monetary accounts, supply dependable scheduling and correct reminders, and have guide approval choices earlier than funds disburse. If your online business is international or has abroad distributors, you’ll additionally need to make sure the system facilitates cross-border funds.

Workflow automation

Accounts payable automation instruments aren’t a lot use in the event that they don’t automate time-consuming duties, proper? Ensure the platform gives as many automation instruments as attainable to avoid wasting your enterprise money and time, however with a particular eye in direction of:

- Customizable workflows modifiable by buy kind, sourcing vendor, recurrence, quantity, and extra.

- Cellular choices for distant approval and monitoring.

- Integrable collaboration for accounts payable workers and approving officers to change and validate invoices shortly.

Buy order matching

A no brainer: your accounts payable automation device ought to mechanically match buy orders and receipts upon consumption and execution whereas storing the identical in an simply accessible format.

Let’s have a look at a number of the greatest accounts payable software program obtainable available in the market. We cowl every software program’s core providing, its high options, distinguished person/buyer profiles, and a guesstimate of its pricing.

Circulate by Nanonets

At its core, Nanonets is an clever automation AI for enterprise processes and AP automation is considered one of its hottest use instances. Circulate is an AP automation software program powered by Nanonets.

With Circulate, firms get two distinct AP automation options – one for automating/streamlining current accounts payable workflows and one other that serves as an entire end-to-end AP automation resolution:

- Handle provider communication, course of invoices in seconds, arrange controls, achieve visibility into spends, and streamline the monetary shut with an AI-based AP automation software program.

- Scan and approve invoices immediately, and make funds at no cost anyplace on this planet. Scale back guide effort on your workforce by 10x.

It’s a platform ideally suited to small-to-medium companies that need to automate their AP course of in a completely customizable but scalable method.

Circulate – demo

Core Providing

- Automate knowledge seize, construct workflows and streamline current AP processes fully

- Finish-to-end automated AP administration – import, approve and pay invoices in the identical platform

Options

(Streamlining current AP workflows)

- Automated knowledge entry

- E-mail payments fetched

- Extract line merchandise knowledge, match and reconcile invoices/receipts/POs

- Arrange guidelines for validations & approvals

- Categorizing and coding transactions based mostly on enterprise guidelines

- Expense workflow

- Reconciliation

- Combine seamlessly with ERPs (Salesforce, Quickbooks, Entrata, Dynamics, and many others.), cloud storage providers (Drive, Dropbox, e-mail, and many others.), and databases (MySQL, PostGres, MSSQL, and many others.)

- Zapier connector to automate end-to-end workflows

(Finish to finish AP automation)

- Simple-to-use dashboard for invoices, receipts, approvals and funds

- 1-click approvals on cellular, e-mail and Slack

- Make funds throughout 45+ currencies globally, utilizing ACH, card or wire switch

- AI-enabled safety features – duplication detection, fraud prevention, cost monitoring

- Absolutely customizable approval insurance policies

- Limitless bill storage within the cloud

- Reconciliation

- Integrations with Quickbooks, Xero, Sage and NetSuite

- Greatest-in-class pricing that does not scale with customers

Greatest For

- Nanonets – Small to medium companies, giant enterprises with legacy ERPs, accounting companies, multi-national companies

- Circulate – Small to medium companies, accounting companies, multi-country companies, and rising firms seeking to formalise or automate their finance operate

Pricing Particulars

Invoice

Invoice.com gives a variety of economic automation instruments notably suited to freelancers, sole proprietors, and small companies. Along with AP automation, Invoice.com gives versatile strains of credit score to let house owners easy out cyclical enterprise intervals and facilitates a variety of accounts receivable choices that are perfect for smaller, nimbler companies that want money shortly.

Invoice.com syncs with software program utilized by a variety of clientele, together with Oracle, Microsoft merchandise, Slack, Quickbooks, and extra. For people or small firms beginning to increase past what they will moderately handle manually, Invoice.com is an easy, intuitive, no-frills possibility.

Core Providing

Create and pay payments, ship invoices, and receives a commission.

Options

- Centralized inbox

- Bill knowledge seize

- 360-degree vendor information

- Limitless doc storage

- ACH, examine, bank card, and worldwide wire switch

- Approval insurance policies

- Consumer roles

- Reductions for reviewers/approvers solely

- Automated 2-way sync with QuickBooks, Xero, Oracle Netsuite, Sage Intacct and Microsoft Dynamics.

