What ought to be within the long-delayed UK Semiconductor Technique? My earlier sequence of three blogposts set out the worldwide context, the UK’s place within the international semiconductor world, some ideas on the longer term instructions of the trade, and a few of the choices open to the UK. Right here, in abstract, is an inventory of actions I feel the UK ought to – and mustn’t – take.

1. The UK ought to… (& there’s no excuse to not)

The UK authorities has dedicated to spending £700m on an exascale pc. It ought to specify that processor design ought to be from a UK design home. After many years of speaking about utilizing authorities procurement to drive innovation, the UK authorities ought to give it a attempt.

Why?

The UK has actual aggressive energy in processor design, and this sub-sector will grow to be an increasing number of vital. AI calls for exponentially extra computing energy, however the finish of Moore’s legislation limits provide of computing energy from {hardware} enhancements, so design optimisation for purposes like AI turns into extra vital than ever.

2. The UK ought to… (although it in all probability gained’t, as it will be costly, troublesome, & ideologically uncomfortable)

The UK authorities should purchase ARM outright from its present proprietor, SoftBank, and float it on the London Inventory Change, whereas retaining a golden share to forestall a subsequent takeover by an abroad firm.

Why?

ARM is the one UK-based firm with internationally vital scale & attain into international semiconductor ecosystem. It’s the only anchor firm for the UK semiconductor trade. Possession & management issues; ARM’s present abroad possession makes it weak to takeover & expatriation.

Why not?

It could value >£50 bn upfront. Most of this cash could be recovered in a subsequent sale, and the federal government may even make a revenue, however some cash could be in danger. But it surely’s price evaluating this with the precedent of the publish GFC financial institution nationalisations, at an identical scale.

3. The UK mustn’t… (& virtually definitely not potential in any case)

The UK mustn’t try and create a UK primarily based manufacturing functionality in vanguard logic chips. This could have to be accomplished by one of many 3 worldwide corporations with the required technical experience – TSMC, Intel or Samsung.

Why not?

A single vanguard fab prices >£10’s billions. The UK market isn’t wherever close to sufficiently big to be enticing by itself, and the UK isn’t able to compete with the USA & Europe in a $bn’s subsidy race.

Furthermore, many years of neglect of semiconductor manufacturing in all probability means the UK doesn’t, in any case, have the talents to function a vanguard fab.

4. The UK mustn’t…

The UK mustn’t try and create UK primarily based manufacturing functionality in legacy logic chips, that are nonetheless essential for industrial, automotive & defence purposes. The lesser technical calls for of those older applied sciences imply this is able to be extra possible than manufacturing vanguard chips.

Why not?

Manufacturing legacy chips could be very capital intensive, and new entrants must compete, in a brutally cyclical world market, with present crops whose capital prices have already been depreciated. As an alternative, the UK must work with like-minded international locations (particularly in Europe) to develop safe provide chains.

5. Warrants one other look

The UK may safe a place in some area of interest areas (e.g. compound semiconductors for energy electronics, photonics and optoelectronics, printable electronics). Focused help for R&D, innovation & abilities, & seed & scale-up finance may yield regionally vital financial advantages.

6. How did we find yourself right here, and what classes ought to we study?

The UK’s restricted choices on this strategically vital expertise ought to make us mirror on the choices – implicit and express – that led the UK to be in such a weak place.

