Everybody now agrees that the UK has a significant issue of financial development – or lack of it – even when opinions differ about its causes, and what we must always do about it. Right here I’d wish to set out the dimensions of the issue with plots of the important thing information.

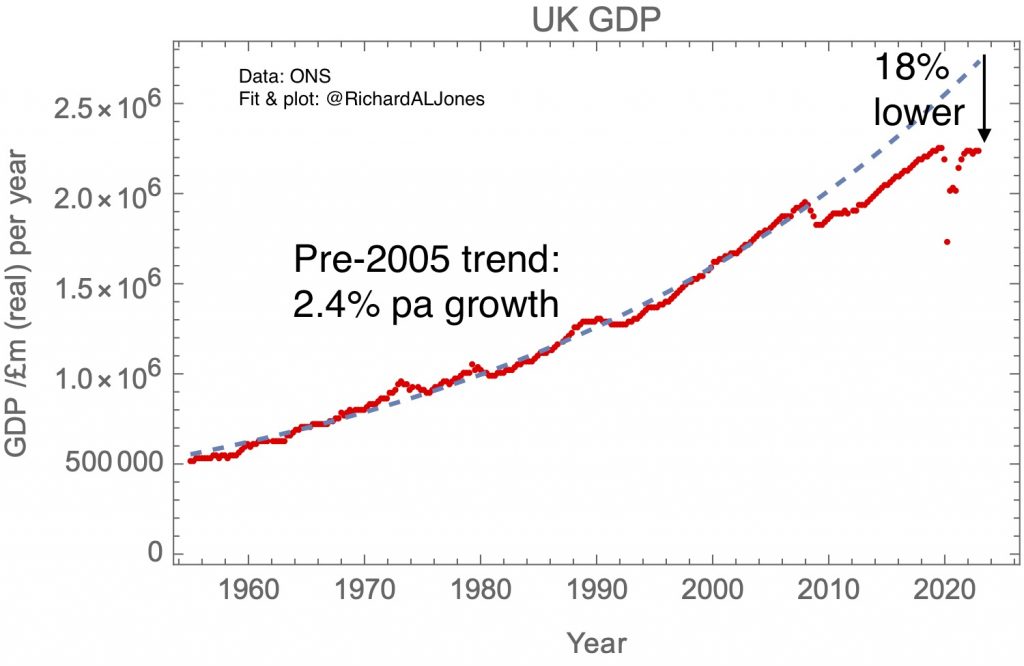

My first plot reveals actual GDP since 1955. The break within the curve on the international monetary disaster round 2007 is clear. Earlier than 2007 there have been booms and busts – however the entire curve is properly match by a pattern line representing 2.4% a 12 months actual development. However after the 2008 recession, there was no return to the pattern line. Progress was additional interrupted by the covid pandemic, and the restoration from the pandemic has been gradual. The UK’s GDP is now about 18% decrease than it will have been if the economic system had returned to its pre-recession pattern line.

UK actual GDP. Chained quantity measure, base 12 months 2019. ONS: 30 June 2023 launch.