Greatest For

Freelancers, self-employed professionals, small companies, impartial accountants

Pricing Particulars

- Necessities plan (Accounts Payable) begins at $45/person/month

- Staff plan (Accounts Payable) begins at $55/person/month

- Company plan (AP & AR) begins at $79/person/month

- Enterprise plan (AP & AR) requires customized pricing

Airbase

Airbase combines a simplified person interface with superior workflow customization and optimization. These traits create an enterprise-level AP automation resolution that’s simply deployed company-wide with a fast studying curve.

Airbase’s approval flows are its spotlight, as customers can automate your complete stream to inform approval authorities as procurement proceeds, and people authorities can simply validate the request digitally. The approval flows are extremely customizable, too, and purchasers can adapt the platform to swimsuit their particular person wants and handle a wide range of use instances – although full customization does take extra work upon adoption, it pays dividends down the street.

Core Providing

Invoice funds, company playing cards, expense reimbursements

Options

- 3-Means Match

- Amortization

- Invoice Funds

- Buy Order & Receipt Administration

- Vendor Portal

- Superior Approvals

- Automated Audit Path

- Accounting Automation

- Cellular App

- Multi-Subsidiary & Multi-Foreign money

- Actual-time Reporting

- Safety & Fraud Detection

Greatest For

Small companies, impartial accountants, mid-sized to enterprise-level companies

Pricing Particulars

Airbase gives 3 quote-based plans that every require customized pricing:

- Commonplace (As much as ~200 staff)

- Premium (As much as 500 staff)

- Enterprise (As much as 5,000 staff)

Ramp

Ramp demo video

Ramp gives a variety of economic merchandise and automation options to companies (largely) concentrated inside the tech sphere. Ramp is exclusive in that it gives a spectrum of providers, together with vendor administration, company bank cards, and billing to smaller firms and startups that in the end let leaders give attention to rising the enterprise.

The preliminary studying curve startups navigate when increasing their monetary footprint is steep and expensive from a time perspective. Entries, approvals, syncs, and extra all take treasured time that might be higher spent managing the corporate. Ramp additionally gives cost administration methods, together with digital playing cards and recurring billing, that permit purchasers automate each payables and receivables.

Core Providing

All-in-one spend administration, worth intelligence, and automation

Options

- Limitless digital playing cards

- Actual-time financial savings insights and reporting

- Automated receipt assortment and matching

- Vendor administration and worth intelligence

- iOS and Android cellular app

- Expense and mileage reimbursements

- Quickbooks, Xero, NetSuite and Sage Intacct integrations

- Service provider & class controls

- Subsequent-day ACH reimbursements

- ACH, examine, card vendor funds

- Multi-level approvals

- Limitless 1.5% cashback

- Multi-currency spend limits

- Multi-entity and international tax help

- Procurement automation and buy order administration

- Automated provisioning & de-provisioning

- Customized person teams and permissions

Greatest For

Massive Enterprises, Mid Dimension Enterprise, Non Revenue, Public Administrations, Small Enterprise

Pricing Particulars

Ramp gives 3 pricing plans:

- The Ramp plan begins at $0 per person/mo

- The Ramp Plus plan begins at $15 per person/mo

- The Ramp Enterpise plan requires a customized quote/pricing

Stampli

Stampli is tailored for firms with environment friendly and helpful methods in place that need to carry AP automation into the fold. Stampli integrates with greater than 70 current ERPs, which means you may fold AP automation and improved administration into your current ecosystem with minimal problem or adoption issue.

Stampli’s plug-and-play, modular nature additionally makes it a high decide for firms actively in search of M&A, as integrating an acquisition’s workflows and books into your personal is simplified by way of Stampli in comparison with guide strategies or attempting emigrate the processes and methods by way of brute pressure.