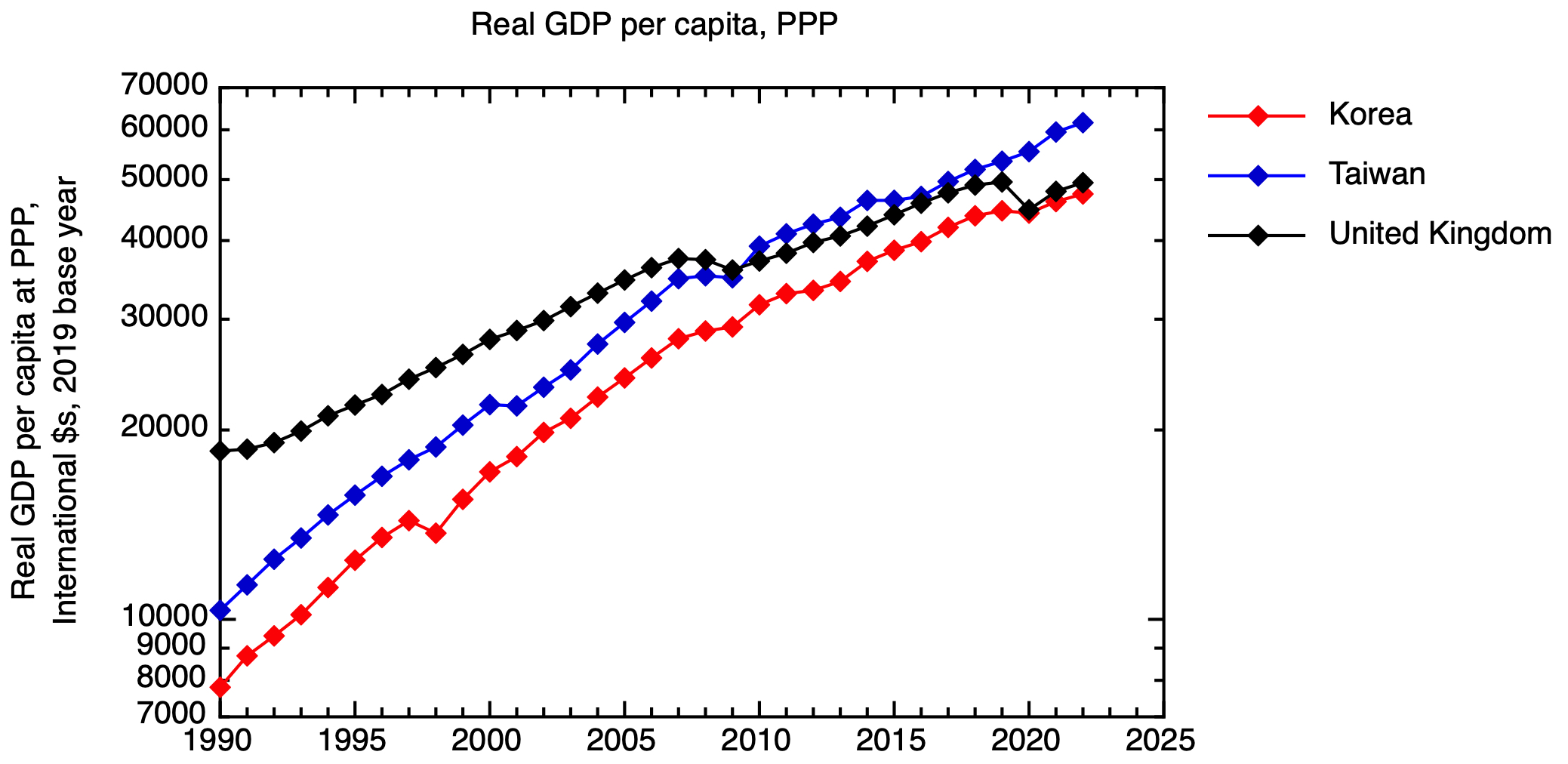

Korea & Taiwan – with much less ideological aversion to industrial technique than UK – rode the wave of the world’s quickest growing expertise whereas the UK sat on the sidelines. Their financial efficiency has surpassed the UK.

Actual GDP per capita at buying energy parity for Taiwan, Korea and the UK. Primarily based on information from the IMF. GDP at PPP in worldwide {dollars} was taken for the bottom 12 months of 2019, and a time sequence constructed utilizing IMF actual GDP development information, & then expressed per capita.

The UK can’t afford to make the identical errors with future expertise waves. We want a correctly resourced, industrial technique utilized persistently over many years, rising & supporting UK owned, managed & domiciled innovative-intensive corporations at scale.