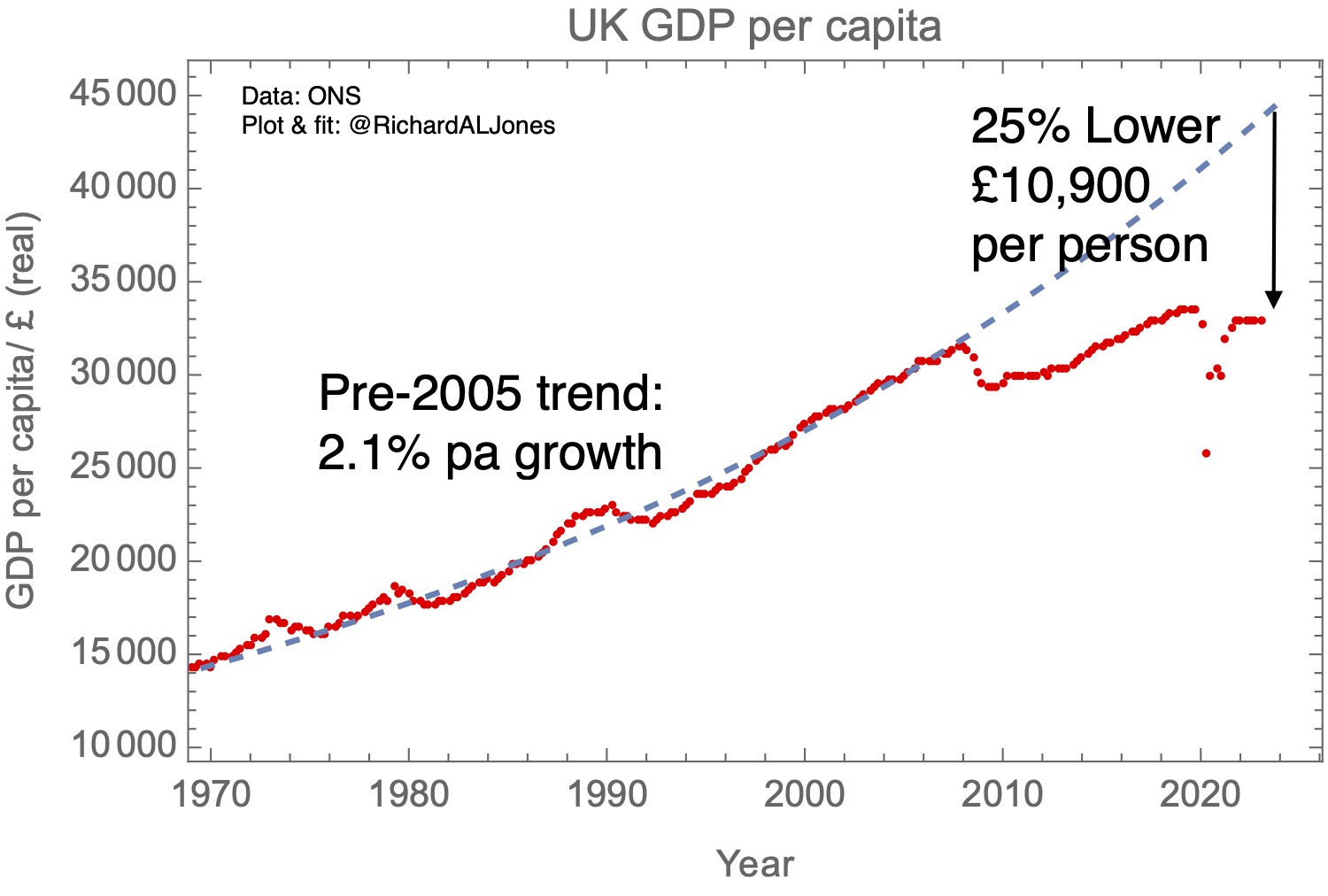

Complete GDP is of specific curiosity to HM Treasury, as it’s the general dimension of the economic system that determines the sustainability of the nationwide debt. However you’ll be able to develop an economic system by rising the dimensions of the inhabitants, and, from the standpoint of the sustainability of public providers and a wider sense of prosperity, GDP per capita is a greater measure.

My second plot reveals actual GDP capita. GDP per individual has risen much less quick than whole GDP, each earlier than and after the worldwide monetary disaster, reflecting the truth that the UK’s inhabitants has been rising. Development development earlier than the break was 2.1% every year; as soon as once more, opposite to all earlier expertise within the post-war interval, per capita GDP development has by no means recovered to the pre-crisis pattern line. The hole with the earlier pattern, 25%, or £10,900 per individual, is maybe the very best measure of the UK’s misplaced prosperity.

UK actual GDP per capita. Chained quantity measure, base 12 months 2019. ONS: 12 Could 2023 launch.