Core Providing

AP communication, doc workflows, and funds

Options

- Actual Time knowledge seize with AI

- Bill processing

- Bill Administration

- Approval routing

- Centralized collaboration

- 2- and 3-way matching

- Superior vendor administration

- Multi-subsidiary help

- Expense Stories

- Digital Funds: ACH, Credit score and Debit, Wire Switch

- Fee Processing

- Strong ERP integrations

- Audit & fraud checks

Greatest For

Small and midsized companies

Pricing Particulars

Stampli solely gives quote-based plans/pricing

Tipalti

Tipalti targets the “next-gen” eCommerce market by letting companies automate their payables to affiliate entrepreneurs, freelancers, and related distinctive contractor positions that primarily function digitally. True to kind, Tipalti’s imaginative and prescient extends past nationwide borders because the platform lets purchasers pay distributors in additional than 200 native currencies.

Tipalti syncs with extra obscure affiliate and influencer platforms that different AP automation instruments don’t even take into account, so it’s a digital advertising workforce’s greatest buddy. On the similar time, by automating these funds, Tipalti helps firms preserve their affiliate or influencer campaigns going with out operational disruption and conserving their model top-of-mind.

Core Providing

Accounts payable and international payables administration

Options

- International funds

- Procurement

- Streamlined provider administration

- Touchless bill processing

- Approvals

- Tax and regulatory compliance

- 2- and 3-way PO matching

- Fee reconciliation

- Company card

- Fee Processing – International cost remittance

- Fee Strategies: ACH, Wire Switch

- Safety and Compliance

- Fraud detection

- Integrations

- Actual-time cost reconciliation

- Enterpise-grade monetary controls

- Spend administration and company playing cards

Greatest For

Small to medium-sized companies

Pricing Particulars

Tipalti gives two scaled pricing plans:

- Tipalti Categorical begins at $149 per thirty days

- Tipalti Superior is quote-based

AvidXchange

AvidXchange demo video

AvidXchange focuses on B2B middle-market purchasers – too huge for primary startup monetary automation instruments however not but needing cumbersome enterprise-level options. AvidXchange streamlines vendor funds by nesting itself inside your current accounting software program or ERP, which means you don’t must rewrite commonplace working procedures with a view to automate accounts payable.

AvidXchange’s middle-market focus means it additionally has a number of account managers standing by prepared to assist deploy AP automation, moderately than leaving monetary groups on their very own to determine AP greatest practices leveraging the software program.

Core Providing

AP automation and invoice cost software program

Options

- Accomplice Onboarding

- International Funds

- Fee Strategies (Home, checks, playing cards, and ACH)

- PO Administration

- FX Options

- Bill Processing

- Bill routing and approval

- ERP Integrations

- Fee Communication

- Multi–Entity

- Trusted by International Manufacturers

- Charge Splitting

- Integrates with a variety of accounting packages

Greatest For

Medium to giant middle-market firms

Pricing Particulars

AvidXchange solely gives quote-based plans.

Melio

Melio demo video

Melio helps small companies, together with native operations, streamline accounts payable by letting purchasers automate financial institution transfers and card funds – together with funds to distributors who solely settle for checks. On the similar time, Melio doesn’t demand the provider create an account; that is essential for smaller operations that won’t have the time or experience to onboard native suppliers.

Melio additionally syncs with frequent platforms smaller firms favor, like Quickbooks, which reduces deployment and integration friction and kickstarts the AP automation course of sooner than bigger, enterprise-focused options.

Core Providing

Switch and obtain funds sooner

Options

- Limitless customers

- Accounting software program sync

- Approval workflows

- Simple invoice seize

- Fee monitoring & updates

- Knowledge & kind export

- Payments administration

- Customized cost requests

- Sync with QuickBooks, Xero, FreshBooks and Enterprise Central

- ACH financial institution switch

- Mail your examine or Quick examine – Get a examine to your vendor inside 3 enterprise days.

- Pay by card

- Quick ACH financial institution switch

- Worldwide funds (USD solely)

- Mix funds

- Break up payments

- Recurring funds

Greatest For

Small companies within the US seeking to pay their payments in additional environment friendly methods.

Pricing Particulars

Melio would not supply a number of pricing plans, as a substitute it fees a price for particular options:

- ACH financial institution switch – Free

- Mailing checks – $1.50 per examine (First 2 checks every month are free)

- Card funds – 2.9% per transaction

- Quick ACH financial institution switch – 1% per transaction (as much as $30)

- Quick examine – $20 per examine

- Worldwide funds (USD solely) – $20 flat price per transaction

Docuware

Because the identify implies, DocuWare’s shining power is in its digital doc administration methods along with workflow automation. DocuWare is a really international operation, servicing customers in additional than 100 nations, and stands as a premier selection for worldwide companies who’re consolidating their doc administration procedures right into a centralized, safe cloud-based resolution.

