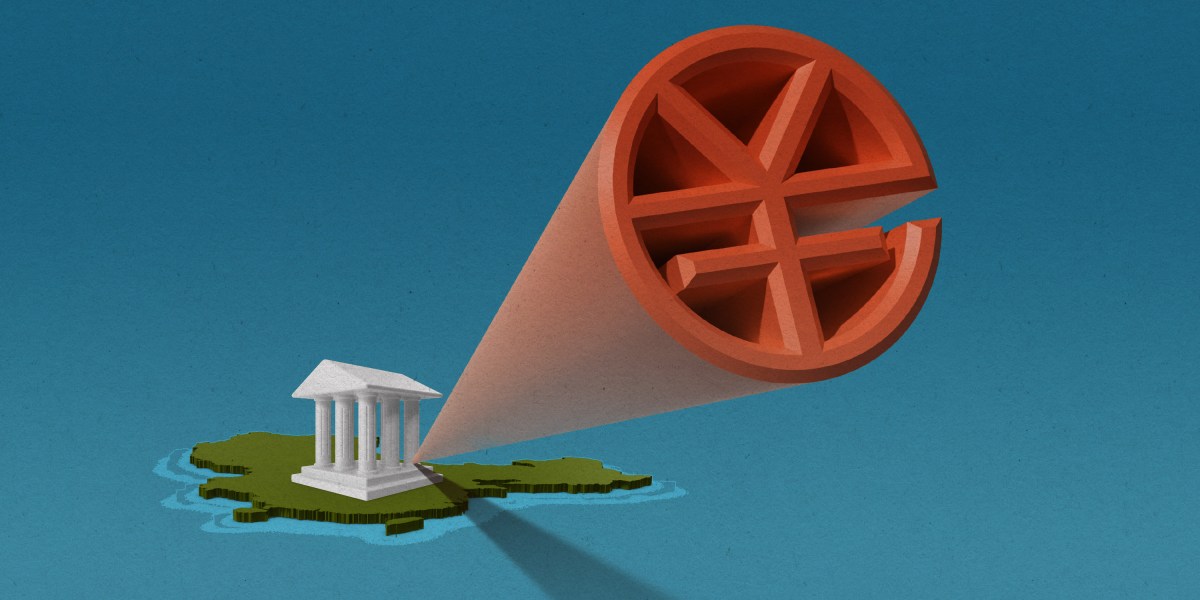

Nearly three years into the pilot, although, it appears the federal government continues to be struggling to search out compelling functions for it, and adoption has been minimal. Now the objective could also be shifting, or no less than broadening. China seems to be charging forward with plans to make use of the e-CNY outdoors its borders, for worldwide commerce.

If it’s profitable, it may problem the US greenback’s place because the world’s dominant reserve forex—and within the course of shake up the worldwide geopolitical order.

The (public) rationale

From the surface trying in, it’s unattainable to totally verify the federal government’s plans for the e-CNY. Although the Folks’s Financial institution of China (PBOC) has not been shy about its central financial institution digital forex (CBDC) mission, it has revealed few particular particulars about how the e-CNY really works—or the way it in the end intends to make use of it.

One factor we do know is that it’s been a very long time within the making.

Whereas Alibaba and Tencent launched their digital cost programs in 2004 and 2005 respectively, China started researching digital forex know-how in 2014 and launched a analysis institute dedicated to the idea in 2016, hoping to create a centralized various. Then in 2019, after Meta (then referred to as Fb) proposed its personal world digital forex, PBOC officers expressed concern that the coin, referred to as Libra, may undermine the financial sovereignty of China’s forex, the yuan. The subsequent 12 months it began the e-CNY pilot section, which continues to be ongoing.

In keeping with Mu Changchun, director basic of the PBOC’s Digital Forex Institute, the e-CNY mission has three foremost objectives: to enhance the effectivity of the central financial institution’s cost system, present a backup for the retail cost system, and “improve monetary inclusion.”

“Now we are able to present 24/7 companies to most people,” he stated throughout a chat he gave by way of Zoom for an occasion hosted final 12 months by the Atlantic Council, a international coverage assume tank in Washington, DC. Mu added that the e-CNY will broaden entry to the PBOC’s cost system—extending it to, amongst others, extra private-sector corporations, together with fintech corporations and telecom operators.

Mu stated e-CNY may even function a crucial backup to the favored cellular cost apps Alipay and WeChat Pay, which dominate China’s each day retail transactions. Most individuals in China don’t use money or bank cards however depend on their telephones to purchase issues, so these industrial platforms have develop into “considerably vital monetary infrastructure,” Mu stated. If one thing ever goes unsuitable with them, “that may deliver a really vital unfavorable influence to the monetary stability of China,” he stated.