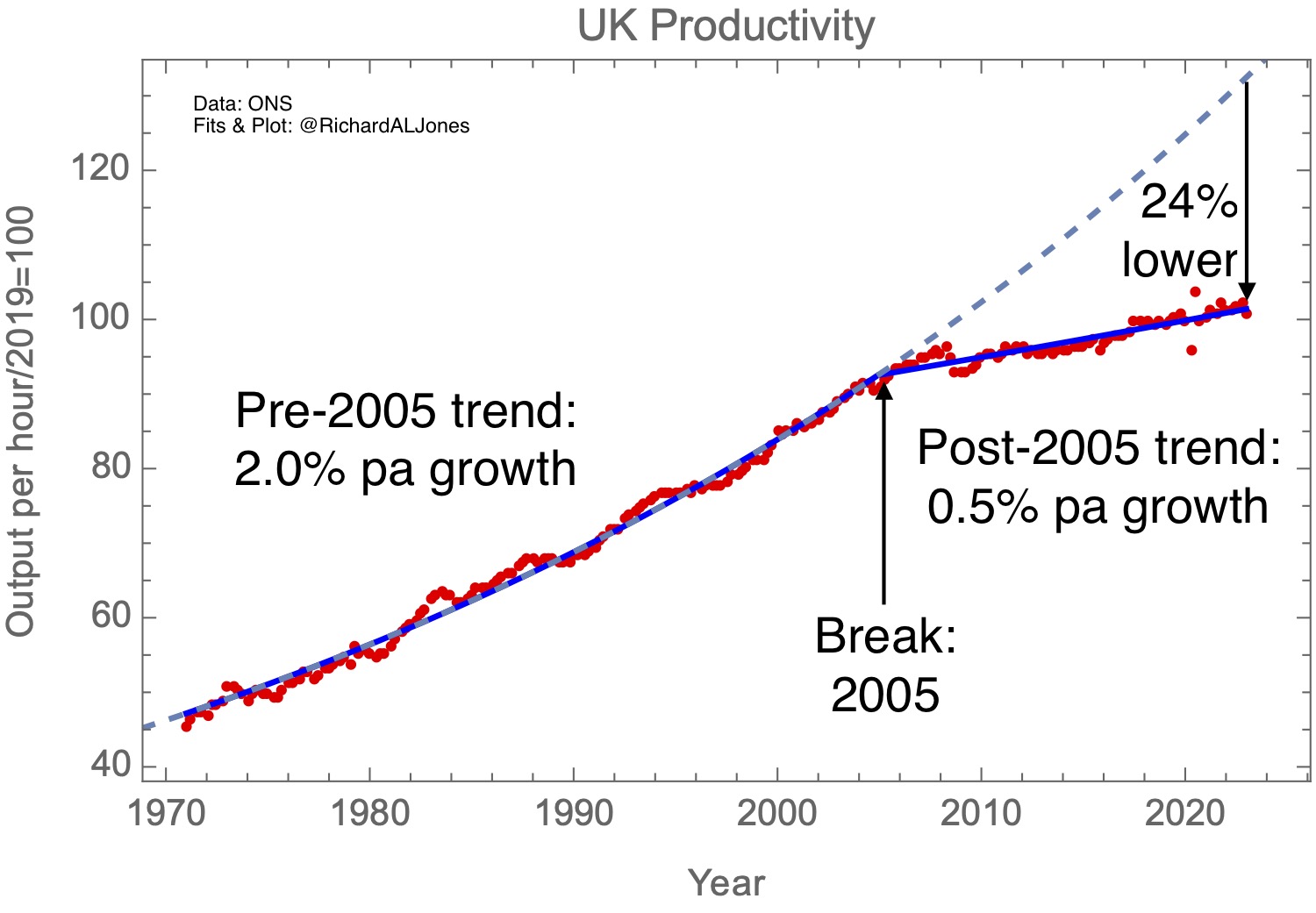

Essentially the most elementary measure of the productive capability of the economic system is, maybe, labour productiveness, outlined because the GDP per hour labored. One could make GDP per capita develop by individuals working extra hours, or by having extra individuals enter the labour market. Within the late 2010s, this was a big issue within the development of GDP per capita, however because the pandemic this impact has gone into reverse, with extra individuals leaving the labour market, typically as a consequence of long-term ill-health.

My third plot reveals UK labour productiveness. This reveals the basic and apparent break in productiveness efficiency that, for my part, underlies just about every part that’s unsuitable with the UK’s economic system – and certainly its politics. As I mentioned in additional element in my earlier submit,“When did the UK’s productiveness slowdown start?”, I more and more suspect that this break predates the monetary disaster – and certainly that disaster might be higher thought as an impact, slightly than a trigger, of a extra elementary downward shift within the UK’s capability to generate financial development.

UK labour productiveness, entire economic system. Chained quantity measure, index (2019=100). ONS: 7 July 2023 launch.