DocuWare helps firms working throughout geographic boundaries or remotely flatten their hierarchy by creating higher doc entry and transparency which, in flip, makes staff extra well-informed and efficient at delivering superior service to prospects.

Core Providing

Doc administration and workflow automation

Options

- Seize and set up data

- Course of paperwork and handle workflows

- Entry and think about content material for decision-making

- Clever indexing and classification

- Knowledge enrichment, kinds for knowledge seize, barcode recognition

- Import from any e-mail account

- Import from print stream

- Workflow automation

Greatest For

Massive Enterprises, Mid Dimension Enterprise, Non Revenue, Small Enterprise

Pricing Particulars

DocuWare solely gives quote-based plans.

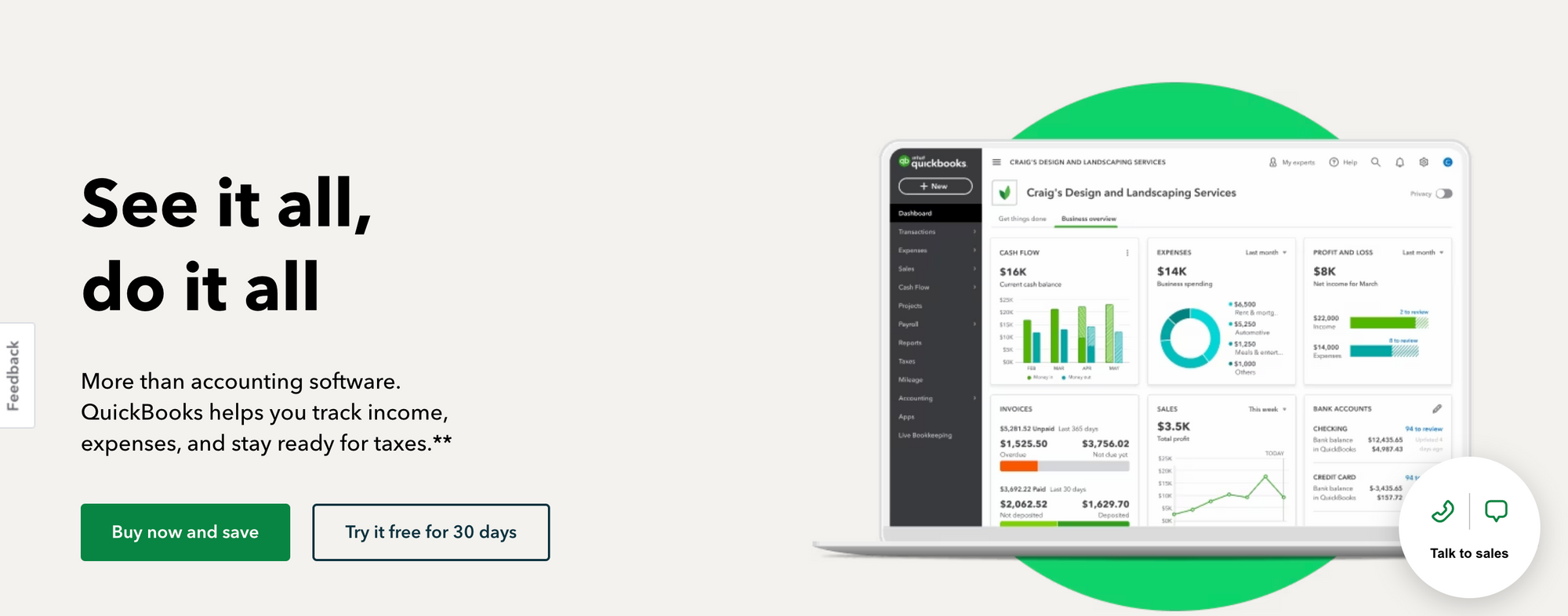

QuickBooks On-line

QuickBooks is among the hottest “one-stop store” digital accounting software program choices obtainable to small and medium-sized companies. The software program helps house owners handle a variety of economic and accounting providers, together with earnings and expense monitoring, stock administration, payroll, and related primary accounting capabilities.

Since Quickbooks is among the most commonly-used platforms, there’s a number of current documentation and person guides to assist even probably the most inexperienced founders and proprietor/operators combine superior monetary providers into their each day enterprise operations. And, since Quickbooks On-line is a browser-based platform, it’s ideally suited for digital nomads and distant staff used to doing enterprise in a wide range of locales that won’t have the digital infrastructure to help extra demanding software program.

Core Providing

Accounting software program that additionally handles bills, payroll and extra

Core accounting, inventory monitoring, financial institution reconciliation, automating workflows,

Options

- Revenue and bills

- Bill and funds

- Tax deductions

- Highly effective experiences

- Receipt seize

- Mileage monitoring

- Money stream

- Gross sales and gross sales tax

- Estimates

- Contractors

- Invoice administration

- Enter time

- Stock

- Venture profitability

- Knowledge sync with Excel

- Worker bills

- Batch invoices and bills

- Customized entry controls

- Unique premium apps

- Workflow automation

- Income recognition

Greatest For

Smal and mid sized companies

Pricing Particulars

QuickBooks On-line gives 4 pricing plans:

- Easy Begin begins at $30/mo

- Necessities begins at $60/mo

- Plus begins at $90/mo

- Superior begins at $200/mo

Sage Intacct

Sage Intacct leverages next-gen cloud know-how to ship superior enterprise options to small and medium-sized companies, together with buyer satisfaction administration, procurement and provide chain capabilities, enterprise intelligence, compliance, and stock.

Sage Intacct serves as one other “one-stop store” for customers in search of a holistic monetary spine to help growth or extra advanced transactions whereas saving effort and time via automation. The corporate additionally hosts frequent person informational periods and webinars to assist purchasers maximize the platform’s advantages.

Core Providing

AICPA-endorsed ERP software program

Options

- Accounting and ERP

- Accounts Payable

- Accounts Receivable

- Analytics

- Dashboards and Reporting

- Dimensions

- Clever GL

- Payroll and HR

- Planning & Budgeting

- Platform providers

- Salesforce integration

- Net providers (API)

- Spend administration

- Time and expense administration

- Vendor funds powered by CSI

Greatest For

SMall to medium companies and accountants

Pricing Particulars

Sage Intacct solely gives quote-based plans.

SAP Concur

SAP Concur demo video

SAP Concur is a part of the SAP ecosystem and one of many high selections for companies that ship staff offsite incessantly. SAP Concur gives numerous journey and expense administration providers, together with guided journey documentation, automated expensing, expedited invoicing and extra. Since journey spend tends to balloon shortly, SAP Concur additionally leverages AI and analytics to assist house owners establish spending traits and stop overspending.

SAP Concur in the end helps staff ship the perfect worth to offsite purchasers by letting them give attention to the duty at hand moderately than preventing to manually add expense tickets or juggle time zone complexities when attempting to handle spending accounts abroad.

Core Providing

Handle invoices, bills and worker journey

Options

- Automated, linked accounts payable

- Digital bill seize

- On-time vendor funds

- Bill Seize

- Consultative Intelligence

- Three-way matching

- Make data-informed choices

- Combine with cost suppliers

- Submit, assessment, and approve expense experiences on the go

- Robotically populate expense experiences with e-receipts

- Enhance budgeting, forecasting, and coverage compliance

- Combine along with your ERP and get a full monetary image of your online business

- Monitor expense knowledge securely

- Concur Expense

- SAP Concur cellular app

- ExpenseIt

- Concur TripLink

- Concur Request

Greatest For

Medium to giant companies with greater than 1000 staff

Pricing Particulars

SAP Concur solely gives quote-based plans.

Lightyear

Lightyear helps customers fight fraud, waste, and abuse by providing superior Buy Order workflows that leverage 3-way matching to make sure the correct amount of money is allotted to the proper receivable. Lightyear’s bill storage options additionally assist purchasers protect towards audit threat by providing an accessible, perennial depository to simply reference previous invoicing shortly.

Lightyear additionally leverages superior OCR know-how to make sure customers can migrate a variety of invoicing documentation – PDF, XML, pen and paper – into that digital repository precisely and easily.