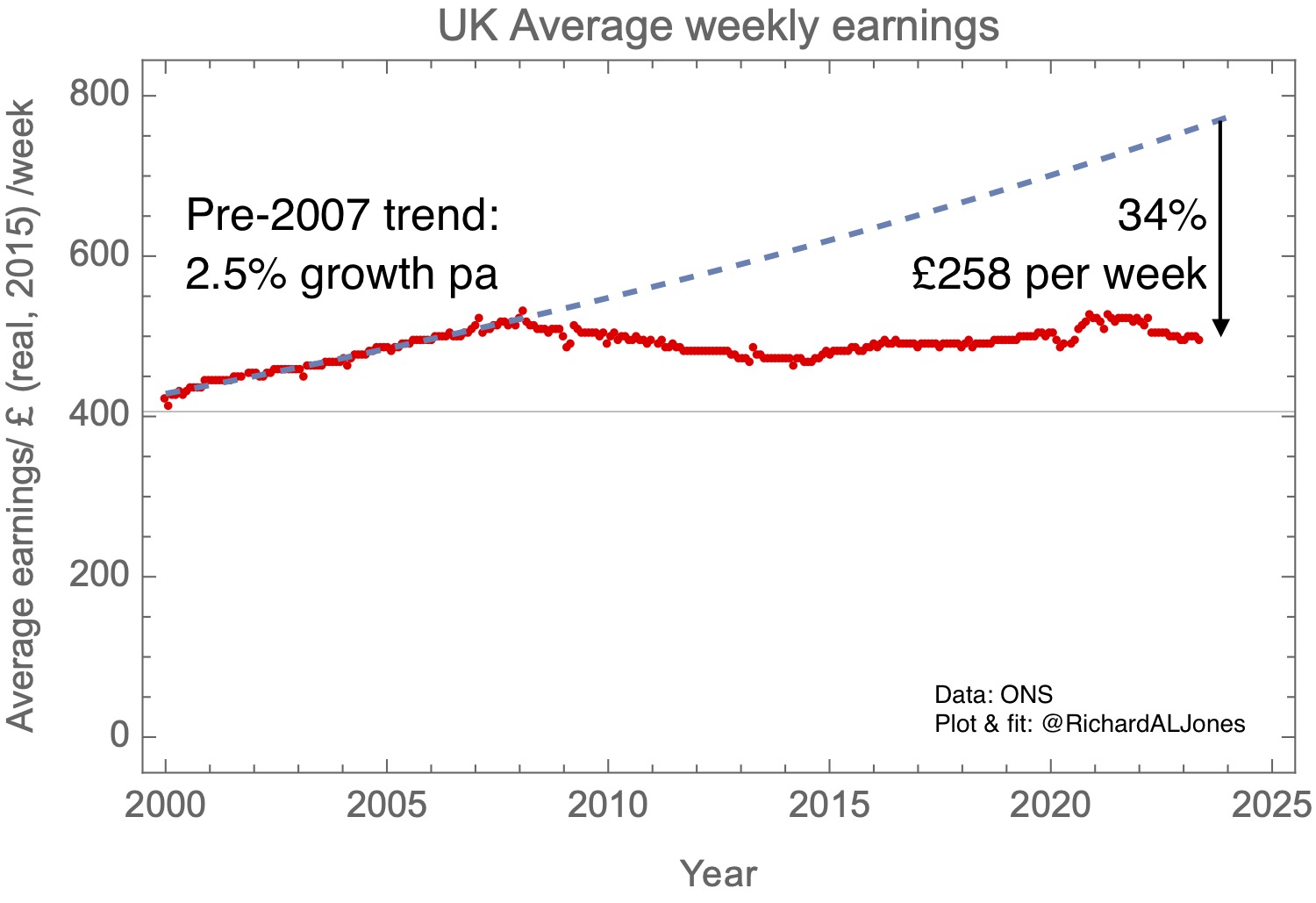

Discuss of GDP development and labour productiveness could appear distant to many citizens, however this financial stagnation has direct results, not simply on the affordability of public providers, however on individuals’s wages. My remaining plot reveals common weekly earnings, corrected for inflation. The image is dismal – there has basically been no rise in actual wages for greater than a decade. This, at root, is why the UK”s lack of financial development is just going to develop in political salience.

UK Common weekly earnings, 2015 £s, corrected for inflation with CPI. ONS: 11 July 2023 launch.

I’ve written rather a lot in regards to the causes of the productiveness slowdown and attainable coverage choices to deal with it, reflecting my very own views on the significance of innovation and on redressing the UK’s regional financial imbalances. Right here I simply make two factors.

On prognosis, I feel it’s actually vital to notice the mid-2000s timing of the break within the productiveness curve. Undoubtedly subsequent coverage errors have made issues worse, however I imagine a elementary evaluation of the UK’s issues should recognise that the roots of the disaster return a few many years.

On treatments, I feel it needs to be apparent that if we feature on doing the identical kinds of issues in the identical manner, we will count on the identical outcomes. Token, sub-scale interventions will make no distinction with no severe rethinking of the UK’s elementary financial mannequin.