Core Providing

Clever buying and accounts payable

Options

- Guidelines-based Automation

- Bill Processing

- Course of funds by way of direct deposit, examine, and ACH funds

- Handle buy orders

- Clever Knowledge Extraction

- Automated line merchandise coding

- Approval workflows

- Provider statment reconciliations

- Reporting and Analytics

- Integration with accounting, ERP and Stock software program

Greatest For

SMEs to giant companies and multi nationwide firms

Pricing Particulars

Lightyear gives 3 pricing plans:

- Starter begins from $125 per thirty days

- Enterprise begins from $199 per thirty days

- Enterprise begins from $1199 per thirty days

Different notable mentions

Aside from the accounts payable software program lined above listed below are a number of notable mentions that provide AP automation options and cater to firms of all sizes:

Accounting software program with AP options

Enterprise content material administration options

ERP software program with AP options

- Microsoft Dynamics 365

- NetSuite

- Oracle EPM Cloud

- Acumatica

- Epicor

Area of interest accounts payable software program

Spend administration software program

Once more, the “greatest” accounts payable device is the one that matches inside your online business dimension and operational mannequin most successfully. Nonetheless, in the event you’re starting preliminary sourcing and platform due diligence, you’ll want to ensure a handful of primary, commonplace, and vital options are a part of the bundle.

Accounts payable course of and accounting integration

Efficient AP automation instruments assist optimize and streamline current workflows. However you don’t need to be compelled to adapt to a brand new accounts payable course of if what you have got works nicely. Bear in mind, efficient AP automation goals to avoid wasting money and time by automating current greatest practices – not forcing your agency to relearn a completely new method of doing enterprise. Likewise, the platform ought to adapt to your organization’s accounting practices and commonplace working procedures (SOPs) – not the opposite method round.

Alternatively, you is likely to be annoyed with an ineffective system and need to pivot to new processes. If you understand that to be the case, you would possibly need to use AP automation platform adoption as a springboard to start a brand new workflow framework. In that case, make sure the platform has loads of digestible documentation and reside help to assist onboard your workforce, flatten the educational curve, and stop frustration

Correct (and helpful) knowledge seize and storage

You possibly can’t handle what you don’t measure, and correct knowledge seize is step one in direction of KPI administration. If, for no matter motive, your invoicing codecs aren’t commonplace throughout distributors (i.e., some are on paper, others by way of PDF, one other in XML format, and many others), you’ll want to ensure the AP automation platform simply integrates numerous sources whereas migrating knowledge precisely.

Relying in your safety wants and scale, your platform ought to help the perfect doc, knowledge, and data storage. Whether or not cloud-based, by way of native {hardware}, or a mixture, your AP automation device ought to adapt to your wants and have the service personnel obtainable to make sure safety and doc storage stability.

Efficient bill administration and cost processes

The highest of the meals chain – your managers and executives – are sometimes these tasked with closing bill approval authority. Whereas this successfully controls spending, an ineffective approval workflow can waste their most treasured commodity – time. An environment friendly AP automation device ought to show all pertinent information in a easy dashboard for fast (and correct) assessment and let approval authorities authorize invoices with a single click on.

On the similar time, although approval needs to be easy, these charged with sustaining correct accounting want maximal visibility on the workflow. Your accounts payable and accounting workforce ought to have a granular look into an bill’s progress and the place holdups are. This helps guarantee speedy supply, in fact but additionally serves to maintain vendor and provider invoicing relations on the appropriate foot.

As soon as routing is full and authorised, your platform of selection ought to disburse funds mechanically and diligently log the transaction in line with your SOP.

Tax administration integration

Tax integration, although it matches into the “accounting integration” class, deserves it’s personal part. Efficient accounting = proactive tax administration and your AP automation instruments in the end feed your taxation cycle. Past different regulatory necessities, mismanaged taxes are one of many high ache factors companies face – and in case your AP automation platform isn’t serving to ease that burden, you’re higher off discovering another.

Takeaway

The usage of Accounts Payable software program or superior bill processing software program comes with compelling advantages similar to time and price financial savings, streamlined accounts payable course of, and in the end higher backside strains.

Automated accounts payable options will allow human staff to focus on higher-value duties similar to enterprise improvement that contribute to enterprise worth.

The selection of an bill to cost automation device is determined by the extent of automation that the enterprise requires, and the flexibility of the software program to mix with the corporate’s practices and insurance policies.